Simplified Explanation of the New GST Set-Off Rules: Business owners have to navigate a variety of rules and regulations to comply with the Goods and Services Tax (GST). The government changed the set-off procedure with effect from 29th March 2019. The new rule specifies that IGST credit set-off rules must be fully utilized before using CGST and SGST credits. Many business owners are confused by these new GST set-off rules. Business owners find it tough to stay on top of constantly changing regulations and stay in compliance. We will do our best to simplify and make easy-to-understand the new GST set-off rules. No matter what kind of business you run or how large your corporation is, we are here to help you navigate the GST system, maintain compliance with the law, and make sure you stay in compliance. Don’t hesitate to reach out to us if you’re feeling overwhelmed by the new set-off rules. Our team is here to assist you.

What are the new GST set-off rules?

With the new rules in place, it is mandatory to utilize the entire IGST available in the electronic credit ledger before utilizing ITC on CGST or SGST. The order of setting off the ITC of IGST can be done in any proportion and any order towards setting off the CGST or SGST output after utilizing the same for IGST output.

Order of Utilization of GST Input Tax Credit

| Output of | 1st Set off from | 2nd set off from |

| IGST | IGST | CGST and SGST |

| CGST | IGST Balance | CGST |

| SGST | IGST Balance | SGST |

In other words, you can simply understand the concept of GST set-off rule easily by the following points.

1. IGST Input Credit Utilization

The IGST Input Tax Credit Shall be

- first utilized towards the output of IGST;

- then towards the output CGST;

- and then towards the output SGST

2. CGST Input Tax Credit Utilization

The CGST Input tax credit shall be

- first utilized toward the output of CGST

- and then toward the output of IGST

- You can’t adjust CGST input toward the output of SGST

3. SGST Input Credit Utilization

The SGST Input tax credit shall be

- first utilized the output of SGST

- and then toward the output of IGST

- You can’t adjust SGST Input toward the output of CGST

How do the new GST set-off rules work?

A business can set off its ITC against its output liability under the new GST set-off rules, as described above. Below are some examples that will clarify the confusion of businessmen about the new GST set-off rules.

Example:

| Head | Output | Input |

| IGST | 1000 | 1300 |

| CGST | 300 | 200 |

| SGST/UTGST | 300 | 200 |

| Total | 1600 | 1700 |

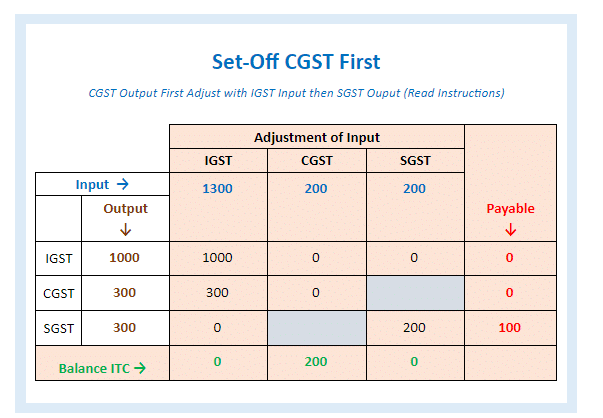

Option 1

Here CGST is adjusted first from IGST input balance.

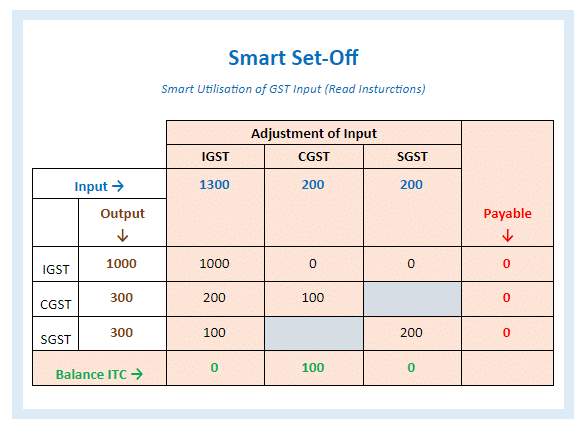

Option 2

In this case, you can adjust the IGST Input balance where the liability lies by using the smart adjustment. For cash payment avoidance, we take more IGST input against SGST output.

Impact on Businesses of New Set-off Rules

- Under option 1, GST is liable for payment under the head of SGST. In option 2, however, there is no liability because it adjusts the balance of the IGST input tax credit to SGST output.

- If we adjust the new set off rules smartly as per rules, then we have more working capital without any blockages.

- Businesses can reduce their GST liability by utilizing the set-off provisions effectively, resulting in lower tax payments. Reduced GST payments can improve the overall cost structure of a business and increase profitability.

Businesses will pay less tax to the government due to a reduced GST liability. By freeing up funds for other business needs, like investment, expansion, or working capital, can enhance cash flow.

Common issues faced by businesses with the new GST set-off rules

- Complexity: Businesses may initially be confused by new GST set-off rules when they are introduced. Confusion can arise from unclear rules or delays in official guidance, making it difficult for businesses to ensure accurate compliance and plan their financial strategies.

- Lack of Clarity: Compliance with GST set-off rules may become more complex as a result of changes. It may involve new calculations, documentation requirements, or modifications to existing systems and processes. Compliance errors and penalties may result from businesses failing to understand and adapt to the revised rules.

That’s why we wrote this detailed article on GST set-off rules. Don’t forget to use our free GST Set off Rules Calculator after reading through completely.

Tips for complying with the new GST set off rules

- Professional Consultation: Consult a tax professional or qualified accountant if you have questions or need assistance with complying with the new set-off rules. Depending on your specific business requirements, they can provide guidance and help ensure compliance.

- Stay Informed: Be sure to stay up-to-date on the latest GST regulations and amendments. Keep track of official notifications, circulars, and guidelines issued by the tax authorities. As a result, you will be aware of any changes in the set-off rules and able to take the necessary steps to comply.

New GST set-off Rules vs. Old GST Set-off Rules

It is important to understand the old GST set off rules before understanding the new ones. The following table compares the new GST set off rules with the old set off rules.

Old Set-Off Rules (till January 2019):

- For inter-state transactions (IGST), the first set-off is claimed from IGST. If there is any remaining balance after utilizing the IGST set-off, it can be further set off against CGST and SGST liabilities.

- For intra-state transactions (CGST and SGST), the first set-off is claimed from CGST or SGST, respectively. If there is any remaining balance after utilizing the set-off against the respective tax, it cannot be set off against IGST.

New Set-Off Rules (from 1st February 2019):

- For inter-state transactions (IGST), the first set-off is claimed from IGST. If there is any remaining balance after utilizing the IGST set-off, it can be further set off against CGST and SGST liabilities.

- For intra-state transactions (CGST and SGST), the first set-off is claimed from IGST. If there is any remaining balance after utilizing the IGST set-off, it can be further set off against the respective tax liability (CGST for CGST transactions and SGST for SGST transactions).

To summarize:

Old Set-Off Rules (till January 2019):

Payment for IGST: 1st set-off from IGST, then CGST and SGST.

Payment for CGST: 1st set-off from CGST, then IGST.

Payment for SGST: 1st set-off from SGST, then IGST.

New Set-Off Rules (from 1st February 2019):

Payment for IGST: 1st set-off from IGST, then CGST and SGST.

Payment for CGST: 1st set-off from IGST, then CGST.

Payment for SGST: 1st set-off from IGST, then SGST.

To Better Understand:

| Old Set Off Rules till January 2019 | New Set Off Rules from 1st February 2019 | ||||

| Payment for | 1st set off from | 2nd set off from | Payment for | 1st set off from | 2nd set off from |

| IGST | IGST | CGST and SGST | IGST | IGST | CGST and SGST |

| CGST | CGST | IGST | CGST | IGST | CGST |

| SGST | SGST | IGST | SGST | IGST | SGST |

New Utilization Rules Statutory Provisions

Here are some of the important provisions related to GST Set Off/utilization.

| Rule 88A | Order of Utilization of Input Tax Credit |

| Section 49A CGST ACT 2017 | Utilization of Input Tax Credit Subject to Certain Conditions |

| Section 49B of CGST ACT 2017 | Utilization of Input Tax Credit Subject to Certain Conditions |

| Notification No.16/2019 Dt 29-03-2019 | |

| Circular No.98/17/2019 GST Dt 23-04-2019 |

Section 49A and 49B incorporated by the GST amendment act, 2018 effective from 1st Feb 2019. The impact of these notifications has been practically nullified by the issuance of rule 88A vide notification no. 16/2019 Ct dated 29th March 2019. CBIC vide circular No. 98/17/2019-GST dated 23-04-2019 clarified the manner of utilizing the credit.

Conclusion and final thoughts

Businesses will benefit from the new GST set-off rules, which simplify the GST system and reduce compliance costs. With the help of professional consultancy services and technology investments, businesses can navigate the complexities of the new GST set-off rules and ensure their long-term success.

Our GST set-off calculator Excel offers two options for GST set-offs. Depending on your working capital requirements, you can choose any one of these options. You can also check the GST portal for manual set-offs. We hope you enjoyed our detailed article on the new GST utilization rules. Feel free to ask any questions regarding GST set-off rules via the comment form. In the shortest time possible, our team will respond to your inquiry.

Our website regularly posts articles on income tax and GST. Get regular updates by subscribing to your email address.

FAQ on New GST Set-Off Rules

Q. Can I utilize SGST input toward CGST?

A. No, you cannot utilize SGST (State GST) input towards CGST (Central GST) or vice versa. SGST credits can be utilized towards the output of SGST, and CGST credits can be utilized towards the output of CGST. These credits cannot be interchanged or adjusted against each other.

Q. Can I utilize CGST input toward SGST?

No, you cannot utilize CGST (Central GST) input towards SGST (State GST) output. The new GST set-off rules specify that CGST credits should be utilized first towards the output of CGST and then towards the output of IGST (Integrated GST). Similarly, SGST credits should be utilized first towards the output of SGST and then towards the output of IGST.

Q. Can I Utilize IGST input twoard CGST and SGST output?

Yes, you can utilize IGST (Integrated GST) input towards both CGST (Central GST) and SGST (State GST) output. According to the new GST set-off rules, the order of utilization for IGST credits is as follows:

IGST output

CGST output

SGST output

If you have IGST input credits available, you can first utilize them towards the output of IGST. If there is any remaining balance after utilizing IGST credits for IGST output, you can further set off that balance against CGST and SGST liabilities. This allows for the utilization of IGST input towards both CGST and SGST outputs, in any proportion and any order after utilizing it for IGST output.

Q. Can a late fee be set off through a credit ledger balance in GST?

A. No, a late fee cannot be set off through a credit ledger balance in GST. Late fees are penalties imposed for non-compliance with GST regulations, such as late filing of returns or late payment of taxes.

Input tax credits (ITC) in the credit ledger can only be utilized for offsetting the tax liability on output supplies. They cannot be used to set off or pay any penalties, including late fees. Late fees are separate from tax liability and need to be paid separately.