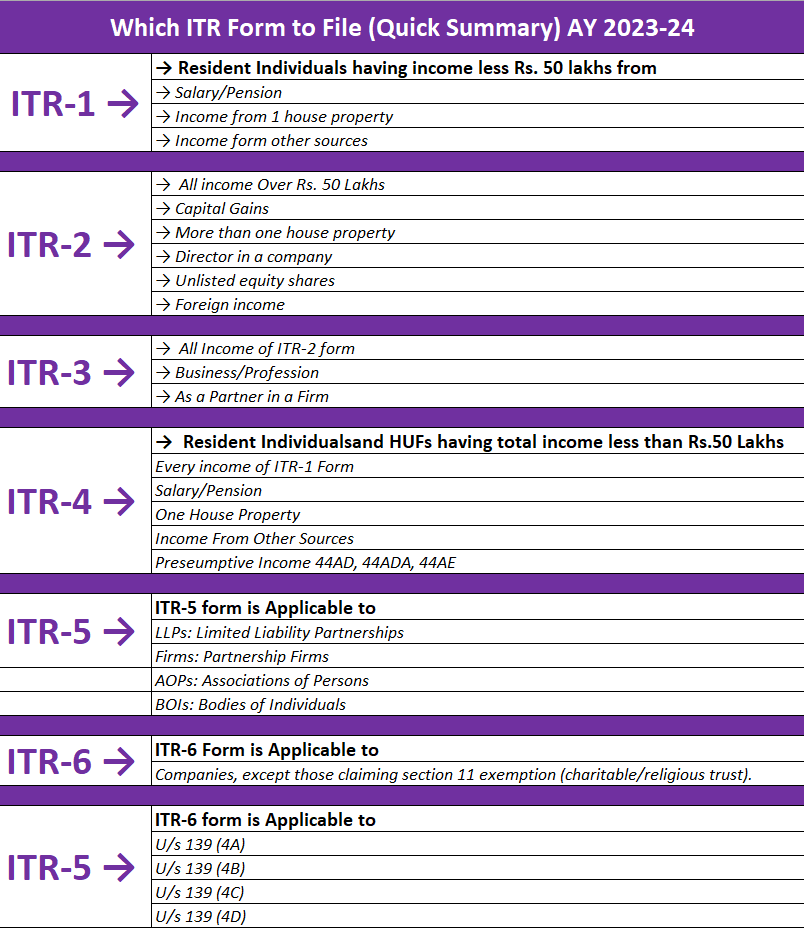

Which ITR Form Should You File for AY 2023-24: It is important to determine the appropriate form to use when filing income tax returns. To facilitate the filing of income tax returns, the income tax department has introduced a variety of forms. However, selecting the correct form can often be difficult for taxpayers. There are seven income tax forms known as ITR forms, namely ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, ITR-6, and ITR-7. The purpose of this article is to analyze each form comprehensively to determine which one applies to your individual tax filing needs. By the end of this read, you’ll better understand which ITR form is right for you and be well on your way to filing your taxes with confidence and ease. So, let’s get started and unravel the mystery of ITR forms!

Understanding the different ITR Forms – ITR 1 to ITR 7

ITR-1

Individuals with an annual income of up to Rs.50 lakhs can file ITR 1 or SAHAJ, the simplest form in the series. Income sources such as salaries, pensions, and interest income are included on this form, also called the ‘Return of Income.’

Who Can File ITR 1 (SAHAJ)?

ITR-1 form is designed for resident individuals in the AY 2023-24. It is applicable if your total income includes:

- Income from Salary/Pension

- Income from One House Property (excluding cases with loss brought forward)

- Income from Other Sources (excluding winnings from lottery and income from racehorses)

- Agricultural income up to Rs 5000 is also considered under ITR-1.

The form simplifies the process of filing income tax returns for individuals with these income sources. By using ITR-1, you can ensure a smooth and hassle-free tax filing experience.

Who Can Not File ITR-1?

- ITR-1 Form is not suitable for certain individuals with specific circumstances. You cannot use ITR-1 if:

- Your total income exceeds Rs 50 lakh.

- Your agricultural income exceeds Rs 5000.

- You have taxable capital gains.

- You have income from business or profession.

- You earn income from more than one house property.

- You hold the position of a Director in a company.

- You have invested in unlisted equity shares during the financial year.

- You possess assets (including financial interest in any entity) outside India or hold signing authority in any account located outside India.

- You are a resident but not ordinarily resident (RNOR) or a non-resident.

- You earn any foreign income.

- You are liable to pay tax on behalf of another person for income on which tax has already been deducted in the hands of that person.

- Tax has been deducted from your income under Section 194N.

- In the case of Employee Stock Ownership Plans (ESOPs), if the payment or deduction of tax has been deferred.

- You have any brought forward loss or a loss that needs to be carried forward under any income head.

- If any of the above situations apply to you, ITR-1 Form is not the appropriate choice for filing your income tax returns.

ITR-2

Hindu Undivided Families (HUFs) and individuals who earn more than Rs.50 lakhs per year from sources other than salaries, pensions, and interest should file an ITR 2. Capital gains, house property, and other sources of income are included in this form. Additionally, if the income of another person, such as a spouse or child, is to be combined (clubbed) with the taxpayer’s income.

Who Can File ITR -2?

TR-2 can be used as long as their income falls within any of the below-mentioned categories.

ITR-2 is appropriate for individuals or Hindu Undivided Families (HUFs) with the following sources of income for Assessment Year (AY) 2023-24:

- Income from Salary/Pension

- Income from House Property

- Income from Other Sources (including Winnings from Lottery and Income from Race Horses)

- Individuals serving as Directors in a company

- Investments in unlisted equity shares during the financial year

- Being a resident not ordinarily resident (RNOR) and non-resident

- Income from Capital Gains

- Possession of foreign income

- Agricultural income exceeding Rs 5,000

- Ownership of assets (including financial interest in any entity) outside India, including signing authority in any account located outside India

- Tax deduction under Section 194N

- Deferred payment or deduction of tax on ESOP (Employee Stock Ownership Plan)

- Presence of any brought forward loss or loss that needs to be carried forward under any income head

Who Can Not File ITR-2?

Individuals who have income from business or profession cannot use ITR-2. They will need to use a different form, such as ITR-3 or ITR-4.

ITR-3

Form ITR-3 can be used by an individual or HUF who is having income under the head business or profession.

Who Can File ITR-3?

To be eligible to file ITR-3, you must meet the following criteria. You must have income from following sources:

- Business or Profession

- Directorship in a Company

- House Property

- Salary/Pension

- Other sources of income

- Investment in unlisted equity shares

Who Can not File ITR-3?

Form ITR-3 can not be used by any person other than an individual or a HUF. Further an individual or a HUF not having income from business or profession cannot use ITR-3.

ITR 4 (Sugam)

The ITR4 or SUGAM is intended for individuals, HUFs, and companies with an annual income up to Rs.50 lakhs and who have elected presumptive taxation under sections 44AD, 44ADA, and 44AE. In addition to income from business and professions, this form includes income from house property and other sources.

Who can File ITR-4 (Sugam)?

In order to file ITR-4, individuals, Hindu Undivided Families (HUFs), and partnership firms (other than LLPs) must have the following types of income for the financial year 2022-23/Assessment Year 2023-24.

- Business income under the presumptive income scheme under section 44AD or 44AE.

- Professional income under the presumptive income scheme under section 44ADA.

- Salary or pension income up to ₹50 lakh.

- Income from one house property up to ₹50 lakh (excluding the amount of brought forward loss or loss to be carried forward).

- Income from other sources up to ₹50 lakh (excluding income from lottery and race-horses).

What is a presumptive income scheme: Presumptive income schemes simplify the process of computing income for taxpayers who meet certain criteria. According to a presumptive income scheme, a taxpayer’s income is presumed to be a certain percentage of their gross receipts or turnover. If you don’t have the time or resources to keep detailed records of your income and expenses, this can be a helpful option for you. The taxpayer will need to file ITR-3 if the business turnover exceeds Rs 2 crore.

Who can not File ITR-4 (Sugam)?

- Individuals with incomes exceeding Rs 50 lakh from salaries, house property, or other sources are not eligible to use this form.

- This form cannot be used by individuals who hold directorships and own unlisted equity shares.

- Individuals, Hindu Undivided Families (HUFs), or partnerships whose books of accounts must be audited under the Income Tax Act, 1961, must complete this form.

- Residents who are Resident but Not Ordinarily Residents (RNOR) and non-residents can use it.

- This Return Form cannot be used by individuals who are both directors of a company and have investments in unlisted equity shares.

- These forms are available to individuals who have received deferred tax on Employee Stock Ownership Plans (ESOPs) from an eligible start-up.

- This form is applicable to individuals with agricultural income exceeding Rs 5,000.

ITR-5

The ITR-5 is an income tax return (ITR) form used by entities other than individuals, Hindu Undivided Families (HUFs). An ITR-5 tax return can be used by a wide variety of entities, including firms, Limited Liability Partnerships (LLPs), Associations of Persons (AOPs), Bodies of Individuals (BOIs), Artificial Judicial Persons (AJPs), Estates of deceased individuals, Estates of insolvent individuals, Business trusts, and investment funds. ITR-5 provide a comprehensive way for such entities to fulfill their tax obligations.

Who can file ITR-5?

ITR-5 can be filed by the following entities:

- Firms

- Limited Liability Partnerships (LLPs)

- Association of Persons (AOPs)

- Body of Individuals (BOIs)

- Artificial Juridical Person (AJP)

- Estate of deceased

- Estate of insolvent

- Business trust

ITR-6

ITR-6 form can be used by any company, except a company claiming exemption under section 11 (exemption under section 11 can be claimed by a charitable/religious trust).

ITR-7

ITR-7 form can be used by a person or company that is required to file returns under sections 139(4A) or section 139(4B) or section 139(4C) or section 139(4D) (such as trusts, political parties, institutions, colleges, etc.).

Step by Step Guide to Choose ITR Form

Now that we have a better understanding of the question which ITR form I should file? let’s take a look at the criteria for selecting the right form.

Step 1: Income sources

The first criterion for selecting the right ITR form is the type of income source. If you are a salaried individual, ITR 1 or SAHAJ is the right form for you. If you have an income from sources other than salary, such as capital gains or house property, you should file ITR 2 or ITR 3, depending on whether you are a partner in a partnership firm or run a proprietorship business. If you have opted for the presumptive taxation scheme, you should file ITR 4 or SUGAM.

Step 2: Residential status

The second criterion for selecting the right ITR form is your residential status. If you are a resident individual, you can file any of the ITR forms mentioned above, depending on the type of income. If you are a non-resident individual or a foreign company, you should file ITR 2 or ITR 3, depending on your income sources.

Step 3- Income amount

The third criterion for selecting the right ITR form is the amount of income earned. If your total income for the financial year is less than Rs.50 lakhs, you can file ITR 1 or SAHAJ, ITR 4 or SUGAM, or any other relevant ITR form. If your income is more than Rs.50 lakhs, you should file ITR 2 or ITR 3, depending on your income sources.

Common mistakes to avoid while selecting an ITR Form

While selecting the right ITR form is crucial, it’s equally important to avoid common mistakes that taxpayers make while selecting a form. Here are some of the common mistakes to avoid:

1) Choosing the wrong form

One of the most common mistakes that taxpayers make is choosing the wrong ITR form. This mistake could result in the rejection of your return or lead to penalties for non-compliance. Make sure you choose the right form based on your income sources, residential status, and income amount.

2) Not disclosing all sources of income

Another common mistake that taxpayers make is not disclosing all sources of income. Make sure you include all sources of income, including income from salary, business, profession, capital gains, and house property, among others.

3) Filing the wrong form multiple times

Filing the wrong form multiple times could result in the rejection of your return or lead to penalties. Make sure you choose the right form from the beginning and rectify any mistakes before filing your return.

How to fill out the selected ITR Form

Once you have selected the right ITR form, the next step is to fill it out correctly. Here’s how you can fill out your ITR form. It is the offline procedure to file ITR form. You can also file ITRs online through the Income Tax Department’s website. You don’t need to download your ITR to file it online.

- Download the ITR form or Excel Utility: The first step is to download the relevant ITR form excel utility from the Income Tax Department’s website.

- Gather all relevant documents: The next step is to gather all relevant documents, including Form 16, Form 26AS, bank statements, and investment proofs, among others.

- Fill out the form: The next step is to fill out the ITR form correctly, including personal details, income details, and tax details.

- Verify the form: The final step is to verify the ITR form using your Aadhaar number, net banking, or bank account details.

Documents Required to File ITR

In order to successfully file your ITR, it is important to have certain documents handy. These documents serve as evidence to support the data you are providing in your tax return. However, please note that you do not need to physically attach these documents to your tax return. They are solely required for verification purposes to ensure the accuracy of the information you are submitting.

- Form 16: Form 16 is a certificate issued by your employer that contains details of your salary income, tax deducted at source (TDS), and other relevant details.

- Form 26AS: Form 26AS is a consolidated statement that contains details of tax deducted at source (TDS), tax collected at source (TCS), and other tax payments made on your behalf.

- Bank statements: You will need bank statements for all your bank accounts to calculate your income and expenses accurately.

Investment proofs: You will need investment proofs, such as mutual fund statements, fixed deposit receipts, and insurance policies, among others, to claim deductions under various sections of the Income Tax Act.

Filing your income tax return is an essential part of your financial planning and compliance. By selecting the right ITR form, filling it out correctly, and filing your return within the due dates, you can avoid penalties and interest. Key takeaways from this article include understanding the different ITR forms, selecting the right form based on your income sources, residential status, and income amount, avoiding common mistakes while selecting a form, filling out the form correctly, gathering all relevant documents, e-filing the return, and complying with the deadlines to avoid penalties and interest. With these key takeaways in mind, you can file your income tax return with confidence and ease.

Don’t forget to read 24 FAQ on Which ITR Form to File?

sir no word to thank u

Thanks, Please share with your friends as it helps us to motivate to assist you more. Thanks

I am having one house on Rent and in another one I live being self occupied the income is treated as NIL Ofcourse I have pension and interest from FDs. Please guide me which ITR to use ITR1 or ITR2. Thanks in advance

sir i am e filling incomtax return verification form 2013-14 on 04 aug 2014 but till date not return my money.pl help me.