ITR-3 A.Y. 2023-24 – Individuals and HUFs have income from profit and gains of business or profession: ITR-3 is a form applicable to resident individuals and Hindu Undivided Families (HUFs) who earn income from proprietary businesses or professions. It is used for filing income tax returns. Individuals or HUFs engaged in activities such as proprietary businesses, including manufacturing, trading, or services, or those practicing professions like medicine, architecture, engineering, or accounting, can use the ITR-3 form to report their income and fulfill their income tax obligations.

Table of contents

- ITR-3 Updates A.Y.2023-24

- What is ITR?

- What is ITR-3?

- Who Can File ITR-3 A.Y.2023-24?

- Documents Required to File ITR-3

- Changes in ITR-3 for A.Y.2023-24

- Pre-Requisites to File ITR-3 Online

- Procedure to File ITR-3 Online or Offline

- Procedure to File ITR-3 Online

- Due Dates to File ITR-3

- Structure of ITR-3 A.Y.2023-24

- FAQ - ITR-3 A.Y. 2023-24

ITR-3 Updates A.Y.2023-24

June 9, 2023: The official e-filing portal now allows the online filing of ITR-3 for the Assessment Year 2023-24, including pre-filled data.

May 25, 2023: Taxpayers can now download the Excel utility of the ITR-3 form for the Assessment Year 2023-24 from the official portal. Download now.

February 24, 2023: The PDF format of the ITR-3 form for the Assessment Year 2023-24 is now available for taxpayers. Download ITR-3 in PDF

What is ITR?

The ITRs are known as income tax return forms. Taxpayers use these forms to report their income, deductions, and taxes to the income tax department. The taxpayer was then assessed for any refunds or taxes due by the income tax department.

There are different types of ITR forms are available for various categories of taxpayers based on their sources of income. There are several types of tax returns, such as the ITR-1, ITR-2, ITR-3, ITR-4, and so on. There are different types of income and eligibility criteria associated with each form. ITR forms must be selected based on the source of income, such as salary, business/profession, capital gains, or other categories.

What is ITR-3?

ITR-3 is a specific Income Tax Return form in India that is used by individuals and Hindu Undivided Families (HUFs) who have income from business or profession. It is one of the seven ITR forms provided by the Income Tax Department for different types of taxpayers and their respective income sources.

ITR-3 is applicable to individuals and HUFs who are engaged in business or profession as partners in a firm, or individuals who earn income as a partner in a Limited Liability Partnership (LLP).

The ITR-3 form requires taxpayers to provide detailed information about their business or professional income, including profit and loss statements, balance sheets, and other relevant financial details.

Who Can File ITR-3 A.Y.2023-24?

Hindu Undivided Families (HUF) and individuals with income from business or profession are required to file the ITR-3. You can file an ITR-3 if you are one of the following entities:

1. Individuals who own a partnership but are not associated with any proprietary business or profession.

2. A HUF whose income comes from a business or profession.

3. Individuals or HUFs who are partners in Limited Liability Partnerships (LLPs).

4. Individuals or HUFs with assets outside of India or earning income from outside India.

Individuals who earn income from salaries, house property, capital gains, or other sources are not eligible for ITR-3.

In short: Salary + Capital Gain (Stock/MF/Property) + Intraday and F&O + Business Income or Professional Receipt + House Property + Other Income

Documents Required to File ITR-3

The CBDT does not require any documents to be attached to ITR-3 A.Y. 2023-24 filings. These documents only help you make the process as efficient and accurate as possible.

1. Personal Information:

– PAN (Permanent Account Number)

– Aadhaar Card Number

– Contact Details (Address, Phone Number, Email)

2. Financial Statements:

– Balance Sheet of the Business/Profession

– Profit and Loss Account of the Business/Profession

– Audit Reports (if applicable)

– Capital Account Statements (if applicable)

– Bank Statements and Passbooks

3. Income Details:

– Income from Business or Profession

– Income from Partnerships (if applicable)

– Income from LLP (Limited Liability Partnership) (if applicable)

– Income from Presumptive Business/Profession (if applicable)

– Income from Foreign Sources (if applicable)

4. Deductions and Exemptions:

– Deductions under various sections of the Income Tax Act, such as Section 80C (Investments), Section 80D (Medical Insurance Premium), etc.

– Exemptions or allowances claimed, if any.

5. TDS (Tax Deducted at Source) Certificates:

– TDS certificates received from employers, banks, or any other deductors.

– Details of Advance Tax paid (if applicable).

6. Form 16:

– Form 16 issued by employers showing salary details, tax deductions, etc. (if applicable).

7. Other Relevant Documents:

– Details of Property owned (if applicable)

– Details of Foreign Assets or Foreign Income (if applicable)

– Any other supporting documents relevant to income or deductions claimed.

Changes in ITR-3 for A.Y.2023-24

The updated ITR-3 A.Y. 2023-24 form includes several changes and additions:

1. Schedule VDA: A new schedule has been introduced to report income from Virtual Digital Assets (VDAs), including cryptocurrencies. If you consider VDA income as capital gains, you need to provide a quarterly breakup in the Capital Gains Schedule. Each VDA transaction should be reported with sale and purchase dates.

2. Opting out of New Tax Regime: Additional questions have been included to determine whether you opted out of the New Tax Regime in previous years. This helps assess the applicability of tax provisions.

3. SEBI Registration for FIIs/FPIs: Foreign Institutional Investors (FIIs/FPIs) are now required to provide their SEBI registration number as an additional disclosure measure.

4. Changes in Balance Sheet Reporting: There is a minor change in reporting the balance sheet. Advances received from individuals mentioned in Section 40A(2)(b) of the Income Tax Act and others must be reported under the ‘Advances’ category in the Source of Funds section.

5. Trading Account: Turnover and income from intraday trading should be reported under the newly introduced ‘Trading Account’ section.

These updates in the ITR-3 form aim to capture specific details related to income from VDAs, tax regime preferences, SEBI registration for FIIs/FPIs, balance sheet reporting, and trading activities. It’s important to carefully review the new form and provide accurate information accordingly while filing your ITR-3.

Pre-Requisites to File ITR-3 Online

There are a few prerequisites needed to file ITR-3 A.Y. 2023-24 online in India:

- PAN (Permanent Account Number: You must have a valid PAN (Permanent Account Number) issued by the Income Tax Department for online filing and verification of your income tax return.

- Access to the Official e-Filing Portal: If you don’t have an account yet, create one or sign in with your existing credentials at https://www.incometax.gov.in/iec/foportal/.

- Digital Signature (Optional): A valid digital signature certificate (DSC) must be registered on the portal if you want to digitally sign the income tax return. It ensures authenticity and eliminates the need for physical signatures. If you don’t have a digital signature, you can e-verify your income tax return by Aadhaar Card.

- Pre-Filled Data (if applicable): If your ITR-3 form can be pre-filled with information, verify the information and make any necessary corrections. The portal may provide personal details, TDS details, and more.

- Bank Account Details: Ensure that your banking details are accurate, including account number, IFSC code, and type of account (savings or current). This information is required for the refund process, if applicable.

- Aadhaar Card Details: You must link your Aadhaar card with your PAN and provide the Aadhaar number in order to file your income tax return online.

- Valid Email Address and Mobile Number: The e-filing portal uses an email address and mobile phone number for communication and verification.

It is necessary to meet these prerequisites before you can file your ITR-3 online.

Procedure to File ITR-3 Online or Offline

There are two methods to file ITR-3 for A.Y.2023-24

1. Online Filing: You can file ITR-3 online through the official e-filing portal of the Income Tax Department (https://www.incometax.gov.in). This method allows you to fill in the form online, validate the details, and submit it electronically. You can also e-verify the return using methods such as Aadhaar OTP, Net Banking, or other available options.

2. Partially Online and Partially Offline Filing: This method involves using the offline utility provided by the Income Tax Department to fill in the ITR-3 form offline on your computer. You can download the utility from the e-filing portal, install it on your computer, and enter the details manually. Once you have filled in the form offline, you can generate an XML file of the filled-in form. After that, you need to visit the e-filing portal and upload the XML file to submit your return online. Once the return is submitted, you have the option to e-verify the return using methods such as Aadhaar OTP, Net Banking, or other available options, or you can choose to send a signed physical copy of the ITR-V to the Centralized Processing Center (CPC) within 30 days.

You can download the offline utility here.

This partially online and partially offline method allows you to fill in the form offline on your computer but requires you to submit the return online through the e-filing portal.

Procedure to File ITR-3 Online

Here is the procedure to file ITR-3 A.Y. 2023-24 online with pre-filled data on the official website of the income tax department i.e. incometax.gov.in.

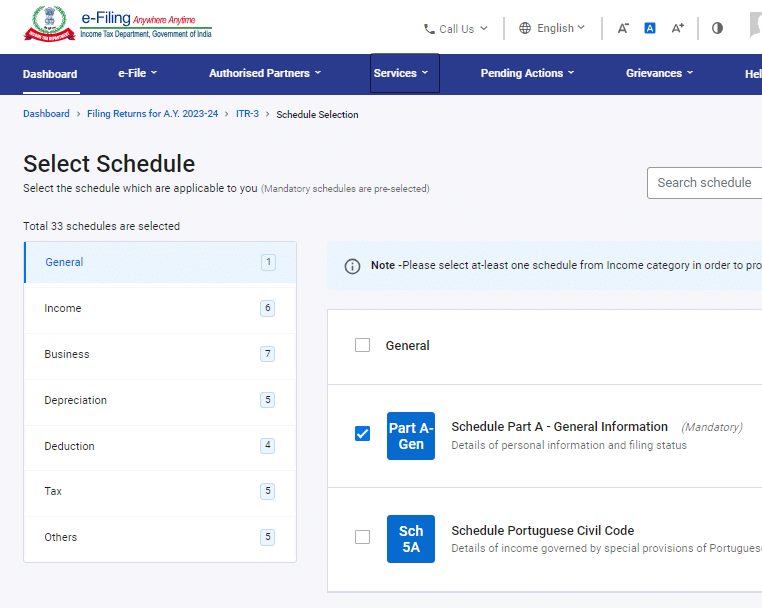

1. Visit the official website incometax.gov.in, Login > Dashboard > File Now > Select Assessment Year (A.Y. 2023-24) > Select Mode of Filing “Online (Recommended)” > Individual/HUF/Others > Select ITR Form “ITR-3” > Click on “Let’s Get Started” > Select “Others”.

2. Review the pre-filled personal information and make any necessary edits in the ‘General Info‘ tab.

3. In the ‘Income Sources‘ tab, check the pre-filled salary details. Enter details of rental income, other income, and capital gains. If you have capital gains from shares or mutual funds, you can import the details from supported platforms.

4. Fill in the details of business income, including balance sheet, profit and loss statement, depreciation, and ICDS if applicable.

5. Enter income from speculative transactions like intra-day trading if applicable.

6. Complete the income computation in Schedule BP and fill in Schedule OI. Provide auditor details if tax audit is applicable.

7. Review the pre-filled tax-saving details under the ‘Deductions‘ tab and make any necessary edits. Take note of tax-saving tips displayed on the screen.

8. Enter tax payments already made and claim relief under Section 89 if applicable.

9. Fill in any other relevant sections based on your specific circumstances, such as Schedule AL for assets and liabilities, and disclosures related to current account deposits.

10. Review the computation of your income tax under both old and new tax regimes. You can switch tax regimes if desired.

11. Verify and submit the self-declaration, confirming the correctness of the information.

12. If any tax is due, make the payment and enter the challan details. If you are due a refund or have no tax due, you can proceed to e-file.

13. E-verify your income tax return to complete the filing process. This step is crucial for the return to be considered filed.

Remember, uploading the ITR alone does not complete the process. It’s important to verify the return to finalize the filing.

Due Dates to File ITR-3

The due dates to file ITR-3 A.Y. 2023-24 are as follows:

| Category of Taxpayer | Due Date for Tax Filing- AY 2023-24 *(unless extended) |

| Individual / HUF/ AOP/ BOI (books of accounts not required to be audited) |

31st July 2023 |

| Businesses (Requiring Audit) | 31st October 2023 |

| Businesses requiring transfer pricing reports (in case of international/specified domestic transactions) |

30th November 2023 |

| Revised return | 31 December 2023 |

| Belated/late return | 31 December 2023 |

Structure of ITR-3 A.Y.2023-24

Here is the new structure of ITR-3 for the assessment year 2023-24.

| Part | Description |

|---|---|

| Part A | General information and nature of business |

| Part A-GEN | General information |

| Part A-BS | Balance Sheet as of March 31, 2023, for the proprietary business or profession |

| Part A-Manufacturing Account | Manufacturing Account for the financial year 2022-23 |

| Part A-Trading Account | Trading Account for the financial year 2022-23 |

| Part A-P&L | Profit and Loss for the financial year 2022-23 |

| Part A-OI | Other Information (optional if not liable for audit under Section 44AB) |

| Part A-QD | Quantitative Details (optional if not liable for audit under Section 44AB) |

| Schedules | Details and computation of various income sources |

| Schedule-S | Details of income under the head Salaries |

| Schedule-HP | Details of income under the head Income from House Property |

| Schedule-BP | Details of income from business or profession |

| Schedule-DPM | Details of depreciation on plant and machinery |

| Schedule-DOA | Details of depreciation on other assets |

| Schedule-DEP | Summary of depreciation on all assets |

| Schedule-DCG | Details of deemed capital gains on the sale of depreciable assets |

| Schedule-ESR | Deduction under section 35 (expenditure on scientific research) |

| Schedule-CG | Details of income under the head Capital gains |

| Schedule-112A | Details of Capital Gains where section 112A is applicable |

| Schedule-115AD(1)(b)(iii) Proviso | For Non-Residents – From the sale of equity share in a company or unit of an equity-oriented fund or unit of a business trust on which STT is paid under section 112A |

| Schedule-VDA | Income from the transfer of virtual digital assets |

| Schedule-OS | Details of income under the head Income from other sources |

| Schedule-CYLA-BFLA | Statement of income after set off of current year’s losses and unabsorbed losses from earlier years |

| Schedule-CFL | Statement of losses to be carried forward to future years |

| Schedule-UD | Statement of unabsorbed depreciation |

| Schedule-ICDS | Effect of Income Computation Disclosure Standards on Profit |

| Schedule-80G | Statement of donations entitled for deduction under section 80G |

| Schedule-RA | Statement of donations to research associations entitled for deduction under section 35 |

| Schedule-80IA | Computation of deduction under section 80IA |

| Schedule-80IB | Computation of deduction under section 80IB |

| Schedule-80IC/80-IE | Computation of deduction under section 80IC/80-IE |

| Schedule-VI-A | Statement of deductions (from total income) under Chapter VIA |

| Schedule-AMT | Computation of Alternate Minimum Tax Payable under Section 115JC |

| Schedule-AMTC | Computation of tax credit under section 115JD |

| Schedule-SPI | Statement of income arising to spouse/minor child/son’s wife or any other person to be included in the assessee’s income |

| Schedule-SI | Statement of income chargeable at special rates |

| Schedule-IF | Information regarding partnership firms in which the assessee is a partner |

| Schedule-EI | Statement of income not included in total income (exempt incomes) |

| Schedule-PTI | Pass-through income details from a business trust or investment fund as per section 115UA, 115UB |

| Schedule-TPSA | Secondary adjustment to transfer price as per section 92CE(2A) |

| Schedule-FSI | Details of income from outside India and tax relief |

| Schedule-TR | Statement of tax relief claimed under section 90, 90A, or 91 |

| Schedule-FA | Statement of foreign assets and income from any source outside India |

| Schedule-5A | Information regarding the apportionment of income between spouses governed by the Portuguese Civil Code |

| Schedule-AL | Assets and liabilities at the end of the year (applicable if total income exceeds Rs 50 lakhs) |

| Schedule-GST | Information regarding turnover/gross receipt reported for GST |

| Part B-TI | Computation of total income |

| Part B-TTI | Computation of tax liability on total income |

| Verification | Declaration and verification by the taxpayer |

FAQ – ITR-3 A.Y. 2023-24

1. What is ITR?

– ITR stands for Income Tax Return forms used by taxpayers to report their income, deductions, and taxes to the income tax department.

2. What is ITR-3?

– ITR-3 is a specific Income Tax Return form in India used by individuals and Hindu Undivided Families (HUFs) who have income from business or profession.

3. Who can file ITR-3 A.Y. 2023-24?

– Individuals and HUFs who earn income from profit and gains of business or profession, including partnership firms, Limited Liability Partnerships (LLPs), and presumptive business or profession, can file ITR-3.

4. Who cannot file ITR-3 A.Y. 2023-24?

– Individuals or HUFs whose primary source of income is not business or profession, and companies or firms, are not eligible to file ITR-3.

5. What documents are required to file ITR-3?

– Personal information, financial statements, income details, deductions and exemptions, TDS certificates, Form 16, and other relevant documents may be required to file ITR-3.

6. What are the changes in ITR-3 for A.Y. 2023-24?

– Changes in ITR-3 include the introduction of a schedule to report income from Virtual Digital Assets (VDAs), provisions for opting out of the New Tax Regime, SEBI registration for FIIs/FPIs, changes in balance sheet reporting, and a new section for trading account.

7. What are the prerequisites to file ITR-3 online?

– PAN, access to the official e-filing portal, digital signature (optional), pre-filled data (if applicable), bank account details, Aadhaar card details, and a valid email address and mobile number are required to file ITR-3 online.

8. What is the procedure to file ITR-3 online or offline?

– ITR-3 can be filed online through the official e-filing portal or partially online and partially offline using the offline utility provided by the Income Tax Department.

9. What are the due dates to file ITR-3?

– The due date for filing ITR-3 for individuals, HUFs, and businesses (not requiring audit) is July 31, 2023. The due date for businesses requiring audit and transfer pricing reports is October 31, 2023.

10. What is the structure of ITR-3 A.Y. 2023-24?

– The structure of ITR-3 includes parts for general information, a balance sheet, a profit and loss statement, and schedules for details and computation of various income sources.

How to enter Transport income in ITR3 java utilitiy. U/S 44AE?

Hi sir

Kya mobile se itr3 file kar sakte hai

Hi Akhilesh, I suggest you should use desktop or laptop to file ITR 3. Thanks

ITR 3 for AY 2018-19 Java Version – No provision to generate xml file?

There is a submit button which does nothing.

How to generate xml to upload?

THANKS

sir itr 3 me coloum 27 about Do you want to claim the benefit u/s 115H (Applicable to Resident)?

me yes or no kuch bhi nahi ho raha hai kaise kare

Sir,

How do you input Aadhaar number in ITR3 & ITR4?

We are unable to put Aadhaar no. & hence the ITR is not uploading on e-filing portal

Thanks & Regards

Hi Swajeet Saran, I will correct it. Thanks for correcting us.