Life insurance premium protects one’s life as well as it is a great tool for tax planning.It helps to save tax.

Life insurance premium is the amount paid by a person for buying a insurance policy. The life insurance company provides a lump sum amount at the end of term which is called maturity in exchange of premium paid. The lump sum amount is sum assured which is given to your family in case of the death of the individual buying the policy.

The income tax act provides tax benefits on premium paid for life insurance so that people invest a part of their savings in purchasing life insurance policy to secure their lives.

Tax Benefits under LIC Plans

Individual and HUF can claim deduction under this section 80C. Individuals can take policies on their name, spouse’s name, child’s name (whether married/ unmarried, minor/major, dependent/ independent). HUF can take policy in the name of its members.

The maximum amount of deduction for payment of insurance premium is Rs.1,50,000. Never forget that deductions under section 80C & 80CCC & 80CCD is Rs.1,50,000.

Important Life Insurance Schemes

- Whole Life Policy

- Limited Life Policy

- Endowment Assurance

- Fixed Term (Marriage) Endowment and Educational Annuity

- Money Back

- Anticipated Whole Life

For more information about various LIC Schemes – Check Here

Frequently Asked Questions (FAQ’s) About LIC

- What is the way of paying premium to claim deduction under section 80C?

No, the premium can be paid by any method such as cash, cheque, and account transfer in order to claim the 80C benefit.

- Is premium paid for the policy taken on the name of Parents, Brother, Sister or in-laws eligible for deduction?

Premium paid for self, spouse, child is only eligible. Hence premium paid for parents, brother, sister or in-laws is eligible for claiming deduction.

- Whether the premium paid for more than one policy taken is eligible for deduction?

If one is paying premium for more than one insurance policy, all the premiums paid are eligible for deduction.

- Is it necessary to have an insurance policy from LIC only?

It is not necessary to have an insurance policy from LIC only; even insurance policy purchased from other companies can be considered for this deduction.

Taxability of Maturity Proceeds

Besides the deductions allowed on premium paid; the amount received on maturity, surrender or death is exempt under Section 10(10D).

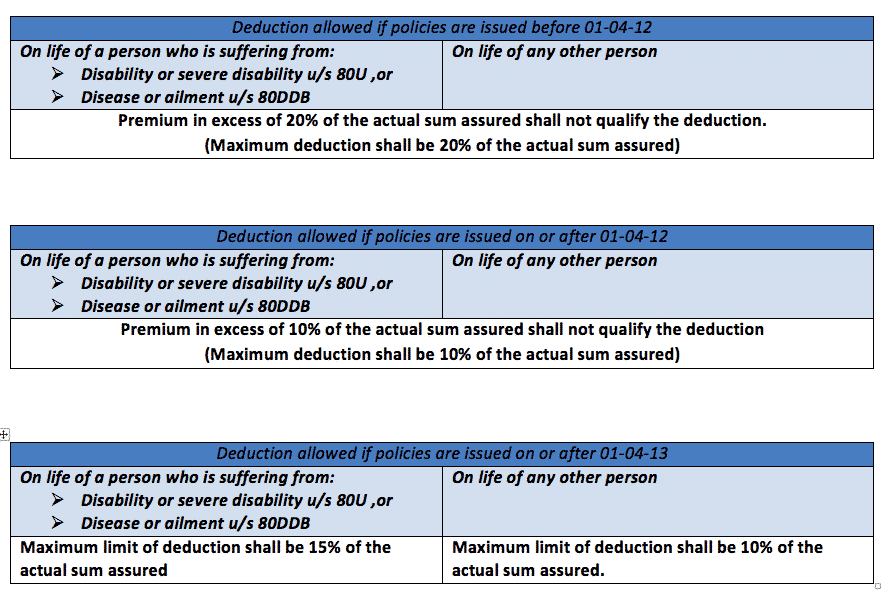

If the policy is issued after April 1, 2003 and up to March 31, 2012 and the premium payable in a year is does not exceed 20% of the actual sum assured, then the amount received on maturity will be exempt, otherwise the amount received on maturity will be taxable.

In case the policy is issued on after April 1, 2012, if the premium payable in a year does not exceed 10% of the sum assured, then the amount received on maturity will be exempt, otherwise the amount received shall be taxable.

In case the policy is issued on or after April 1,2013 if the premium payable in a year does not exceed 10% of the sum assured and 15% of the sum assured in case of several disability or disease then the amount received on maturity shall be exempt, otherwise the amount received shall be taxable.

In case of death, the amount received shall always be exempt. In other words, any amount received by the dependent/nominee on the death of policy holder is fully exempt.

Life Insurance Premium Deduction Limits in Certain Cases