Income Tax Updated Return (ITR-U)

For the persons to update income within 24 months from the end of the relevant assessment year

Why ITR-U

The department has provided the additional time of 24 months to file an updated return whether you have filed income tax return previously or not. So, you can say that there is another chance for the taxpayers who have missed the chance to file income tax return from A.Y. 2020-21. The taxpayer shall be required to pay additional tax and fee to correct the ITR which is required to be paid along with updated ITR (ITR-U).

ITR-U Applicable Assessment Years

- Any person who is eligible to file ITR-U can file the updated return for A.Y. 2020-21 and subsequent assessment years. Please check eligibility if you can file ITR-U or not from the column of eligibility for ITR-U.

- Starting From A.Y. 2020-21 and Subsequent Years

- The Taxpayer can file an updated ITR within 24 months from the end of the relevant AY. So, for the AY 2022-23, the taxpayer can file his updated ITR latest by March 31,2025.

Eligibility to File ITR-U

- Any person whether or not he has furnished a return of income for an assessment year can file an Updated ITR. Therefore, an Individual, Firm, LLP, a Company or AOP or BOI can file updated return of income.

The ITR-U can be filed whether the Taxpayer has file his original ITR within the extended time. In case where the Taxpayer has not filed any ITR in that case also an Updated ITR (ITR-U) can be filed, provided

(i) ITR-U can not be filed if having loss

(ii) ITR-U can not be filed if having refund

Additional fees to file ITR-U

The Taxpayer shall be liable to pay additional fee for filing ITR-U in the following cases.

- If an ITR has been filed u/s 139(1), then no fees is payable along with an Updated ITR.

- If no ITR has been filed, additional fees of Rs.5,000 shall be payable.

Additional Tax to File ITR-U

- The computation of tax payable on the income returned in the Updated ITR is similar to normal tax computation.

- Credit of TDS, Advance Tax, relief etc. is required to be allowed.

- However, the next tax payable as per the Updated ITR is required to be increased by 25% and 50% respectively if the Updated ITR is filed within the 12 months or 24 months from the end of the relevant AY.

Important Dates

- ITR-U Notified – 29th April 2022

Related Provisions

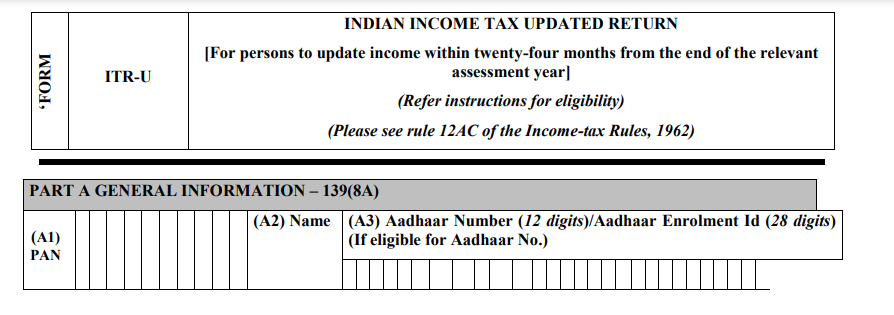

- Section 139 (8A) of Income Tax Act

- Rule 12AC of Income Tax Rules

- Download ITR-U Form

What is the benefit to the assessee to file ITR U if he is not allowed to file with a loss or refund…? It is only for the benefit of the department/ Govt to make money it seems.