In simple words, a PAN card is an identity in the eyes of Income Tax Department. It contains all the necessary information which Income Tax Department needs. In this article, we will cover all aspects of PAN like what is PAN, How to apply, Who is liable to apply etc. Please ask if you have any queries regarding PAN in the comment form given below.

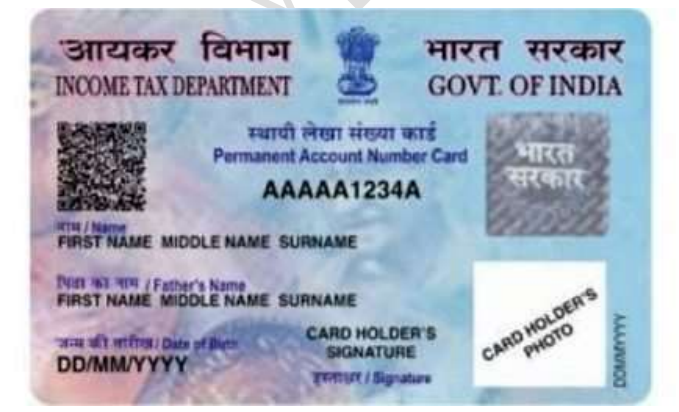

What is PAN Card?

- A PAN Card represents an identity proof for an individual that serves as recognition to the Government at the time of paying taxes.

- It is a ten-digit unique alpha numeric number that is distinct from any other PAN Card.

- The full form of PAN is ‘Permanent Account Number’ and usually comes in a laminated form from the Assessing Officer of the Income Tax Department.

- Apart from mainly being used as an aid to pay taxes, it also serves as a medium of convenience when serving occasions such as depositing a sum in excess of Rs. 50, 000 with a bank or a Post Office, or, while making a payment in excess of Rs. 20, 000 at the restaurant as a bill.

- There are also other instances where the presence of the PAN Card becomes valid at the time of making certain specified expenditures.

Structure of PAN Card

Let’s discuss the structure of the ten characters of PAN card.

Example PAN: BLGPS1234D

- Out of the first five characters, the first three characters represent the alphabetic series running from AAA to ZZZ.

- The fourth character of PAN represents the status of the PAN holder.

- “P” stands for Individual

“C” stands for Company

“H” stands for Hindu Undivided Family (HUF)

“A” stands for Association of Persons (AOP)

“B” stands for Body of Individuals (BOI)

“G” stands for Government Agency

“J” stands for Artificial Juridical Person

“L” stands for Local Authority

“F” stands for Firm/ Limited Liability Partnership

“T” stands for Trust - The fifth character of PAN of the first character of PAN holders’ last name/surname in the case of an individual. In the case of non-individual PAN holders, the fifth character represents the first character of PAN holder’s name.

- The next four characters are sequential numbers running from 0001 to 9999.

- The last character, the tenth character is an alphabetic check digit.

Am I liable to apply for PAN Card?

- Every person who is liable to pay taxes falls into the category of people who should necessarily obtain PAN from the Indian Government.

- Additionally, people who are into any kind of financial or economic transaction should also obtain a PAN where such criteria are required to be fulfilled.

- However, it should be known that a person may also be allotted a PAN Card by the Assessing Officer himself if the officer desires so.

- Any person receiving any income on which TDS is payable will furnish PAN to the TDS deductor and the deductor will give Form 16 to the deductee specified PAN in it.

Procedure to apply for PAN Card?

- For the purpose of applying for a PAN Card, one must ensure the presence of certain documents beforehand.

- These documents include a colour photograph of the assessee, a valid residential proof of the assessee, a signature specimen of the assessee and other informative data.

- Once all the necessary documents have been accumulated, the person needs to obtain FORM 49A.

- You can apply for PAN card online – Here

- You can apply for PAN card offline – Download From 49A and submit it to TIN Facilitation Center – Find the address here

Is it necessary to file an income tax return if having PAN Card?

- Filing a return becomes mandatory only if the income is above the tax-free limit.

- In the case where an assessee finds his income below the taxable limit, then the same is not under an obligation to file his taxes in spite of having a PAN Card.

- However, in a period where his income is taxable in a year, he then must file his income tax return and also his PAN Card number at the time of filing the return.

- The assessee also has the option to file his return with nil taxable income just to be on the safer side.

Should I Surrender my Extra PAN Card?

- You should have only one PAN card in your name.

- If you have by mistake or by any reason two or more PAN cards in your own name then you must surrender them to the help desk of the Assessing Officer.

- A detailed press release was issued in this regard on 12th Feb 2007. (Press Release No.402/92/2006-MC (08 of 2007).

Check PAN Card Status for New PAN Applications

PAN Validation Tool – Check PAN Format Valid or Not?

I Have Missed My Pen Card slip. How To i find my pen nomber plz help me..

Hi sir

I m Manoj he mane pan card bnwane k liye online form bhra tha wo mujse dilit ho gya he mere pas pan card ka number b Yas nhi he me apna pen card kese bnwa skta hu pleased help me

Kindly let me know from you,How I can find out My Pan Card Number which got faded. Is it possible to get the Pan card From the:-

Name M.K. Jacob

Date of Birth 09/05/1952

Thanking you,

Sir i lost my pan card, i know my pan card number, date of birth not remember so please tell me what can i do….

SIR MERA PAN CARD MISS HO GAYA AND PAN NUMBER BHI NAHI HAI.PLEASE HELP ME SIR MEIN ISE KASE PA SAKTA HU

Hot to get area code and ao number please inform me sir

Sir,

Lost my pan card my pan number may kindly b sent to me nd oblige

Yours faithfully

Find pan number

sir i lost my pan card and idon’t remember pan card no .what to do know plz help me in getting my pan card no

sir i lost my pan card and idon’t remember pan card no .what to do know plz help me in getting my pan card no

I forgot my login id for filling my return. I request please provide me my login id of income tax.

Regards

Raman Kwatra

I am a member of an organization registered under the Societies of the State. Basing on this we obtained a PAN Card under the category of group of individuals. . However, our Income is below the taxable limit. Is it obligatory to file the IT Return even if the net income is below the taxable limit.

Kindly clarify.

Thanking you