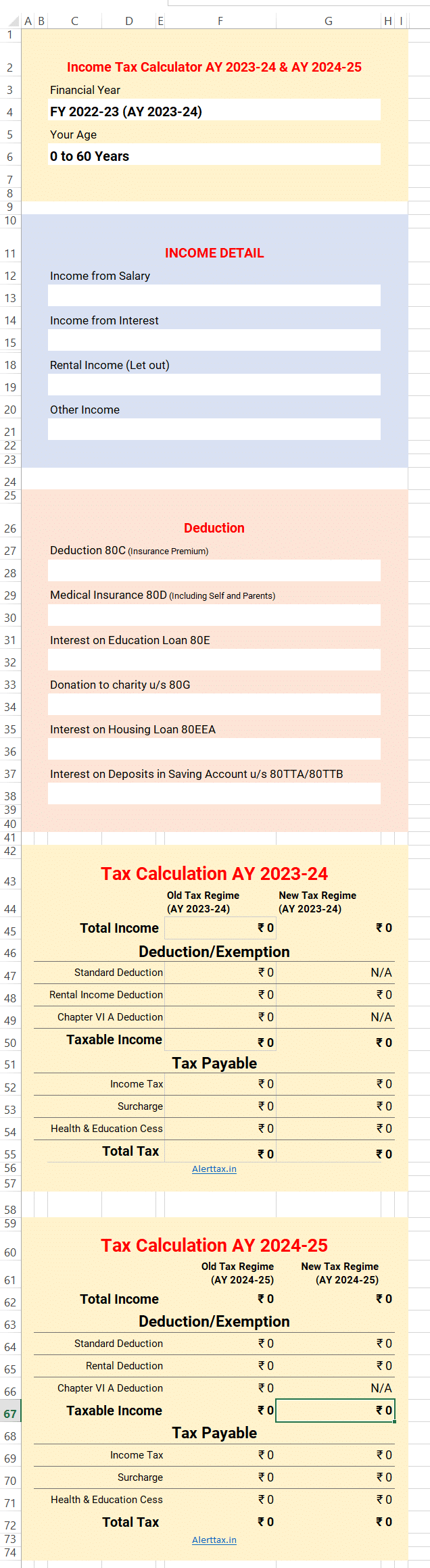

Excel Income Tax Calculator AY 2024-25: This income tax calculator is for calculating income tax for both AY 2023-24 and AY 2024-25. This income tax calculator is free to download.

You can calculate the income tax amount for both old tax regime and new tax regime. All amendments up to finance bill 2023 are included in this income tax calculator. With this income tax calculator in Excel, you will be able to calculate the margin relief applicable to surcharges in excess of 50 lakhs and income tax in the new tax regime, income over 7 lakhs.

Using the predefined formulas, it will automatically calculate the taxable income, tax calculation, and tax payable for the income amount you enter. Excel Income Tax Calculator AY 2024-25 offers accuracy, reusability, organized data, flexibility, and comparisons between old and new tax regimes.

Download Income Tax Calculator in Excel AY 2024-25 and AY 2023-24

Here are the links to download the income tax calculator in excel format and using online.

| Particulars | Assessment Years | Download Link |

| Income Tax Calculator Excel | AY 2024-25 AY 2023-24 (Updated on 29th May 2023) V9.1 | Download Here |

| Income Tax Calculator Online (Print Option Available) | AY 2024-25 AY 2023-24 | Visit Here |

How to Use Excel Income Tax Calculator AY 2023-24 or AY 2024-25

You can use an Excel income tax calculator by following these steps:

- You will need to open the Excel income tax calculator ay 2024-25 & 2023-24.

- Please choose a financial year, such as AY 2023-24 or AY 2024-25.

- Select your age in the column “Your Age”.

- In the “Income Detail” column, enter the income amount for which you wish to calculate the tax. Your annual income should be entered in the appropriate cell, for example Salary, Interest, Rental Income, Other Income.

- The calculator will automatically calculate the taxable income, tax calculation, and tax payable based on the predefined formulas once you enter the income amount.

- Then, if applicable, you can enter the deduction amount for the year.

- Check the calculated values in the “Taxable Income,” “Tax Calculation,” and “Tax Payable” columns. Based on your income, these columns should display the calculated amounts.

- Calculate the tax liability for different scenarios by entering different income amounts.

Benefits of Income Tax Calculator Excel AY 2023-24 & 2024-25

There are many benefits to using Excel income tax calculator ay 2024-25 and ay 2023-24.

- Accuracy: You can be sure that the calculation of income tax will be accurate as Excel uses sophisticated formulas and functions. In this way, you can eliminate the possibility of manual calculation errors

- Future Use: You can save your tax calculation for future use with this income tax calculator ay 2024-25 and ay 2023-24. You can print the calculation sheet easily. In the future, this excel sheet can be valuable when using it for any future reference.

- Reusability: Excel’s income tax calculator can be reused for future years by updating tax slabs and rates as necessary. In subsequent years, you can reuse the template, saving time and effort.

- Organized Data: When entering income details and calculating taxes, This excel income tax calculator provides a structured and organized format. Tax liabilities, deductions, exemptions, and multiple income sources can easily be tracked and managed.

- Flexibility: Excel provides flexibility in customizing your income tax calculator according to your specific needs. Based on the latest income tax laws or your own circumstances, you can easily change income, deductions, and exemptions.

- Old Tax Regime Vs New Tax Regime: This excel income tax calculator compares tax under the old tax regime and the new tax regime for both a.y. 2023-24 and a.y. 2024-25.

Please use the comment form if you have any problems downloading or using this calculator. Our team will work immediately to resolve the issue.

Disclaimer: Income Tax Calculator

The income tax calculator provided is intended for general informational purposes only and should not be considered as professional tax advice. The calculator is designed to assist users in estimating their potential tax liability based on the provided inputs and predefined formulas. Please note that tax laws, regulations, and rates are subject to change, and the calculator may not account for all the specific factors that may apply to an individual’s tax situation. The results obtained from the calculator should not be relied upon as a substitute for professional tax advice or consultation with a qualified tax professional. The accuracy and applicability of the calculated results may vary based on individual circumstances and the specific tax laws applicable to your jurisdiction. It is always advisable to consult with a professional tax advisor or refer to the latest tax guidelines from the relevant tax authorities for accurate and personalized tax calculations. By using the income tax calculator, you acknowledge and agree that the calculator is provided on an “as-is” basis, without any warranties or representations of any kind, express or implied. We disclaim any liability for errors, omissions, or damages arising from the use of the calculator. Your use of the income tax calculator is at your own risk, and you are solely responsible for any decisions or actions taken based on the calculated results.

Where is NPS deduction there is no provision given This is very basic saving exemption

How is it missing ?

Sir,

Can you pl share the Password,

to check rate of tax applied in each slab.

You can check income tax slab here https://alerttax.in/new-income-tax-slab-f-y-2023-24-a-y-2024-25-budget-2023/ thanks

your excel not owrk data entry

The income tax calculator is working fine. You should click on enable editing when asked in pop-up. Thanks

Hi Team,

Thank you for this Excel. Very much useful.

If possible request to share the Password to unprotect the sheet, to view the formulas.

The excel sheet does not except saving deductions of Rs. 50000 in NPS or interest on home loan

Hello Sir, the option is available u/s 80EEA. please check again or download again. thanks

Hi,

Unable to change Financial Year (i.e. FY 2023-24) and Age drop down menu.

It shows the error of “The cell you are trying to change is on a procted sheet”.

Sorry Sanjay Prajapait Ji, We have rectified the problem you are facing about the problem of not changing the financial year and age drop down menu. Please check now, if you have any suggestion about income tax calculator excel please tell us. You can use also income tax online ay 2023-24 and 2024-25 here. https://alerttax.in/income-tax-calculator-2024-25-ay-2023-24/