HUFs and individuals interested in opting for the new tax regime for the Assessment Year 2023-24 are advised to use Form 10IE. The purpose of this form is to indicate that they would prefer the new tax regime to the default old tax regime. Individuals and HUFs with business or professional income must use Form 10IE.

In the case of individuals without income from business or professional sources, there is no need to submit Form 10IE. They can simply switch to the new tax regime without submitting Form 10IE. For individuals and HUFs with business or professional income who wish to opt for the new tax regime, it is essential to submit Form 10IE in advance of filing your income tax return for Assessment Year 2023-24.

People with business income who opt for the new tax regime have only one opportunity to switch back to the old tax regime. Therefore, individuals and HUFs with business income will have to submit Form 10IE twice in their lifetime – once to choose the new tax regime and once to switch back to the old regime. Consider your options carefully before making a decision. Salary individuals can choose between the old and new tax regimes every year.

Table of contents

- Quick Summary of Form 10IE

- Timeline to Submit Form 10IE

- Form 10IE Eligibility

- Form 10IE Ineligibility

- Structure of Form 10IE

- Procedure to Fill and Submit Form 10IE

- How to Fill and Submit Form 10IE Online - Procedure Step by Step

- How to Download Filed Form 10 IE?

- Default Tax Regimes

- Updates - Form 10IEA Announcement

- Difference Between 10IE and 10IEA

- FAQ

Quick Summary of Form 10IE

The following table provides a concise summary of important information regarding Form 10IE, its eligibility criteria, submission deadlines, and the procedure to fill and submit the form online. Additionally, the table highlights the differences between Form 10IE and the newly introduced Form 10IEA, which is applicable for the assessment year 2024-25.

| Topic | Summary |

|---|---|

| Purpose of Form 10IE | To opt for the new tax regime for individuals and HUFs with business or professional income. |

| Submission of Form 10IE | Required for individuals and HUFs with business or professional income. Submit before the deadline for filing the income tax return. |

| Form 10IE Eligibility | Individuals and HUFs with business or professional income who want to opt for the new tax regime. |

| Form 10IE Ineligibility | Individuals and HUFs without business or professional income, and those filing ITR-1 or ITR-2 with specific income sources. |

| Structure of Form 10IE | Table outlining personal details, income information, PAN, address, and declarations required in the form. |

| Procedure to Fill and Submit | Form 10IE is submitted online through the income tax e-filing portal. Step-by-step guide provided for filling and submitting the form online. |

| Downloading Filed Form 10IE | Step-by-step guide for downloading Form 10IE from the Income Tax Portal. |

| Updates – Form 10IEA Announcement | Introduction of Form 10IEA for AY 2024-25 to opt out of the new tax regime. |

Timeline to Submit Form 10IE

If you have income from a business or profession and want to take advantage of the new tax regime, it’s important to submit Form 10IE before the deadline for filing your income tax return (ITR). You can easily file this form online on the income tax e-filing portal. Make sure to complete and submit it on time to ensure you can benefit from the new tax regime.

For individuals and HUFs who do not have their accounts audited, it is mandatory to submit Form 10IE before filing their income tax return. The deadline for filing the income tax return, in this case, is 31st July 2023. Therefore, it is essential to complete and submit Form 10IE prior to this deadline to ensure the accurate declaration of opting for the new tax regime.

However, for those individuals and HUFs who have their accounts audited, the deadline for submitting Form 10IE is extended to 30th September 2023. This additional time allowance recognizes the complexity involved in the auditing process and allows for the proper completion and submission of Form 10IE.

It is strongly recommended that individuals and HUFs adhere to these time limits and submit Form 10IE within the stipulated deadlines.

Form 10IE Eligibility

Form 10IE is specifically designed for individuals and Hindu Undivided Families (HUFs) who meet the following eligibility criteria:

1. Business or Professional Income: You should have income from a business or profession. This includes income generated through self-employment, freelancing, consulting, or any other entrepreneurial activities.

2. Opting for New Tax Regime: You must have the intention to opt for the new tax regime introduced by the tax authorities. The new tax regime offers different tax rates and exemptions compared to the old tax regime.

If you meet both these criteria, you are eligible to file Form 10IE.

Form 10IE Ineligibility

Form 10IE is not applicable or required for certain individuals and Hindu Undivided Families (HUFs) who fall under the following categories:

1. Individuals and HUFs who do not have business or professional income: If you do not have any income from business or profession, there is no need to submit Form 10IE. This form is specifically for those who have a business or professional income and want to opt for the new tax regime.

2. Individuals and HUFs filing ITR-1 or ITR-2: If you are planning to file ITR-1 or ITR-2 and your income sources include salary income, other income sources, or capital gains income, you do not need to file Form 10IE.

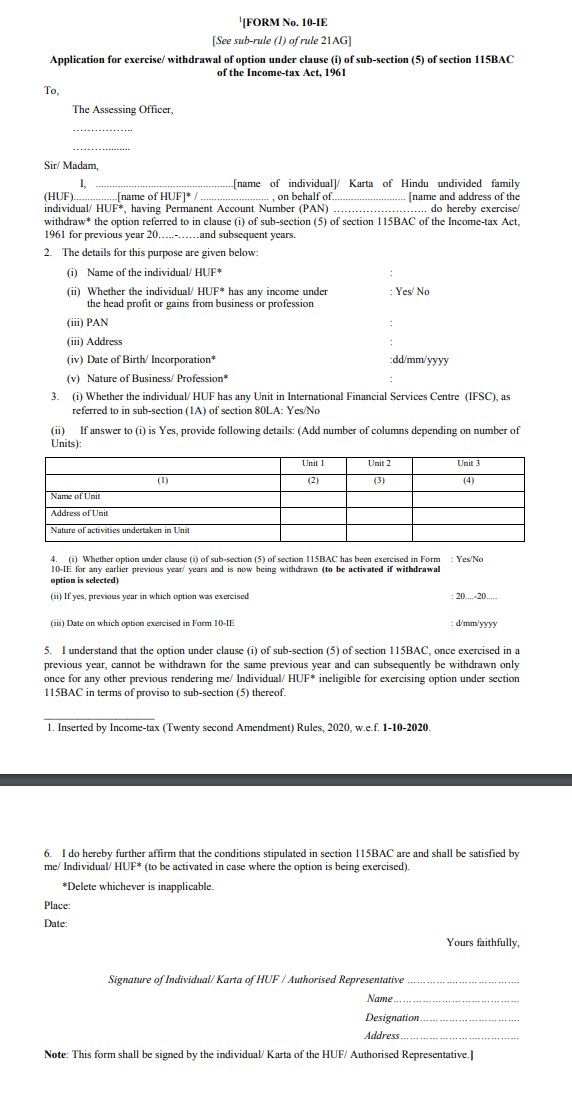

Structure of Form 10IE

The table outlines the information that needs to be provided in the form, including personal details, business or professional income information, PAN, address, and relevant declarations. It serves as a helpful reference to ensure that all necessary details are included in the form when completing the filing process. The procedure to submit Form 10IE is done online through the income tax e-filing portal. It is not submitted offline. You can check the PDF Format of 10IE here.

| Serial No. | Details |

|---|---|

| 1 | Name of the individual/HUF |

| 2 | Confirmation – Whether income from business or profession |

| 3 | PAN |

| 4 | Address |

| 5 | Date of Birth/Incorporation (dd/mm/YYYY format) |

| 6 | Nature of Business/Profession |

| 7 | Confirmation – Unit in International Financial Services Centre (IFSC) (if applicable) |

| 8 | Details of the previous Form 10-IE filed (if applicable) |

| 9 | Declaration |

Procedure to Fill and Submit Form 10IE

- The procedure to submit Form 10IE is done online through the income tax e-filing portal.

- It is not submitted offline.

- The income tax e-filing portal provides a convenient and secure platform for taxpayers to electronically file their forms, including Form 10IE.

- By logging into the portal and accessing the relevant section for form submission, individuals and HUFs can fill out the form online, enter the required details accurately, and submit it electronically.

- This online submission process ensures efficient processing and reduces the need for physical paperwork.

How to Fill and Submit Form 10IE Online – Procedure Step by Step

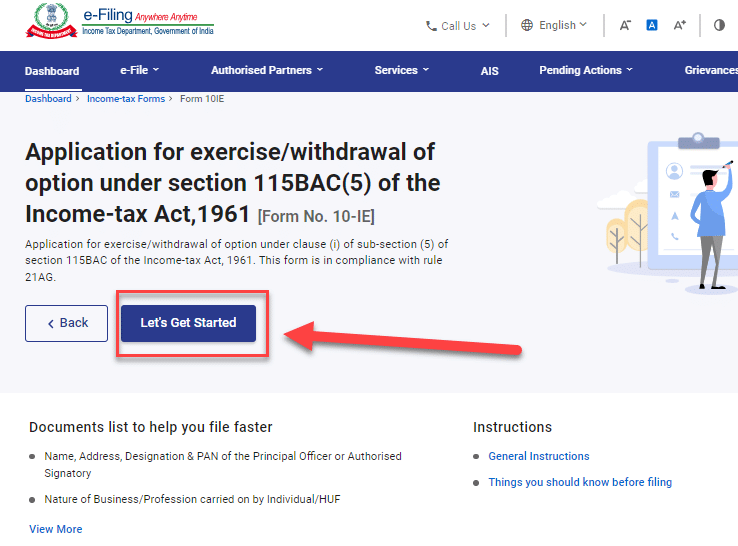

Here is a step-by-step guide on how to fill out and submit Form 10IE online on the Income Tax Portal.

1. Log in to the Income Tax e-Filing Portal using your credentials. (Know How to Register and Login on Income Tax Portal)

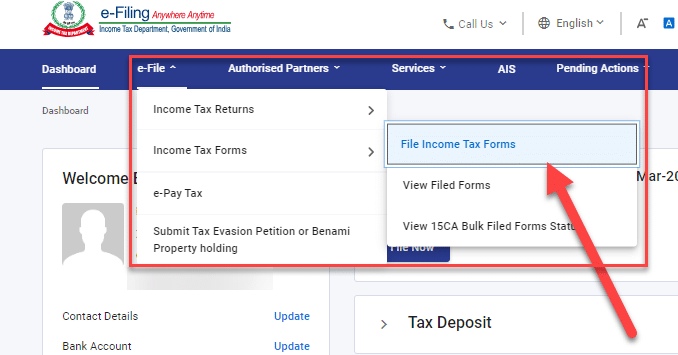

2. Click on the “e-File” tab and select “Income Tax Forms” from the drop-down menu. Click on “File Income Tax Forms”

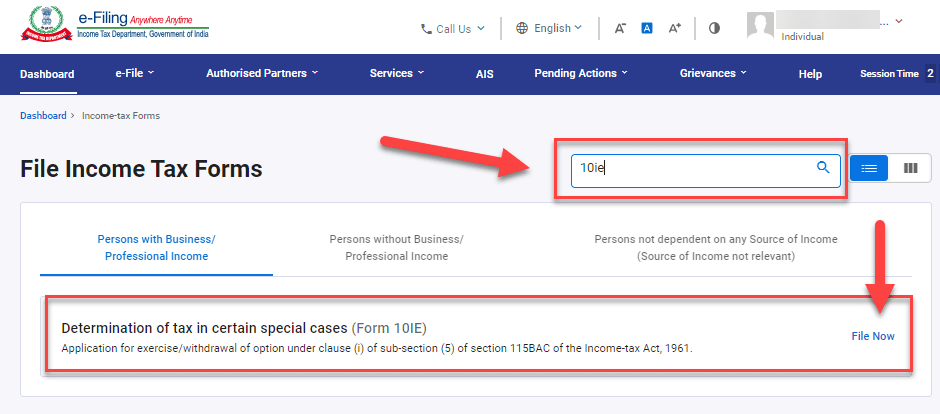

3. Choose Form 10IE from the list of forms. You can also search by typing “10IE” if you are unable to locate the form

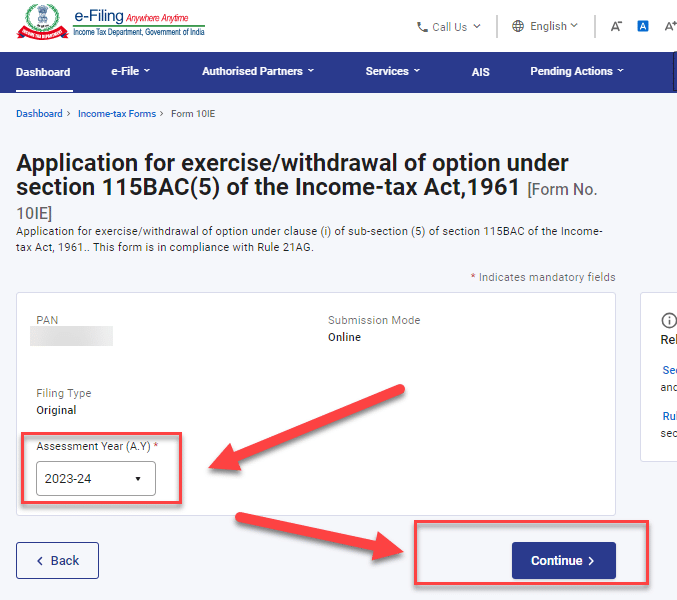

4. Select the relevant assessment year for which the form is being filed (e.g., AY 2023-24 for income earned in FY 2022-23) and click on “Continue”.

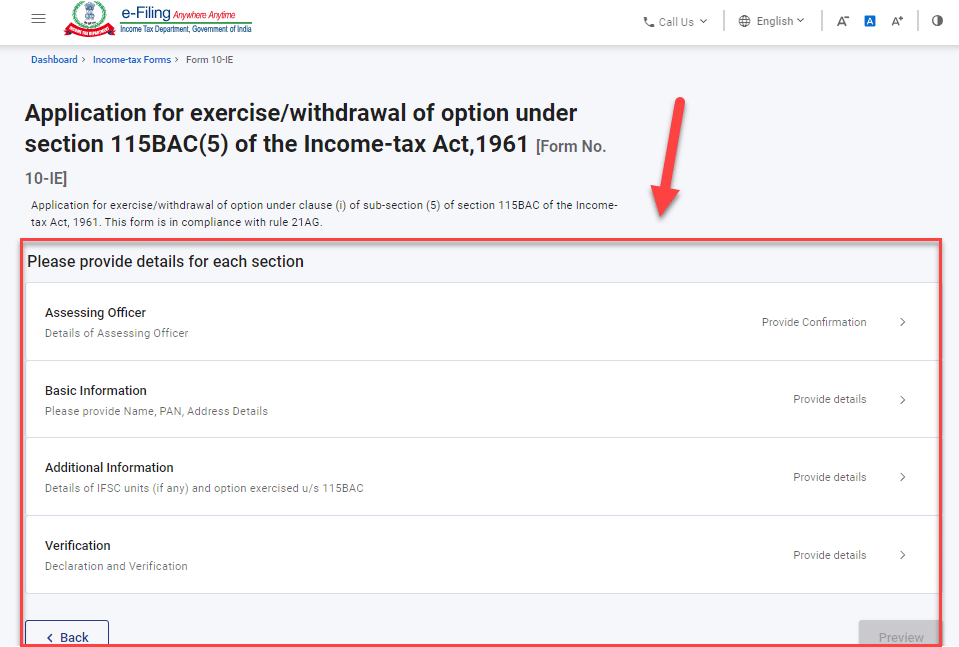

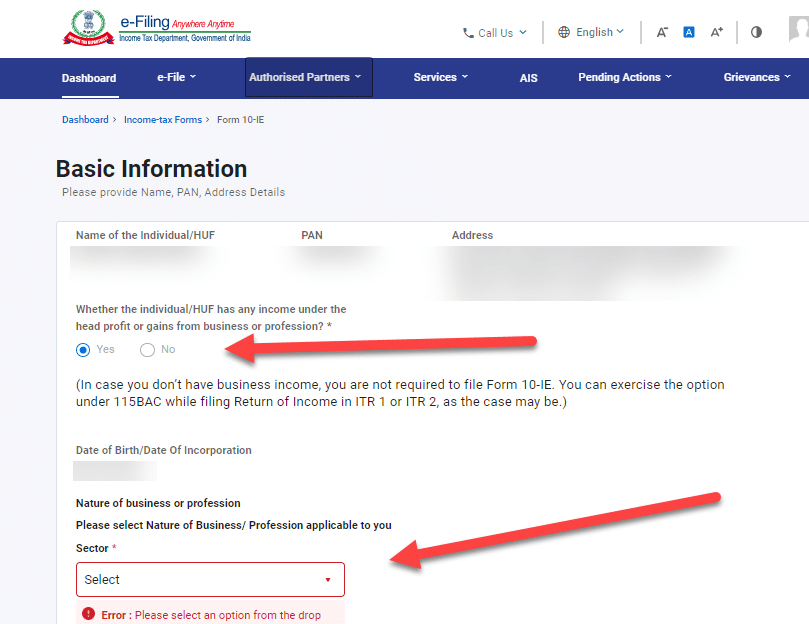

6. Check your information by clicking on “Basic Information” as displayed by the income tax portal such as name, address, and contact information.

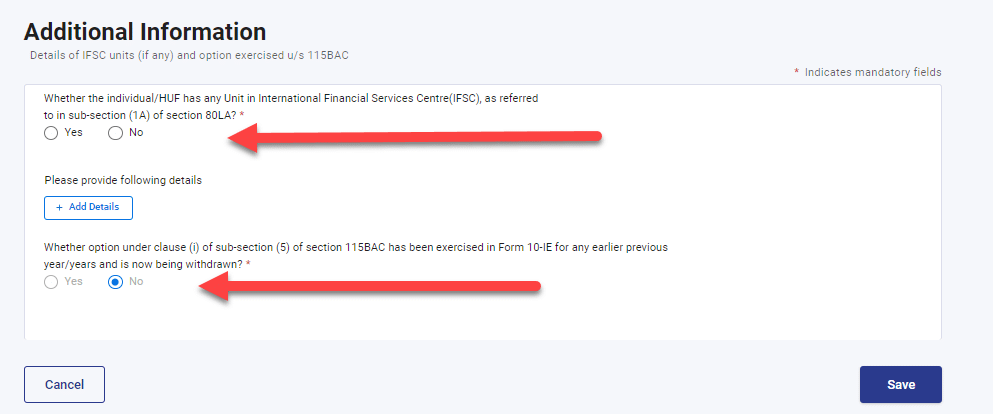

7. Provide additional information in the respective sections, such as details of IFSC units (if applicable) and any previous exercise of the option to pay tax as per the new regime.

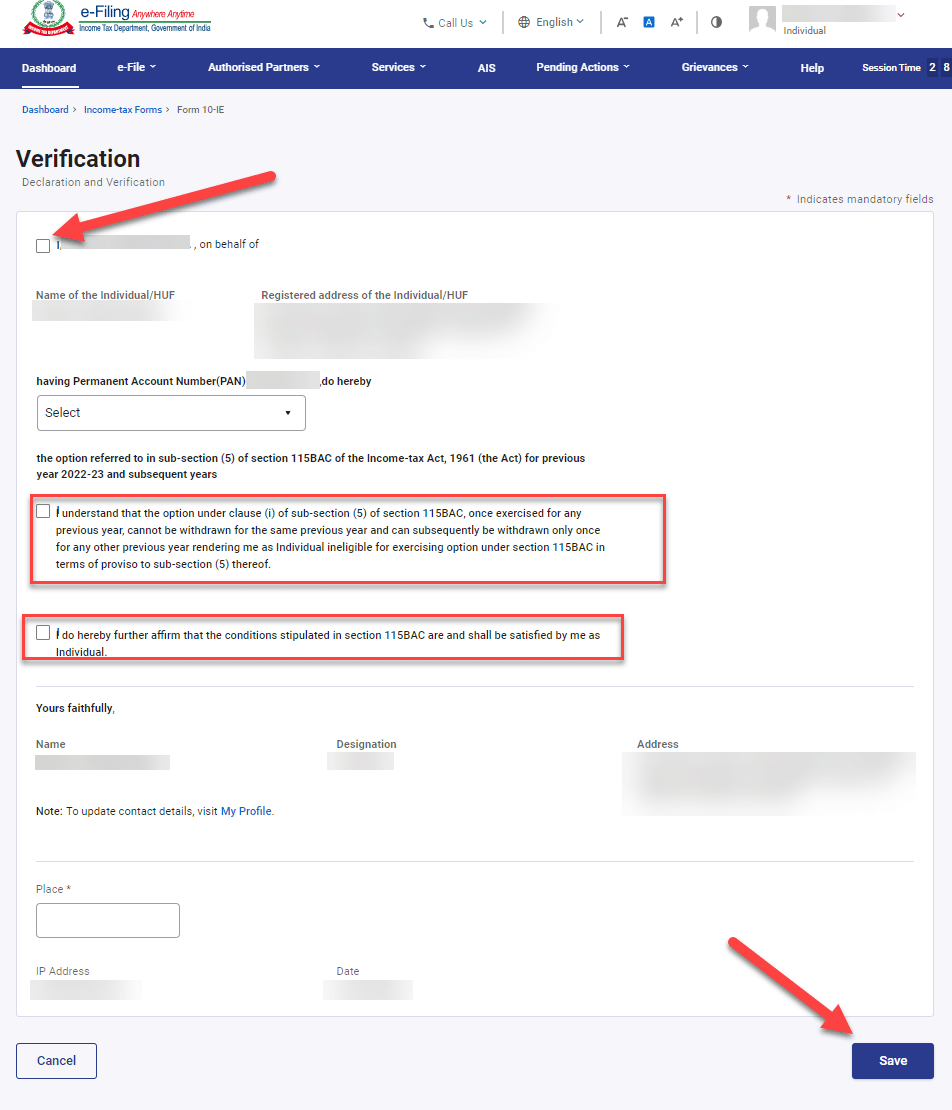

8. Verify all the information provided and save the form. You can preview the form to ensure accuracy.

9. Choose one of the verification methods: Aadhaar OTP, Digital Signature Certificate (DSC), or Electronic Verification Code (EVC).

10. If using Aadhaar OTP or EVC, enter the code received on your registered mobile number or email ID to complete the verification process.

11. Once all the information is verified and correct, click the “Submit” button.

12. After submitting the form, you will receive an acknowledgment number. Make sure to save this number for future reference.

By following these step-by-step instructions, you can successfully fill out and submit Form 10IE online on the Income Tax Portal, ensuring compliance with the requirements for opting in or out of the new tax regime.

How to Download Filed Form 10 IE?

Here is a step-by-step guide on how to download Form 10IE from the Income Tax Portal:

1. Visit the Income Tax e-Filing Portal and log in using your credentials.

2. Click on the “E-File” tab and select “Income Tax Forms” from the drop-down menu. Then select “View Filed Forms.”

3. Choose the relevant assessment year for which you filed Form 10IE from the available options.

4. Select the “Income Tax Return” option from the drop-down list.

5. Click on the “Submit” button to proceed.

6. A list of all the returns/forms filed for the selected assessment year will be displayed. Locate Form 10IE and click on the acknowledgment number associated with it.

7. On the next screen, the details of the form will be shown. Look for the “Download” button and click on it to initiate the download process.

8. Once the download is complete, you can keep the downloaded copy of Form 10IE for your records. If needed, you can also take a printout of the form.

Default Tax Regimes

- For the assessment year 2023-24, the default tax regime is the old tax regime. To switch to the new tax regime, individuals need to fill out Form 10IE.

- However, for the assessment year 2024-25, the default tax regime becomes the new tax regime. To opt for the old tax regime instead, individuals must fill out Form 10IEA.

Check the following table to understand better.

| Assessment Year | Default Tax Regime | Form to Opt Other Tax Regime |

| A.Y. 2023-24 | Old Tax Regime | Form 10IE to Opt New Tax Regime |

| A.Y. 2024-25 | New Tax Regime | Form 10IEA to Opt for Old Tax Regime |

Updates – Form 10IEA Announcement

The income tax department has introduced a new form, Form 10IEA, for the assessment year 2024-25. It is important to note that this form is specifically for A.Y. 2024-25. However, for the assessment year 2023-24, the existing Form 10IE will continue to be used to switch the default tax regime.

- From the assessment year 2024-25 onwards, the default tax regime becomes the new tax regime. In order to opt for the old tax regime instead, individuals need to fill out Form 10IEA.

- Individuals with business income can opt for the old tax regime by filling out Form 10-IEA before the specified due date.

- This form requires essential details and the choice of opting in or out of the default new tax regime.

- The new tax regime becomes the default option, and individuals must specifically opt for the old regime if they wish to continue with it.

- Once chosen, individuals have a one-time opportunity to switch to the new regime but cannot go back to the old regime.

- Form 10-IEA needs to be verified using a digital signature or electronic verification code.

- Taxpayers without business or professional income can opt for the old regime by ticking the checkbox in their ITR forms.

Difference Between 10IE and 10IEA

The table provides a comparison between Form 10IE and Form 10IEA, highlighting the key differences and purposes of each form. Form 10IE is used for opting into the new tax regime, while Form 10IEA is for opting out of the new tax regime. The table outlines the filing requirements, submission deadlines, information required, verification process, switching options, form withdrawal, and their usage in income tax return (ITR) forms.

| Form 10IE | Form 10IEA | |

|---|---|---|

| Assessment Year | A.Y. 2023-24 | A.Y. 2024-25 |

| Purpose | Opting into the new tax regime | Opting out of the new tax regime |

| Filing Requirement | Required for individuals and HUFs with business or professional income | Required for individuals and HUFs opting out of the default new tax regime |

| Submission Deadline | On or before the due date for filing the return of income for the assessment year | On or before the due date for filing the return of income for the assessment year |

| Information Required | Basic personal details, PAN, assessment year, opting in/out details | Basic personal details, PAN, assessment year, opting in/out details |

| Verification Process | E-verification through digital signature certificate, EVC, or Aadhaar OTP | E-verification through digital signature certificate, EVC, or Aadhaar OTP |

| Switching Options | Can switch from old tax regime to new tax regime only once | Can switch from new tax regime to old tax regime only once |

| Form Withdrawal | Not applicable | Can withdraw from the old tax regime only once by filing Form 10IEA |

FAQ

FAQs:

1. Who should use Form 10IE and Form 10IEA?

– Form 10IE is to be used by individuals and HUFs with business or professional income who want to opt for the new tax regime.

– Form 10IEA is for individuals and HUFs who wish to opt out of the default new tax regime and switch to the old tax regime.

2. Do individuals without business or professional income need to submit Form 10IE?

– No, individuals without business or professional income can switch to the new tax regime without submitting Form 10IE.

3. When should Form 10IE be submitted?

– Form 10IE should be submitted before the deadline for filing the income tax return (ITR). The deadline for individuals and HUFs without audited accounts is July 31, 2023.

4. What is the deadline for submitting Form 10IE for individuals and HUFs with audited accounts?

– Individuals and HUFs with audited accounts have an extended deadline of September 30, 2023, to submit Form 10IE.

5. Can individuals with business income switch back to the old tax regime?

– Yes, individuals with business income who have opted for the new tax regime have one opportunity to switch back to the old tax regime by filing Form 10IEA.

6. How can Form 10IE be submitted?

– Form 10IE can be submitted online through the income tax e-filing portal. It is not submitted offline.

7. What are the eligibility criteria for filing Form 10IE?

– Individuals and HUFs with business or professional income who intend to opt for the new tax regime are eligible to file Form 10IE.

8. Who is not required to file Form 10IE?

– Individuals and HUFs without business or professional income and those filing ITR-1 or ITR-2 with salary income, other income sources, or capital gains income do not need to file Form 10IE.

9. What is the difference between Form 10IE and Form 10IEA?

– Form 10IE is for opting into the new tax regime, while Form 10IEA is for opting out of the new tax regime.

– Form 10IE is used for A.Y. 2023-24, and Form 10IEA is used for A.Y. 2024-25.

– The submission deadlines, switching options, and purposes of the forms differ.

10. How can I download the filed Form 10IE?

– Form 10IE can be downloaded from the Income Tax Portal by logging in, selecting “View Filed Forms,” choosing the relevant assessment year, and clicking on the acknowledgment number associated with Form 10IE.