The GST department has enabled a new feature for taxpayers that will make their lives easier. It is now possible for them to file their GSTR-1 NIL return with just a single click of the mouse. This is a new facility that has been added to the GST portal. In order to file your GSTR-1 Nil return using the new facility, we are going to provide you with step-by-step instructions on how to do it.

Who is eligible to File GSTR-1?

Persons eligible to file GSTR-1: Those listed below can file the nil return.

No Outward Supplies: If there are no outward supplies for the month or quarter, you can file your GSTR-1 as Nil. The outward supplies include reverse charge basis supplies, zero-rated supplies, and deemed exports.

No changes or amendments: In the absence of any changes or amendments to the previous period, you can file GSTR-1 as Nil using this new facility.

No Debit or Credit Notes: If you do not have any debit or credit notes.

No Advance Received: In the event that there are no advances recorded, you may also file GSTR-1 returns as Nil.

Steps to File GSTR-1 Nil Return

Procedure to File GSTR-1 Nil Return: It is now very easy to file a GSTR-1 nil return if you haven’t made any of the above transactions during the period you’re filing your return. You can file GSTR-1 as Nil by following the steps below.

Step 1: First visit the GST portal and login with your credentials. Now, go to Return dashboard (Services -> Returns -> Returns Dashboard -> Form GSTR-1 -> Prepare Online).

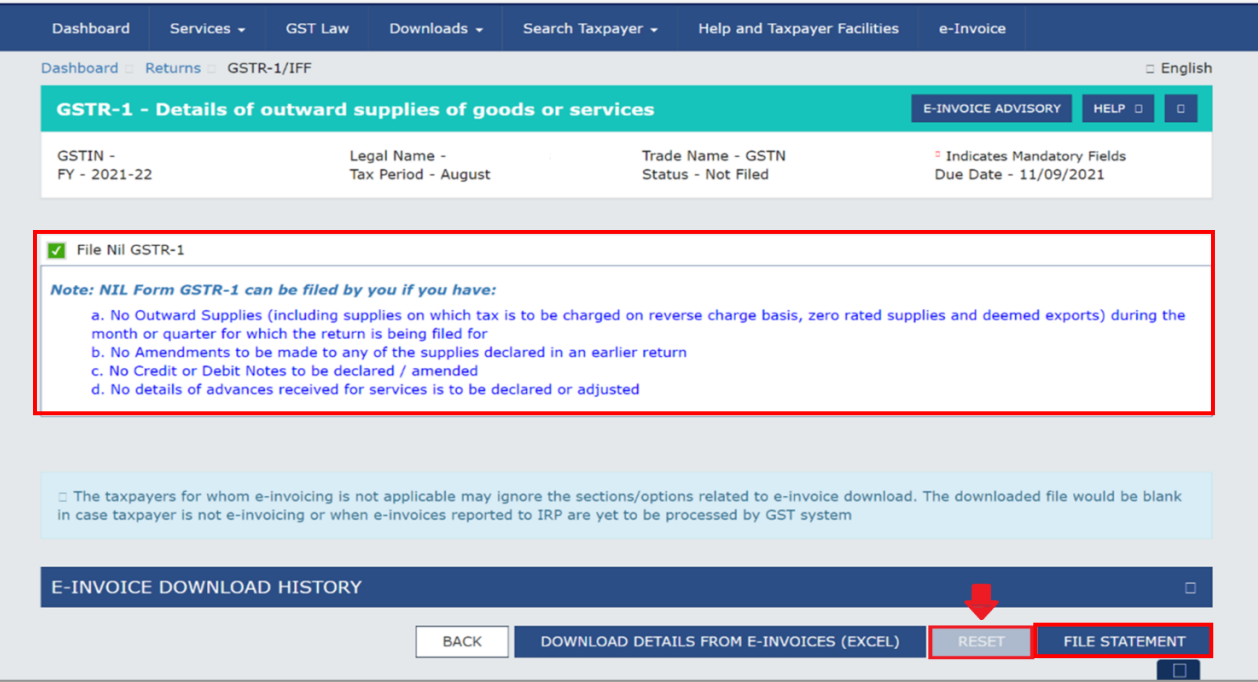

Step 2: Select file NIL GSTR-1 checkbox: The GST department has introduced a new feature in the form of this facility. Prior to this, we had to go through various tables in order to file a NIL GST return. Now, you can now simply check the box “File Nil GSTR-1” to continue.

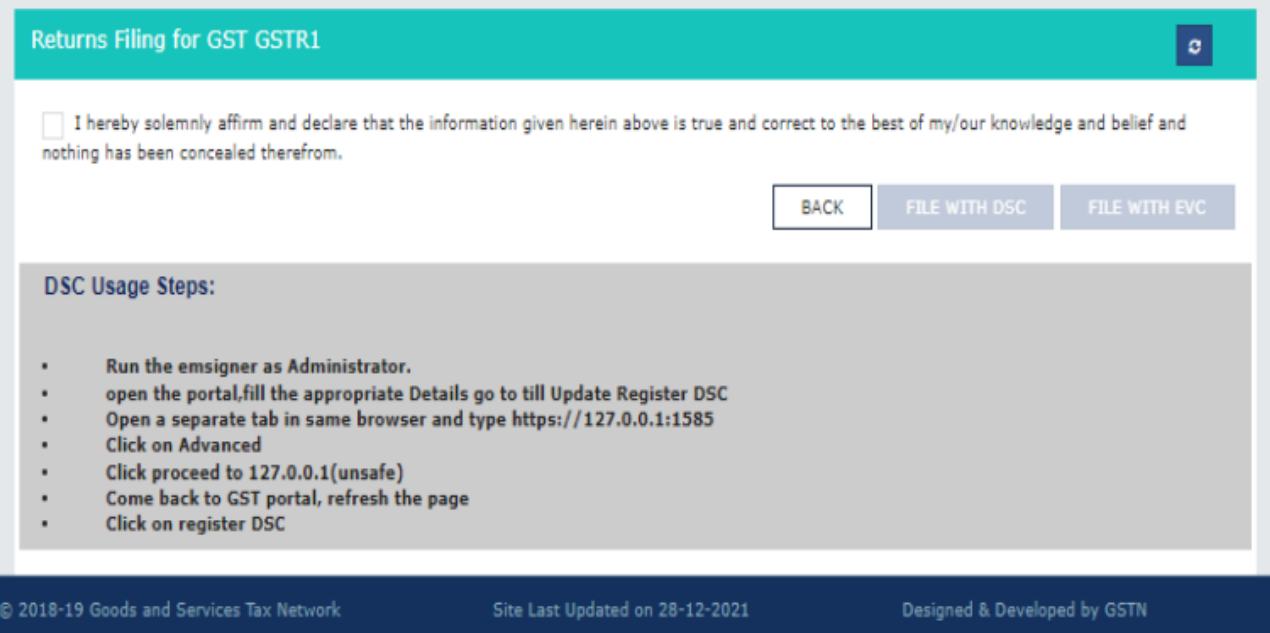

Step 3: The next step is to click on the “File Statement” button. You will be redirected to the filing page where you can submit GSTR-1/IFF using EVC/DSC in order to file it.

This is all you need to do! It is now very easy for taxpayers to file GSTR-1 nil returns in the future.