How to File ITR-1 (Sahaj) Step by Step (A.Y.2023-24): To file an income tax return, the income tax department has released different types of income tax forms based on the category of taxpayers. Currently, there are seven ITR forms available to file an income tax return.

The Income Tax Return Form 1 (ITR-1), also known as Sahaj, is the simplest form that an individual assessee, who has income from salaries, one house property, or other sources (interest etc.) and who does not have any capital gains or business income, can use to file his or her income tax return.

The ITR-1 form is meant for individuals who have income from salary, one house property, and other sources (excluding lottery winnings and income from racehorses) with total income below Rs. 50 lakh.

ITR-1 is also known as the Sahaj form. The income tax department officially refers to it as the ITR-1 (Sahaj) form. The ITR-1 form is relatively easier to fill compared to other ITR forms. In this article, we will discuss complete details about ITR-1, including who can file it, who cannot file it, preparation, the complete procedure, verification, and other relevant information.

ITR-1 can be filed either online or offline. However, in this article, we will only discuss how to file ITR-1 online.

Table of contents

- Quick Summary About ITR-1

- Updates on ITR-1

- What is ITR

- What is ITR-1

- Pre-requisites to File ITR-1 Online

- Eligibility to File ITR-1:

- Who is Not Eligible to File ITR-1

- Procedure to File ITR-1 Online or Offline

- Changes in ITR-1 A.Y. 2023-24

- Documents Required to File ITR-1

- Procedure to File ITR-1 Online Step by Step

-

Online Mode - Utilizing the e-Filing Portal

- Step 1: Register on the Income Tax e-Filing Portal

- Step 2: Login to the e-Filing Portal

- Step 3: Select the "Filing of Income Tax Return" Option

- Step 4: Choose Assessment Year and ITR-1 Form

- Step 5: Pre-fill Personal Information

- Step 6: Fill in the Income Details - Gross Total Income

- Step 7: Claim Deductions and Tax Relief - Total Deductions

- Step 8: Compute Tax Liability and Pay Taxes (if applicable)

- Step 9: Review and Validate the Form

- Step 10: Proceed

- Step 11: Pay if There is Any Tax Liability

- Step 12: Final Steps to Submit ITR-1

- Step 13: E-verify the ITR

Quick Summary About ITR-1

| Topic | Information |

|---|---|

| ITR-1 Form (Sahaj) | – Simplest form for individual taxpayers with income from salaries, one-house property, or other sources (excluding capital gains or business income) |

| Eligibility to File ITR-1 | – Total income below Rs. 50 lakh – Income sources limited to salary, one house property, and other sources (excluding lottery winnings and income from racehorses) – Clubbed income should also meet the eligibility criteria |

| Ineligibility to File ITR-1 | – Total income exceeding Rs. 50 lakh – Non-residents and residents not ordinarily resident – Multiple house properties – Specific income sources (lottery winnings, racehorses, etc.) – Capital gains – Unlisted equity shares – Business or professional income – Directorship – Section 194N deduction – ESOP tax deferral – Other ineligibility criteria |

| Procedure to File ITR-1 | – Online or offline filing options – Online filing for most individuals – Offline filing for individuals aged 80 or older and HUFs with income below Rs. 5 lakhs |

| Documents Required to File ITR-1 | – Form 16 (issued by employer) – Bank statements – Form 26AS (consolidated tax statement) – Proof of investments and expenses – House rent receipts (if applicable) – Housing loan interest certificates – Capital gains documents – Form 15G/15H (if applicable) – Details of other income – Aadhaar card – Previous year’s tax return |

| Procedure to File ITR-1 Online | – Register on the Income Tax e-Filing Portal – Login to the e-Filing Portal – Select the “Filing of Income Tax Return” option – Choose the assessment year and ITR-1 form – Pre-fill personal information – Fill in income details – Claim deductions and tax relief – Compute tax liability and pay taxes (if applicable) – Review and validate the form |

| Updates on ITR-1 | – New online mode with prefilled data available – Excel-based utility released for ITR-1 and ITR-4 – Introduction of a new scheme for electronic filing – ITR-1 forms available in PDF format |

| Changes in ITR-1 A.Y. 2023-24 | – No changes in eligibility criteria – Certain individuals cannot use ITR-1 (unlisted equity shares, directors in a company, etc.) – Hindu Undivided Families (HUFs) cannot use ITR-1 – Agricultural income limit set at Rs. 5,000 |

Updates on ITR-1

May 22, 2023

The new online mode allows users to access prefilled data on the official portal for ITR-1 and ITR-4. Now you can file your ITR-1 online with prefilled data. You can access it online.

April 26, 2023

An Excel-based utility has been released by the Income Tax Department for forms ITR-1 and ITR-4 for the Assessment Year 2023-24. You can now download it.

April 12, 2023

CBDT has introduced a new scheme for electronic filing that applies to residents (except non-ordinarily residing residents) who earn a total income of Rs. 50 lakh, receive a salary, own a house, and earn Rs. 5 thousand from agriculture. Click here to download the JSON file.

Feb 24, 2023

ITR-1 forms for AY 2023-24 are now available in PDF format.

What is ITR

ITR means Income Tax Return, which is a form filed by taxpayers to disclose their income earned during the financial year. There are multiple ITR forms provided by Income Tax Department, such as ITR 1 to ITR 7. The taxpayers are required to fill out the relevant ITR form based on their income earned during the year.

What is ITR-1

- Individual taxpayers primarily use Sahaj Form or ITR-1 with salary, pension, or one-house property income.

- The ITR form is the simplest and most basic of all ITR forms.

- Those with an income of up to Rs. 50 lakhs and meeting certain criteria can file their income tax returns using ITR-1.

- People with income from businesses or professions, capital gains, or multiple houses are not eligible to file ITR-1 and should use the appropriate ITR form according to their income source.

- For instance, individuals with income from more than one house property should use ITR-2 to file their income tax returns.

Pre-requisites to File ITR-1 Online

- Registration on e-Filing Portal (How to Register and Login)

- PAN and Aadhaar are linked (mandatory w.e.f. 1st July 2023)

- PAN should be Active

- You must have a mobile phone number registered with your Aadhaar card (for e-verify your Income Tax Return)

- Pre-validated Bank Account (Mandatory for income tax refund)

Eligibility to File ITR-1:

If you earned the following income during the financial year 2022-23 (starting on 01-04-2022 and ending on 31-01-2023), you must file ITR 1 form. If not, you will need to check other ITR forms, such as ITR-2 and ITR-7.

1. Total Income: The individual’s total income during the financial year should not exceed ₹50 lakh.

2. Income Sources: The income sources should be limited to the following:

a. Salary or Pension

b. Income from one house property (excluding cases with carried forward losses)

c. Income from other sources (excluding winnings from lotteries, races, etc.)

3. Clubbed Income: If the individual’s spouse or minor child’s income is clubbed with their own, it should also fall within the specified eligibility conditions mentioned above.

Who is Not Eligible to File ITR-1

While ITR-1 is suitable for a specific group of taxpayers, there are certain scenarios where individuals cannot file ITR-1 for the assessment year 2023-24. The following individuals are not eligible to file ITR-1:

1. Income Threshold: Individuals with a total income exceeding ₹50 lahks during the financial year.

2. Non-Residents and RNOR: Non-Resident Indians (NRIs), as well as residents not ordinarily resident (RNOR), cannot use ITR-1.

3. Multiple House Properties: Individuals with income from more than one house property, including cases of carried forward losses.

4. Specific Income Sources: Individuals with income from lottery winnings, racehorses, legal gambling, etc.

5. Capital Gains: Taxpayers with taxable capital gains, both short-term and long-term, from the sale of assets like property, shares, etc.

6. Unlisted Equity Shares: Individuals who have invested in unlisted equity shares during the financial year.

7. Business or Profession: Individuals with income from business or profession.

8. Directorship: Individuals serving as directors in companies.

9. Section 194N Deduction: Individuals who have tax deductions under section 194N of the Income Tax Act.

10. ESOP Tax Deferral: Individuals with deferred income tax on ESOP (Employee Stock Ownership Plan) received from an eligible start-up.

12. Other Ineligibility: Individuals who do not meet the specific eligibility conditions for ITR-1 as prescribed by the Income Tax Department.

Procedure to File ITR-1 Online or Offline

There are two ways to file your ITR-1 for salaried employees: Online or Offline

Offline Filing:

The following individuals are eligible for offline filing of the Income Tax Return:

1. Those who are 80 years or older.

2. Hindu Undivided Families (HUFs) or individuals with income not exceeding Rs. 5 lakhs, do not need to claim a refund in their ITR.

They will need to fill out a paper form and submit it. An acknowledgment is provided by the Income Tax Department once a physical return is sent.

Online Filing:

The income tax return of all other persons except those mentioned above must be filed online at the income tax department’s official website, incometax.gov.in.

Changes in ITR-1 A.Y. 2023-24

CBDT has announced the Income Tax Return (ITR) forms for the current financial year 2022-23 ( Assessment Year 2023-24). ITR-1 to ITR-6 were notified on February 10, 2023, and ITR-7 on February 14, 2023. The forms have mostly stayed the same since they were last updated.

There are no changes to the eligibility criteria for filing the ITR-1 form. A resident whose total income does not exceed Rs 50 lakh must file ITR-1, also known as Sahaj. It applies to income sources such as salary, one-house property, interest income, dividend income, etc. An individual can also include agricultural income but can be at most Rs 5,000.

It is important to remember that certain individuals cannot use ITR-1 to file their tax returns—individuals who hold unlisted equity shares or serve as directors in a company. The ITR-1 form cannot be used by those with tax deducted under Section 194N (tax deducted on bank withdrawals) or with an income tax liability for ESOPs. In FY 2022-23/A.Y 2023-24, Hindu Undivided Families (HUFs) cannot file tax returns using ITR-1.

Documents Required to File ITR-1

The following documents and information are typically required to file your Income Tax Return (ITR-1) in India:

1. Form 16: This form is issued by your employer and provides details of your salary income, deductions, and taxes withheld during the financial year. You can use the values on your Form-16 to complete your Income Tax return. Your Form-16 can be compared with the income tax return if the values are prefilled.

2. Bank statements: You will need bank statements for all your savings accounts and fixed deposits held during the financial year. This will make it easier for you to calculate income from other sources. You can get the details of interest on savings accounts, interest on fixed deposits, etc. In addition, you can cross-check the bank details such as IFS code, account number, etc. on the return with those in your bank statement.

3. Form 26AS: It is a consolidated statement that provides details of tax deducted at source (TDS) on your income, advance tax paid, self-assessment tax paid, and any refund received during the financial year. You can download it from the Income Tax Department’s e-Filing portal.

4. Proof of investments and expenses: You need to collect all the documents related to your tax-saving investments under Section 80C, such as receipts and statements related to your Employee Provident Fund contributions, Public Provident Fund account statements, and National Savings Certificates (NSCs).

5. House rent receipts (if applicable): If you live in a rented house and wish to claim House Rent Allowance (HRA) exemption, collect rent receipts from your landlord.

6. Housing Loan Interest Certificates: The details of interest paid on a home loan can be used to claim a deduction under section 80EE and 80EEA for income from house property. In addition, you can obtain information about the principal amount repaid towards your home loan for purposes of claiming section 80C benefits.

7. Capital gains: If you have sold any investments, property, or assets during the financial year, gather documents related to the sale transactions, such as sale deed, purchase deed, and details of expenses incurred.

8. Form 15G/15H: If you are eligible to submit Form 15G/15H to avoid tax deduction at source on interest income, ensure you have these forms, if applicable.

9. Details of other income: If you have income from sources other than salary, such as interest income, rental income, or freelance income, gather supporting documents and information.

10. Aadhaar card: Although not mandatory for filing ITR-1, having an Aadhaar card is beneficial as it simplifies the verification process.

11. Previous year’s tax return: Keep a copy of your previous year’s tax return, as it may contain relevant information and help you ensure consistency in reporting.

Procedure to File ITR-1 Online Step by Step

There are two methods available for filing ITR-1:

1. Online Mode – Utilizing the e-Filing Portal (Entirely online process – Submission and Filing)

2. Offline Mode – Utilizing the Offline Utility (Also online – Submitting ITR-1 online, preparing/filing ITR-1 offline by downloading excel utility)

In this article, we will focus solely on the online mode. The following steps outline the procedure for submitting and filing ITR-1.

Online Mode – Utilizing the e-Filing Portal

Sure! Here is a step-by-step procedure to file ITR-1 online using the e-Filing portal:

Step 1: Register on the Income Tax e-Filing Portal

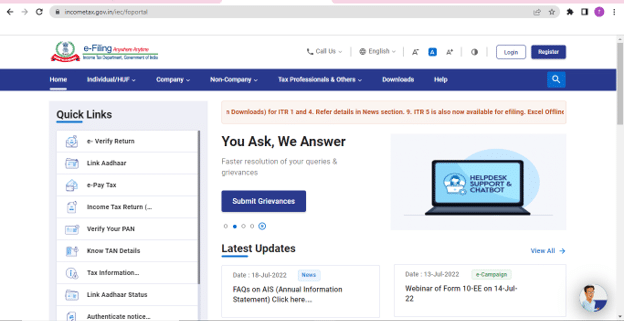

Step 1.1: Visit the Income Tax e-Filing Portal (https://www.incometax.gov.in/).

Step 1.2: Click on the “Register Yourself” button.

Step 1.3: Select your user type (Individual, HUF, etc.) and click on “Continue.”

Step 1.4: Fill in the required details such as PAN, name, date of birth, contact details, and choose a password.

Step 1.5: Enter the captcha code and click on “Submit.”

Step 2: Login to the e-Filing Portal

Step 2.1: Once registered, go back to the Income Tax e-Filing Portal.

Step 2.2: Click on the “Login Here” button.

Step 2.3: Enter your PAN, password, date of birth, and captcha code.

Step 2.4: Click on “Login.”

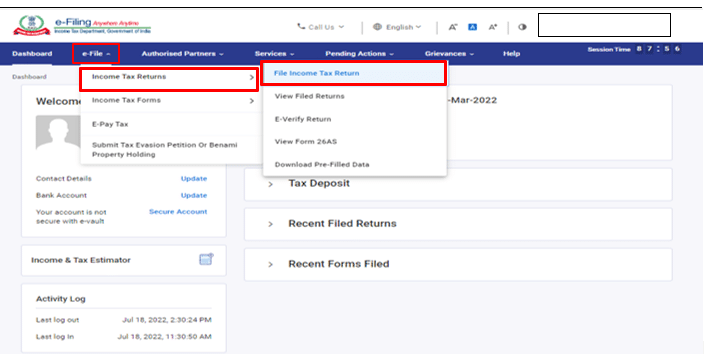

Step 3: Select the “Filing of Income Tax Return” Option

Step 3.1: After logging in, you will be redirected to the dashboard.

Step 3.2:Click on the “Filing of Income Tax Return” option under the “Quick Links” section.

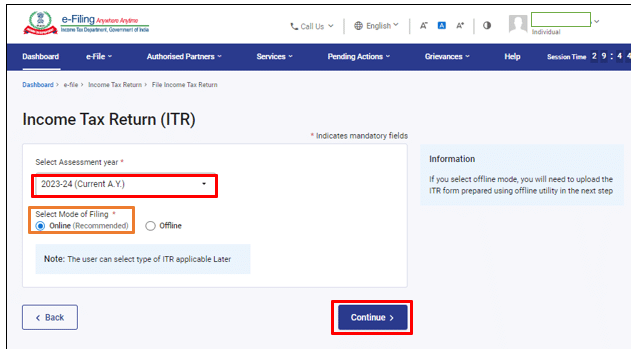

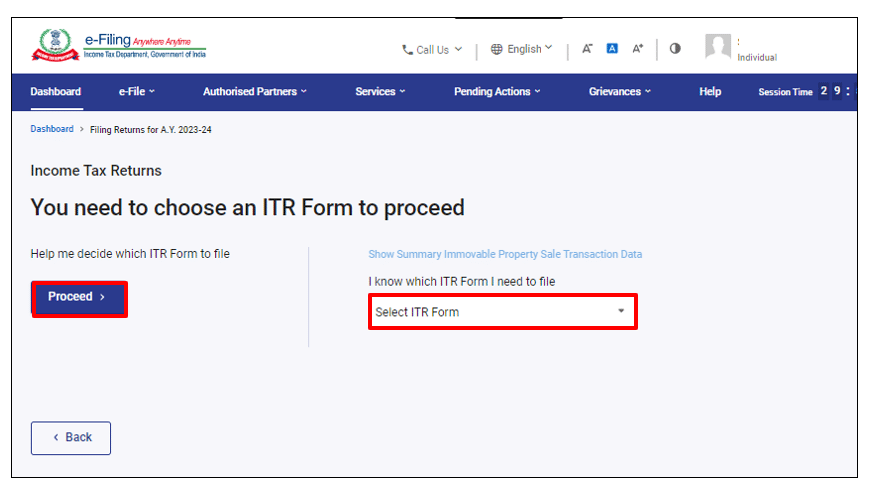

Step 4: Choose Assessment Year and ITR-1 Form

Step 4.1: On the “Filing Income Tax Return” page, select the appropriate “assessment year” for which you want to file the return and Select the Mode of Filing “Online (Recommended)“.

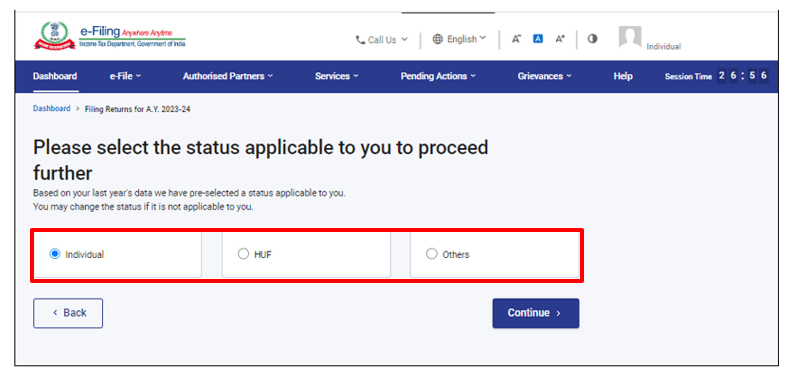

Step 4.2: Now, Select the status “Individual”.

Step 4.3: Choose the “ITR-1″ form from the drop-down menu.

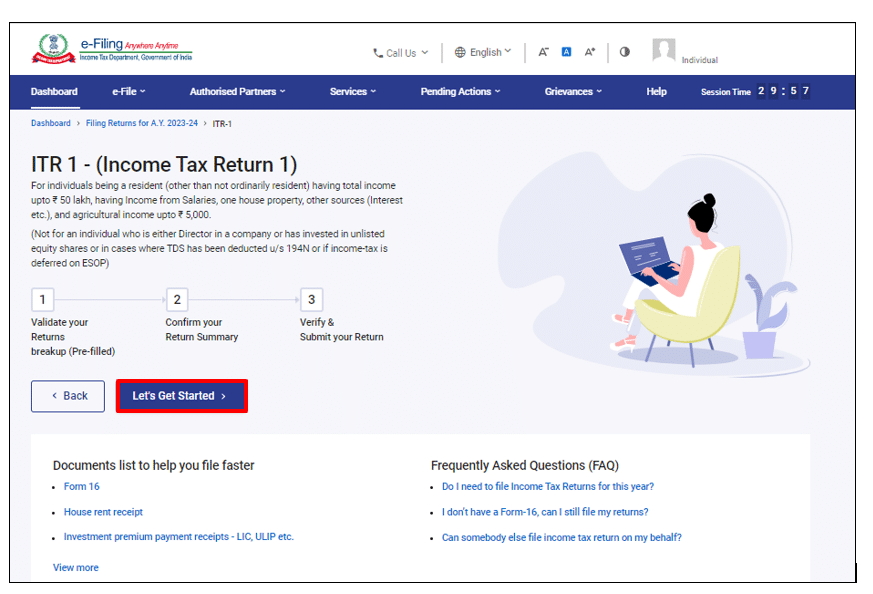

Step 4.4: Click Let’s Get Started when you’ve selected the ITR applicable to you.

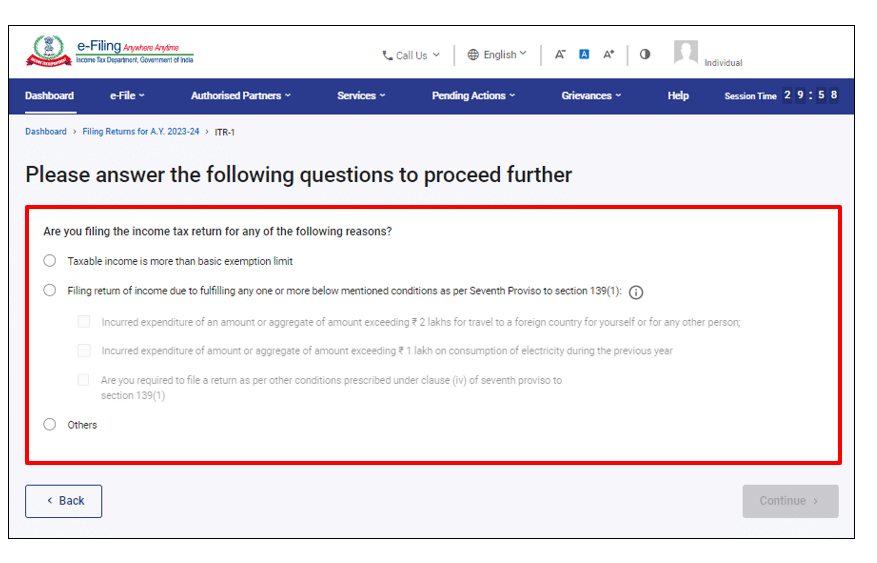

Step 4.5: Now, select “Taxable income is more than basic exemption limit”.

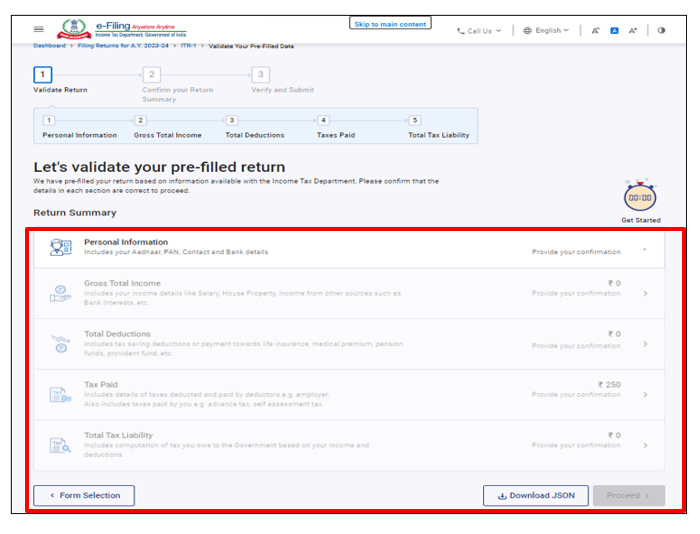

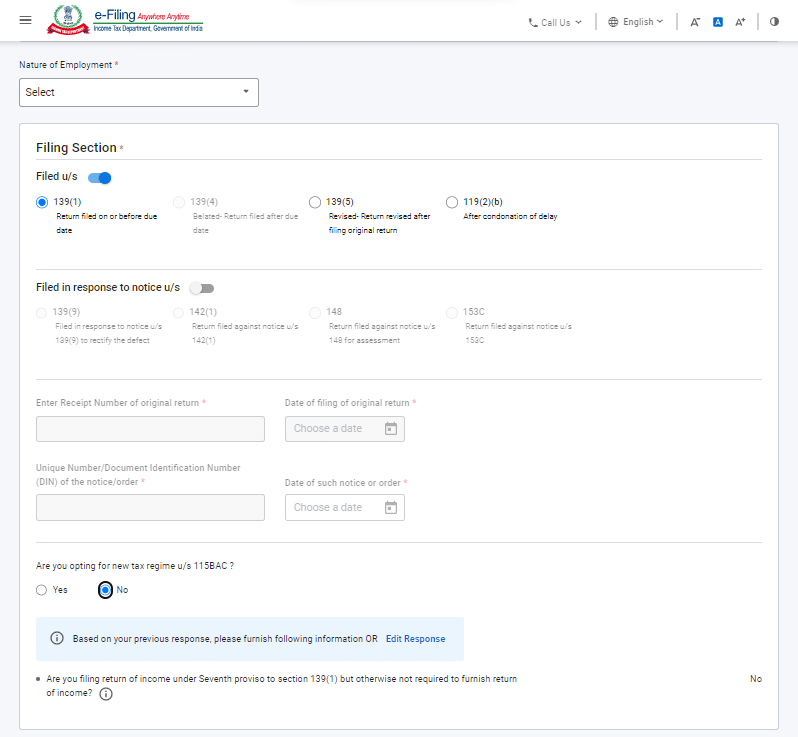

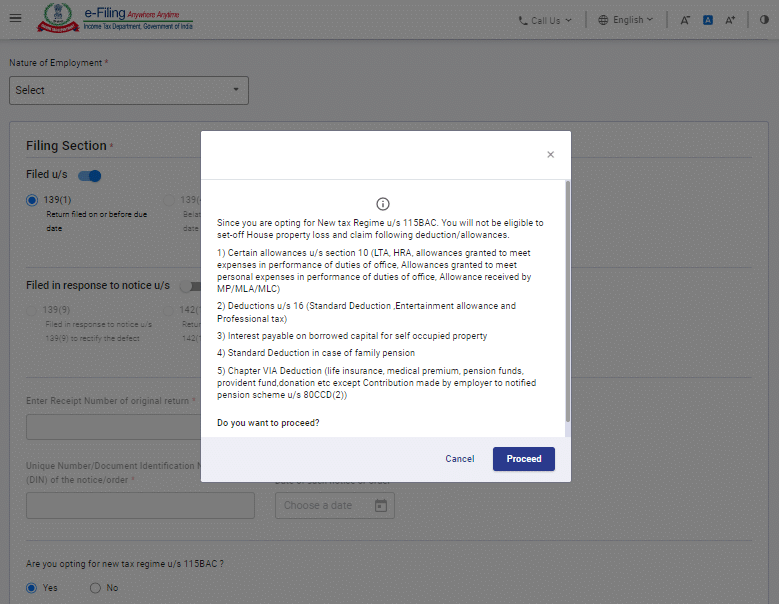

Step 5: Pre-fill Personal Information

You must validate the pre-filled data in e-Filing’s Personal Information section of the ITR. The form does not allow you to edit some personal data directly. However, you can change the required information by going to your eFiling profile. The form allows you to edit your contact details, filing type details, and bank details.

Step 5.1: Your personal information will be pre-filled based on your e-Filing account.

Step 5.2: Verify the details and make any necessary updates or corrections.

Step 6: Fill in the Income Details – Gross Total Income

Step 6.1: Fill in the details of your income, such as salary, house property income, income from other sources, etc.

Step 6.2: Provide accurate and complete information in the respective sections of the form.

Step 7: Claim Deductions and Tax Relief – Total Deductions

Step 7.1: In this step, provide details of deductions you are eligible for under various sections of the Income Tax Act.

Step 7.2: Enter the relevant amounts for deductions such as Section 80C, 80D, 80G, etc.

Step 8: Compute Tax Liability and Pay Taxes (if applicable)

Step 8.1: The portal will automatically calculate your tax liability based on the information provided.

Step 8.2: If you have any tax payable, pay it using the available online payment options.

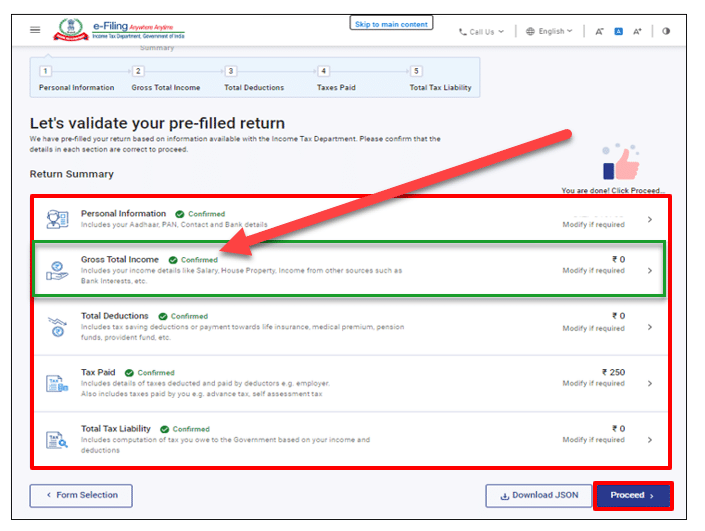

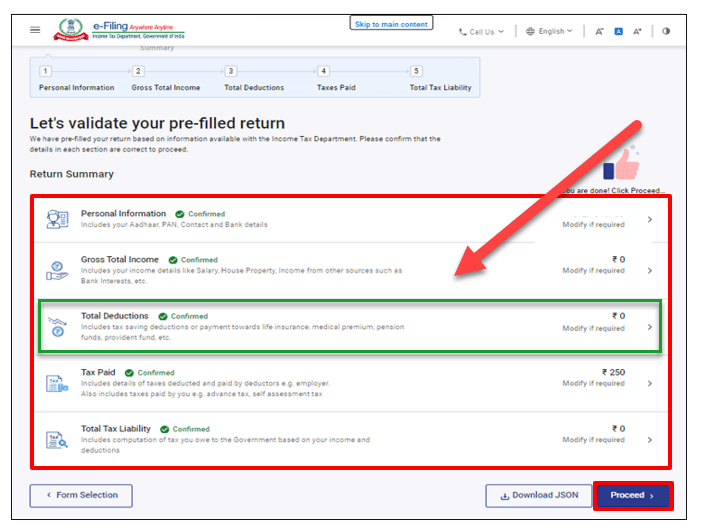

Step 9: Review and Validate the Form

Step 9.1: Review all the information provided in the ITR-1 form.

Step 9.2: Ensure the accuracy and completeness of the data.

Step 9.3: Validate the form to check for any errors or inconsistencies.

Step 10: Proceed

Step 10.1: Click Proceed when you have completed and confirmed all the sections of the form.

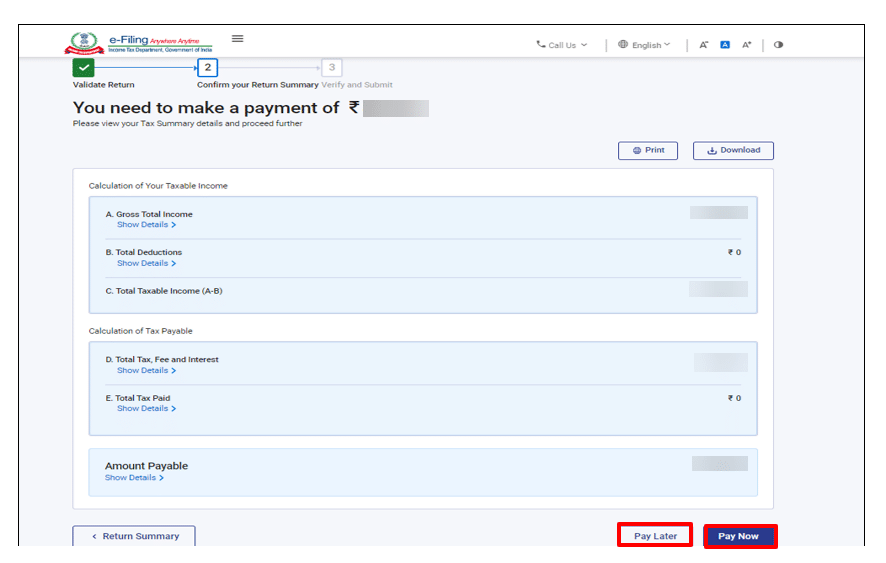

Step 11: Pay if There is Any Tax Liability

Step 11.1: When you click on total tax liability, a summary of your tax computation will appear based on your inputs.

Step 11.2: At the bottom of the page, you will find the options to Pay Now and Pay Later if there is a tax liability

Step 11.3: We recommend using the Pay Now option.

Step 11.4: The option to Pay Later allows you to make the payment after filing your Income Tax Return, but you may be considered a taxpayer in default, and you may have to pay interest on tax owed.

Step 11.5: Upon clicking Preview and Submit Your Return, you will be taken to a page where you can confirm whether a tax liability is payable, or if a refund is due based on tax computation.

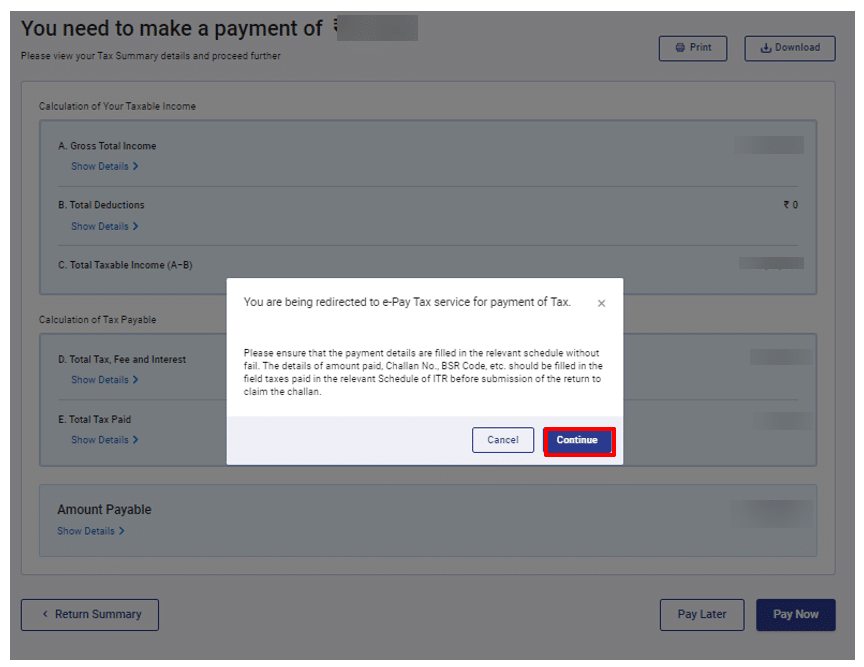

Step 11.6: You will be redirected to the e-pay Tax service if you click on “Pay Now”. Click Continue

Step 11.7: Once you click Continue, you will be taken to the e-Pay Tax page on the portal. For more information, refer to the e-Pay Tax article.

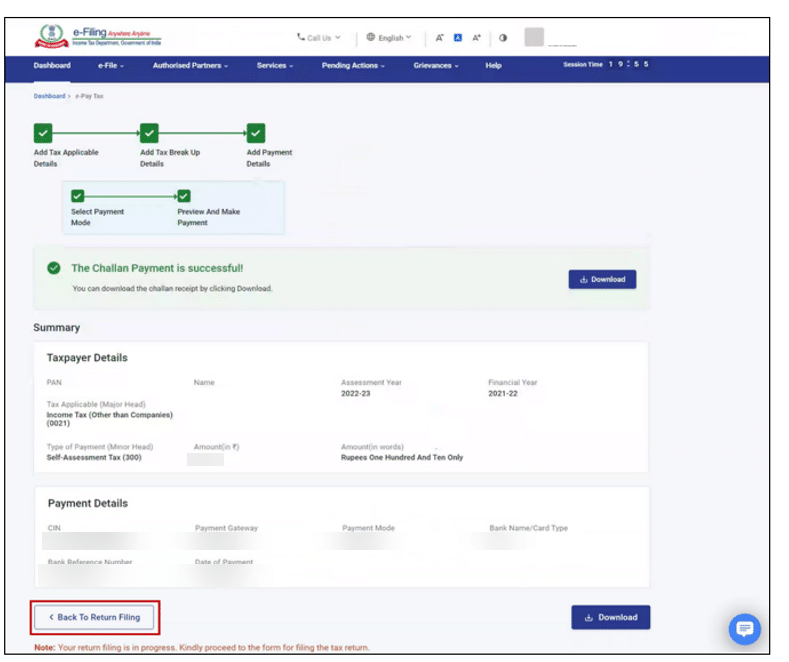

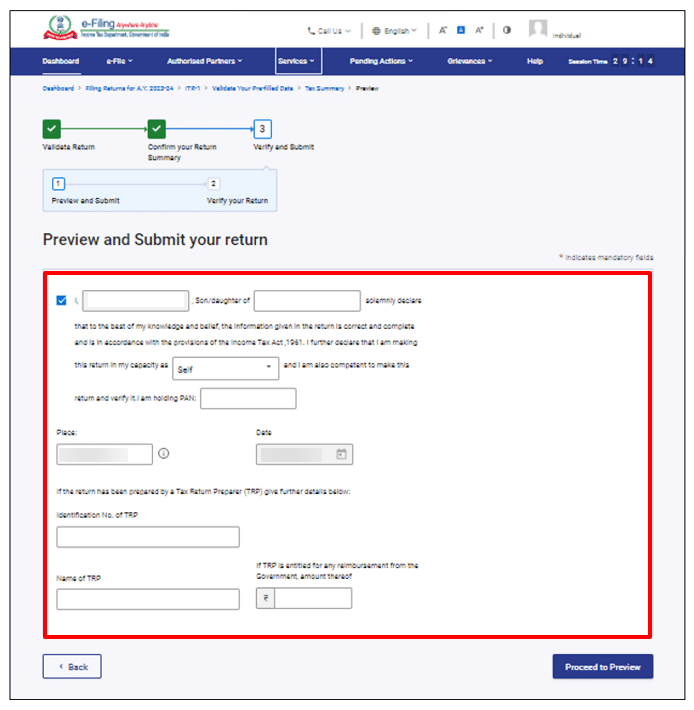

Step 12: Final Steps to Submit ITR-1

Step 12.1: The e-Filing portal displays a success message after the payment is successful. For a complete ITR filing, click Back to Return Filing.

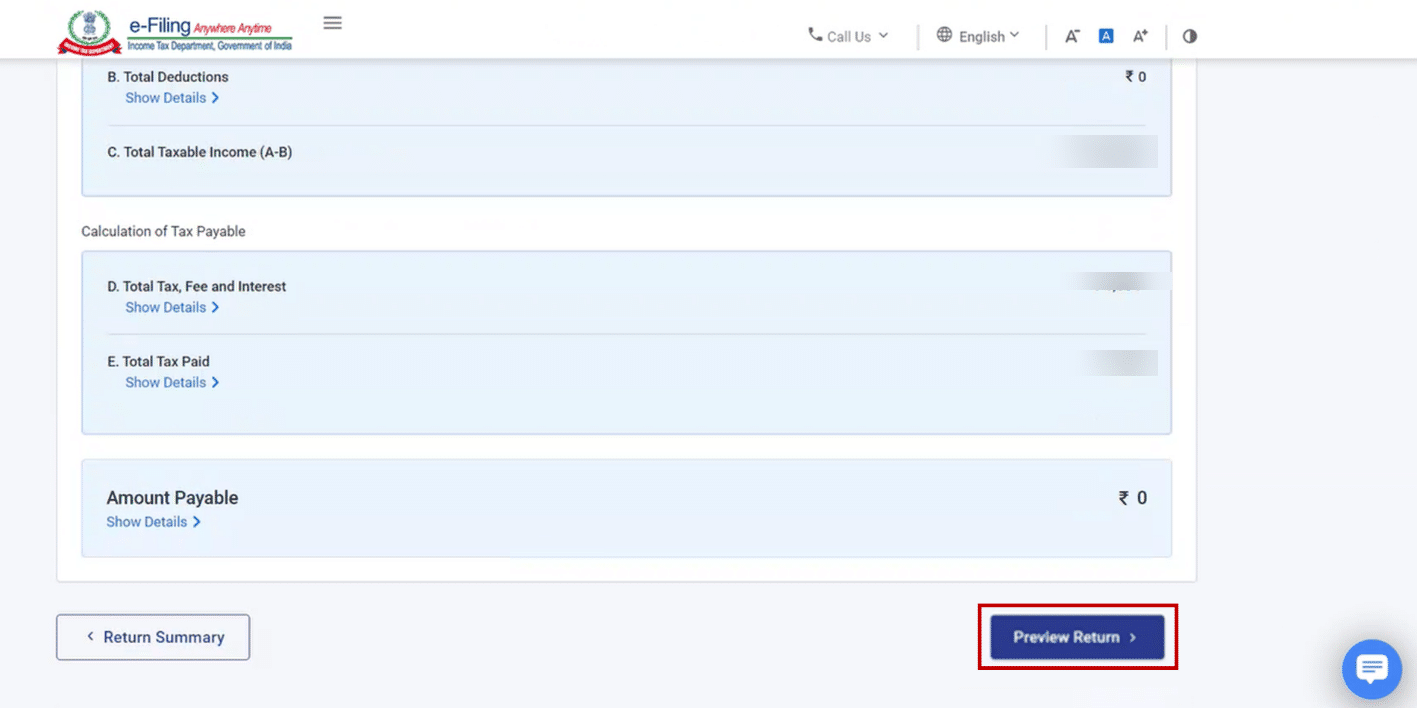

Step 12.2: Click Preview Return.

Step 12.3: Click Proceed to Preview on the Preview and Submit Your Return page and select the declaration checkbox.

Step 12.4: You can leave the TRP text boxes blank if you have not used a tax return preparer.

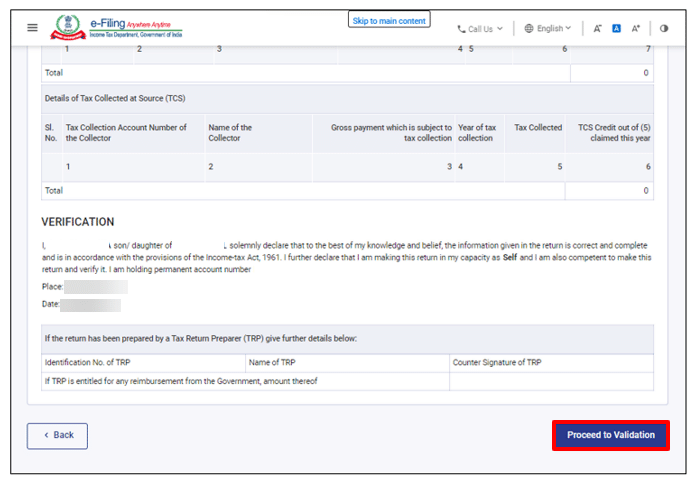

Step 12.5: Click Proceed to Validation after previewing your return.

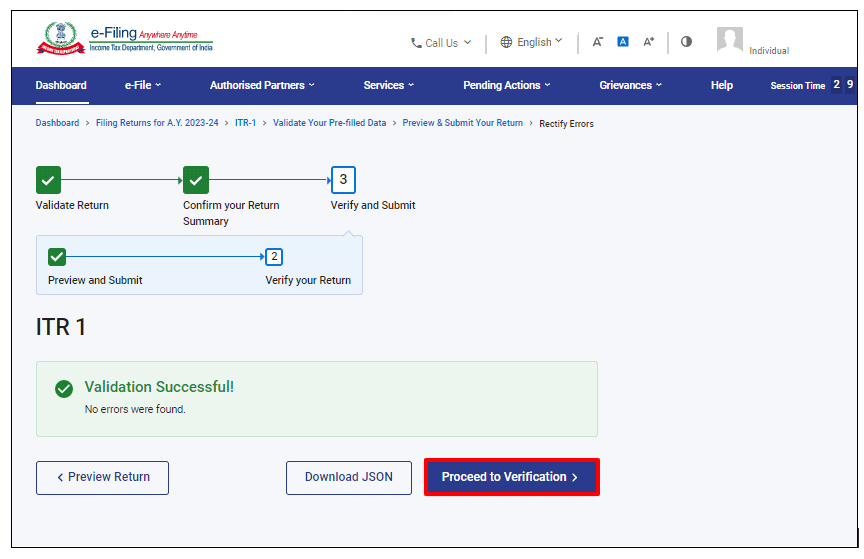

Step 12.6: After you have validated your return, click Proceed to Verification on the Preview and Submit your Return page.

Step 12.7: You must go back to the form if you receive a list of errors in your return. Then click Proceed to Verification if there are no errors.

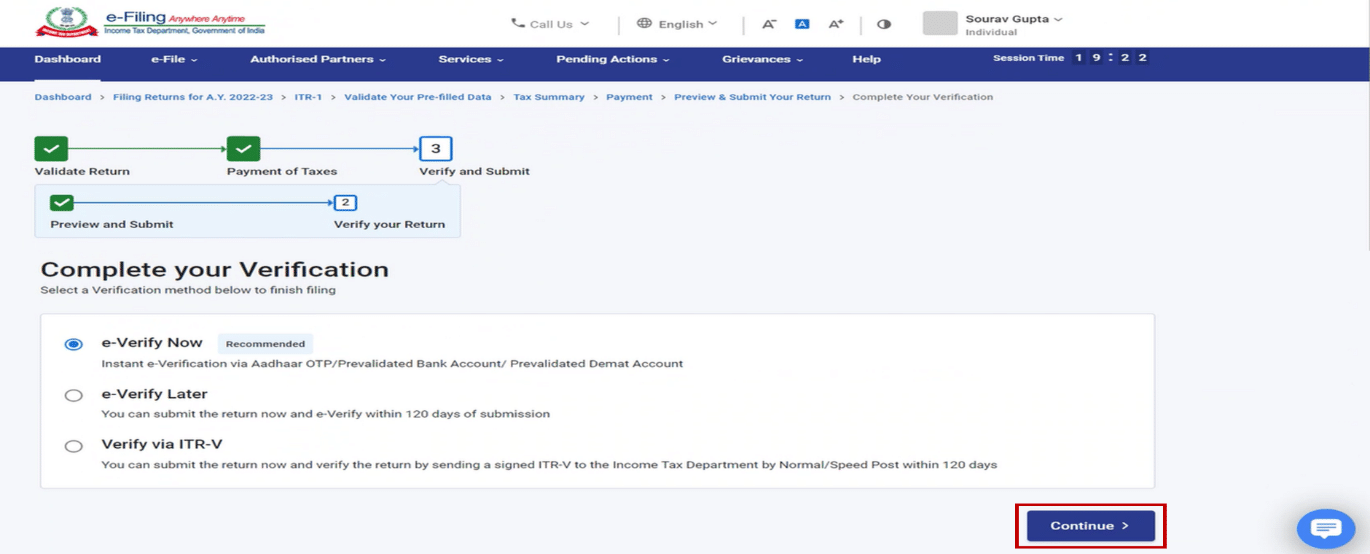

Step 12.8: Then click Continue on the page titled “Complete your Verification.

Step 13: E-verify the ITR

Step 13.1: You must verify your return, and e-Verification (recommended option – e-Verify Now) is the easiest and fastest way to do so.

Step 13.2: As a result of choosing e-Verify Later, you will be required to verify your return within 30 days of submitting it.

Step 13.3: You must send a physical copy of your ITR-V signed by you within 30 days to Centralized Processing Center, Income Tax Department, Bengaluru 560500 by speed post.

Step 13.4: Ensure that your bank account has been pre-validated before any refunds are credited.

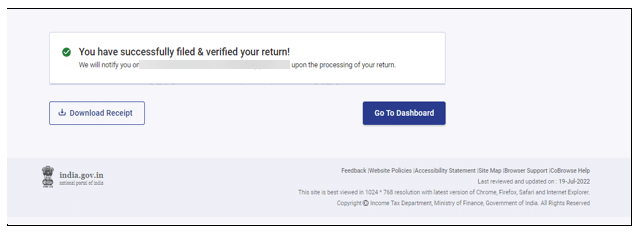

Step 13.5: The Acknowledgment Number and Transaction ID are displayed once you’ve e-Verified your return. An e-Filing confirmation message will also be sent to the mobile number and email address you registered.

Refer Article How to e-Verify Income Tax Return here for detailed information.

FAQ for Filing ITR-1 Sahaj – A.Y.2023-24

SIR,

I HAVE RETIRED FROM STATE GOVT. SERVICE IN FEBRUARY 2023. I HAVE GOT PENSION AND OTHER RETIREMENT BENEFITS LIKE

1) COMMUTED VALUE OF PENSION

2) GRATUITY

3) GENERAL PROVIDENT FUND

4) GISS

5) LEAVE ENCASHMENT

I UNDERSTAND THAT PENSION IS TREATED AS SALARY INCOME U/S 17(1) AND TAXABLE.

BUT HOW DO I SHOW OTHER BENEFITS AS MENTIONED AND CLAIM EXEMPTION IN ITR1?

SHOULD I ADD ALL UNDER SALARY U/S 17(1) AND THEN CLAIM EXEMPTION U/S 10 FROM SALARY INCOME FROM DROP DOWN MENU?

REGARDS,

Sir,

I am a salaried Govt. Employee. I have income from salary and other sources like Bank F.D. interest from which TDS is deducted.

Now in ITR1 for AY 2019-20 I have to report Total Taxes Paid which includes…. Total TDS claimed+ Self assessment tax+ Advance tax paid. Now what is this “Total TDS claimed”? Is it the sum total of TDS from salary as per Form 16 (Schedule TDS1)+ TDS on the Bank F.D. interest as per Form 16A (Schedule TDS2)?

Kindly clarify.

Sir,

I am a govt. employee. I earn some annuity from LICI annuity plan. I understand that the amount is fully taxable im my hand. My query is

1) Under which head of Income in itr1 for the AY 2019-20 I shall show that amount

2) For the AY 2019-20 “Income from other sources” is highly structured and specific. Now under which sub-head of “Income from other sources” I shall show that amount?

Regards.

Sir,

I am a senior citizen. Can I claim deduction u/s 80TTB (upto Rs. 50000) on my SAVINGS BANK INTEREST?

Sir,

My mother is a super senior citizen. She has income from Family Pension and Savings Bank Interest. But her Total Income including all sources never exceeded the basic exemption limit applicable to her. But she submits ITR every year.

Now that she is too aged and invalid and that her income is unlikely to exceed the Basic Exemption limit in foreseeable future, can she discontinue filing ITR any more? If yes whom to contact in IT Department to pray for exemption from filing ITR?……..Is it her AO(ITO) or any other authority? Can she submit her prayer to the nearest any ASK centre? Or can she submit it online and how?

hello Sir , when i file my return i can’t submit my return and show a massage that ” Since the amount disclosed in “income under Head Salaries” is less than 90% of salary reported in TDS1, please ensure to fill details in “Others” in “Exempt income”. as my form 16 part A and B , i dont have any other income. so what should i do to file my returns?

thanks and regards

Mehul Zala,

A standard deduction of Rs. 40000 from the salary income is applicable for the salaried individuals for the F.Y. 2018-19.

Is it applicable for the pensioners also and at the same rate?

I am a govt. employee and a senior citizen. I want to deduct tax solely on my salary income by my deductor for the FY 2018-19. I intend to show the interest income in the itr1 and pay self assessment tax/advance tax as applicable after deduction of Rs. 50000 under 80TTB.

My question is……in that case the form 16 issued by my employer will not show the deduction under 80TTB. Can I claim that deduction in my ITR1?

Is there any problem of mismatch between form 16 and itr1?

Sir,

My D.O.B. is 21/10/1958. Can I claim the I.T.benefits for the F.Y. 2018-19 as a senior citizen?

SINCE YOU ARE ATTAINING AGE 60 IN THE FY 2018-19, YOU ARE A SR.CITIZEN AND CAN CERTAINLY BE TAKE ADVANTAGE OF SR.CITIZEN FOR AY 2019-20…

1)Sir, I am a Govt. Employee. I am facing some problem regarding filling up Schedule TDS in ITR1 for AY 2018-19…..I have declared income from other sources apart from my salary income

to my deductor. After adding both “Salary” and “Income from other sources” I arrive at “Gross Total Income” and allowing deduction under chapter 6A, I arrive at “Total Taxable Income” and tax has been deducted at source accordingly by my employer. Now what should I fill in column (3)i.e. amount which is subject to tax deduction of schedule TDS? Is it only “Salary income” or “Gross Total Income” or “Total taxable income”? In column (4)i.e. year of tax deduction of schedule TDS what should I fill as total tax has been deducted during FY 2017-18? Column (5) is Tax deduction at source, that I can understand. But what shall I fill in column (6) i.e. amount out of (5) claimed this year? Plz. reply.

No Income details or tax computation has been provided in ITR but details regarding taxes paid have been provided.

this messg occurs during the efilling what to do ?? plz tell as soon as possible

Has anyone encountered this message :

When I click on the “Generate XML” button in ITR-1 Sahaj Form, I am getting the following warning :

Amount of Salary disclosed in “Income details / Part BT” is less than 90% of salary reported in Schedule TDS1. I rechecked the values in Income details and also in TDS worksheet. It is as per FORM 16.

can anyone clarify.

sir…the person whose annual salary..is not upto the taxable income……is that necessary to fiil up iITR 1

If your income is below exemption limit then you have option to file income tax return. But our advise to you that file your income tax return for every year irrespective of your income. It will help you in future like loan approval, visa approvals and in other documents formalities.

My TDS has been deducted how do Iclaim it . I have been told that I have to file return But how ???????????????? can u help me.

Sir ,mai 2012 & 2013 ka itr bhara nahi ,abhi bhar sakta hu pls sir rply

Thank you.

if your income is lower than the taxable limit then you don’t need to file.

pl let us know when ITR fors 3, 4 , 5 will be available

thanks

Sir,

If I have more than 2 savings or current bank accounts, how I disclose those in the new ITR-1 form ? In the form, there are only two spaces.

Surajit

Dear Sir,

ITR1 for AY 2015-2016 is not calculating total tax payable. Can you please advise me where I am doing mistake?

How to know the entries of bank interest in pan account. Credited in our pan card account

Sir/Madam,

Please confirm us, that when we will get the ITR 4 for Assessment Year 2015-16. I have seen all the related sites of the Income Tax Returns.

Thank You.

my PAN has been deleted under de-duplication process. For restoration I contacted ITO, Ghazipur but could not responsed. How can I file the return within March 2015. Please help

dear sir salary return bharne ke liye koun sa form bharu please reply

How can I view / pirnt my ITR-1 which as already submitted online. Is there any option for the same. Kindly help me.

Login to your account and find download section thanks

i have a very needful this site .I am realy happy to see this site

ITR-2 Form for A.Y. 2014-15: Income Tax Return Form -konsa file karna h main CISF MAIN HUN RPL

pls rpl my mail id

महोदय ! मैंने अपना इनकम टेक्स रिटर्न फ़ाइल किया था , परन्तु कुछ गलती रह गयी जिस कारण पुनः भरना होगा कैसे क्या करें मार्गदर्शन करें|

महोदय !

मैंने अपना इनकम टेक्स रिटर्न फ़ाइल किया था , परन्तु कुछ गलती रह गयी जिस कारण पुनः भरना होगा कैसे क्या करें मार्गदर्शन करें|

भवदीय-

डा. सुन्दर नारायण झा

I am trying but unable to download ITR-4 Form, in excel fomat kindly solve my problem –

please provide sample to itr1 sahaj online utitlity.

ITR-1 Excel utility software belongs to previous year 13-14. Please anybody upload ITR-1 for the year 14-15

share AY14-15 excel utility software if u hv

I am trying but unable to download ITR-4 Form, kindly solve my problem !

I have downloaded ITR1 but there is no acknowledgement form attached to the file. Should we upload the same without the acknowledgement form..??

Kindly advise.

Uday Pradhan

dear sir, i download ITR1 , but acknowledgement form is attach to ITR1 , how to download acknowledgement from

WHY IS ITR1 SHOWING ERROR MSG AS “COMPILE ERROR IN MODULE 3”.. HW DO I DEAL WITH IT

please prove the sample return for itr 1 & itr 2

Dear Sir

please cancelled the above itr 1 in this itr country code is wrong please update and attache again. country is 11-india in ur itr and but right is 91-india.

thanking you

regard