PAN Validation Tool: This tool (PAN Validator) confirms the valid structure of the Permanent Account Number (PAN). There are ten letters and numbers in this code, as discussed in the PAN structure above. There is a particular structure that follows the formation of a PAN (Permanent Account Number) card in India. PAN Validator allows you to check whether the PAN you have entered is valid or not based on its structure.

How to use PAN Validation Tool?

Here are the steps you can take to check PAN card is valid or not. In addition, the criteria for using this PAN validation tool are provided.

Step 1: You’ll need the PAN card number.

Step 2: Enter your PAN Number Here. This took will automatically check whether your PAN is valid or not. Here valid means that the structure of PAN is valid or not.

After typing the PAN card number, the system will check it and show the results. The PAN card number’s legitimacy will be shown as per the following criteria.

Criteria 1: It will check whether the PAN has 10 digits or not.

Criteria 2: It will check the first three characters of PAN should be alphabetically or not.

Criteria 3: Then it will tell you the payee type by the 4th character of PAN.

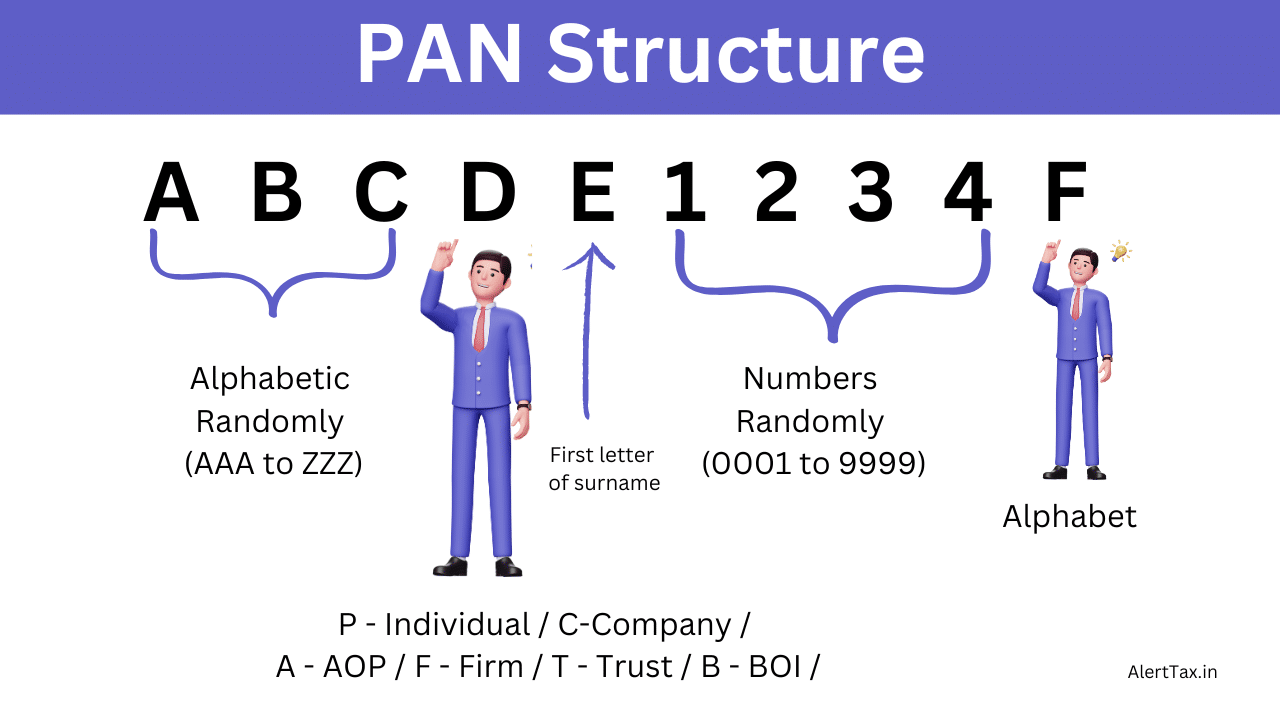

PAN Structure

There are certain standards that must be met when it comes to the look of a PAN card (Permanent Account Number) in India. A PAN card number consists of ten characters divided into five parts. So by checking these five parts you can verify and validate the PAN on your own.

Part 1: The first three characters, from AAA to ZZZ, are the alphabet. Any random alphabet can be represented by these characters.

Part 2: A fourth character is an alphabet as well. However, it represents the type of assessee, such as Individual, Company, HUF, AOP, BOI, Government Agency, Artificial Juridical Person, Local Authority, Firm/LLP, and Trust.

Part 3: It says that the fifth character on a PAN card must be a letter between A and Z. The first alphabet of the assessee’s surname is represented by this letter,

Part 4: The next four characters will be from a numerical series. The numbers may be random.

Part 5: The last character of the PAN card will be chosen at random, but it will be an alphabetical character.

The above PAN validation tool will check the complete structure of PAN.

Assessee Types to Check Validation

The following characters represent the following assessee type. The 4th character provides information about the type of assessee, so you can verify the PAN using it.

| Character | Assessee Type |

| P | Individual |

| C | Company |

| H | Hindu Undivided Family (HUF) |

| A | Association of Persons (AOP) |

| B | Body of Individuals (BOI) |

| G | Government Agency |

| J | Artificial Juridicial Person |

| L | Local Authority |

| F | Firm/Limited Liability Partnership |

| T | Trust |

PAN Validation Example

Here’s a PAN card number as an example of how the format works:

ABCPD1234K

The check figure is used to make sure that the PAN card number is real.

In this case, “ABC” stands for any random alphabet, “P” stands for assessee type i.e. Individual, and “D” stands for the first letter of the last name/surname of the assessee.

Taxpayers should be aware that the style of a PAN card number hasn’t changed over time.

The PAN Validation Tool (PAN Validator) is a tool used to check the validity of Permanent Account Number (PAN) cards in India. It requires the PAN card number, enters it, and checks its verification based on criteria such as whether it has 10 digits, the first three characters should be alphabetically, and the payee type by the 4th character. A PAN card number consists of ten characters divided into five parts: the alphabet, type of assessee, letter between A and Z, numerical series, and last character. The PAN validation tool checks the complete structure of the card, which includes the alphabet, type of assessee, a letter between A and Z, numerical series, and letter between A and Z. Taxpayers should be aware that the style of a PAN card number has not changed over time.

If you found any error in the PAN Validation tool, please contact us via the comment form.