Sukanya Samriddhi Yojna Calculator Excel: Personal finance is a field that deals with complicated calculations and forecasts, so it would be very helpful to have something that can simplify them. A new Excel tool has been developed which enables investors to comprehend their investments in the Sukanya Samriddhi Yojana better. This Sukanya Samriddhi Yojna Calculator Excel will let users estimate maturity values, amounts of interest earned among other things using the power of Microsoft Office.

In this article, we are going to give you both the downloadable link for Sukanya Samriddhi Yojna Calculator Excel and an online calculator without a download required. You will also get instructions on how to use this calculator.

Update: The Government has recently provided some financial relief for families saving up towards their daughters’ future. They increased interest rates on savings plans under SSA from 8% p.a by 0.2% points making it 8.2%. These changes are made periodically but this time around they happened just before one major election event in our country’s history

| SSY Excel CalcultorVersion | SSY Excel Calculator Download Link |

| Download Sukanya Samriddhi Yojana Calculator (Excel) | Download |

| Use Sukanya Samriddhi Yojana Calculator without Downloading (Online) | Visit Here |

What is Sukanya Samriddhi Yojana?

I would like to discuss the purpose of the calculator before we delve into the details of the calculator. SSY is a scheme launched by the Government of India to ensure the financial future of girl children. It offers attractive interest rates, tax benefits, and a designated account to accumulate funds over the years for education, marriage, and other significant life events.

Sukanya Samriddhi Yojana 2023: Interest Rates, Age Limit, Tax Benefit & More Details

Why Do You Need Sukanay Samriddhi Yojana Calculator?

Undoubtedly, SSY has a lot of advantages but making accurate projections and understanding its intricacies can be difficult. That’s where Sukanya Samriddhi Yojana Calculator in Excel steps in; empowering people to make financial decisions based on informed choices through quick and correct calculations which act as a gateway for smooth financial planning. Here are some points you should know before downloading the excel calculator of SSY.

Features And Benefits: This is an Excel-based calculator designed with user convenience in mind, below are some features and advantages.

1. Accuracy: The tool uses reliable formulas and functions within Excel thus ensuring accuracy while projecting values making it essential for sound financial decision-making.

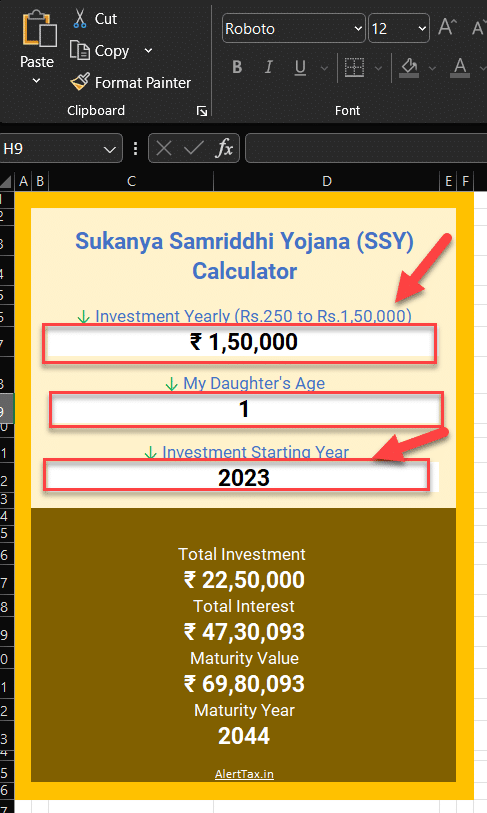

2. Flexibility: Investment details such as investment amount, girl child’s age, start year etc can be easily input by users due to the friendly nature of excel interface they’re dealing with.

3. Instant Results: Maturity value estimates along with maturity year projection and interest amounts are provided by this calculative device instantly after being triggered into actions through certain inputs from user end.

4. Customization: Different investment scenarios can be explored by users plus re-adjusting projections multiple times is allowed too.

5. Accessibility: Financial projections saved on an Excel sheet can easily be shared among different individuals hence enabling them have access whenever required.

6. No Personal Information Required: The privacy of Sukanya Samriddhi Yojana users is respected by this excel calculator service provider because it does not ask for any email ids or phone numbers or any other personal details at all.

How To Access The Calculator:– The Sukanya Samriddhi Yojana Calculator in Excel can be accessed via the following ways:-

1. Visit this website (Alerttax.in) providing the calculator.

2. Locate and click on the link to download the Excel file.

3. Open the file using Microsoft Excel on your device.

SSY Excel Calculator for Empowering Financial Planning

We always need the right tools for making financial decisions that shape our destiny. The Sukanya Samriddhi Yojana Calculator Excel (SSY excel Calculator) simplifies estimation and enables us to plan well for the future of a child. This calculator clears things up and gives direction in your financial journey whether as a parent thinking of investment options for your daughter’s education or as a guardian planning for marriage expenses.

Employ technology and data-driven decision-making through Sukanya Samriddhi Yojana Calculator in Excel; know different investment scenarios, choose wisely and secure a better life for your family because ultimately nothing beats a good financial future as a gift to children.