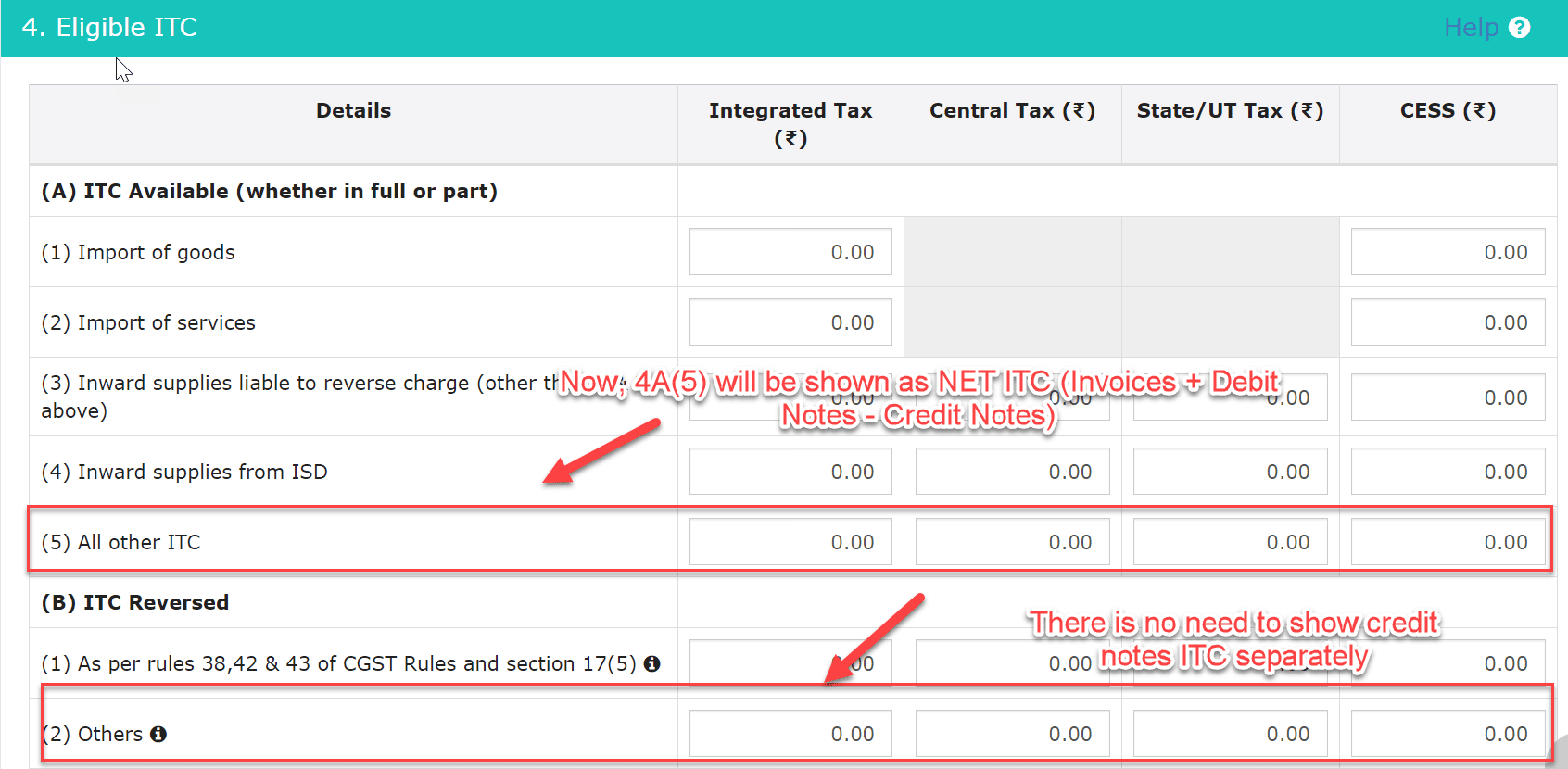

GSTN will now automatically populate Table 4(A) of GSTR-3B with ITC (net of credit notes).

Therefore, the Net ITC with amendments (Invoices + Debit Notes – Credit Notes) will be auto-populated in Table 4(A)

Example:

| Old GSTR 3B up to DEC 2022 | New GSTR 3B from Feb 2023 (Jan 2023 Data) |

| Purchase – 500000 ITC – 25000 Credit Note ITC Reversed – 5000 In the old system, you have to show 25000 in 4A (5) and 5000 in 4B (2). But in the new system, you don’t need to show 5000 in 4B (2). The net balance will be automatically shown in 4A (5) from 2B. |

But in the new system, you don’t need to show 5000 in 4B (2). The net balance will be automatically shown in 4A (5) from 2B. |

Changes are effective from January 2023. The intention of this amendment is to reduce the compliance burden on businesses since they will no longer have to manually calculate and enter the Net ITC value in Table 4(A). This will simplify the filing process, increase accuracy, and help ensure timely tax payments.

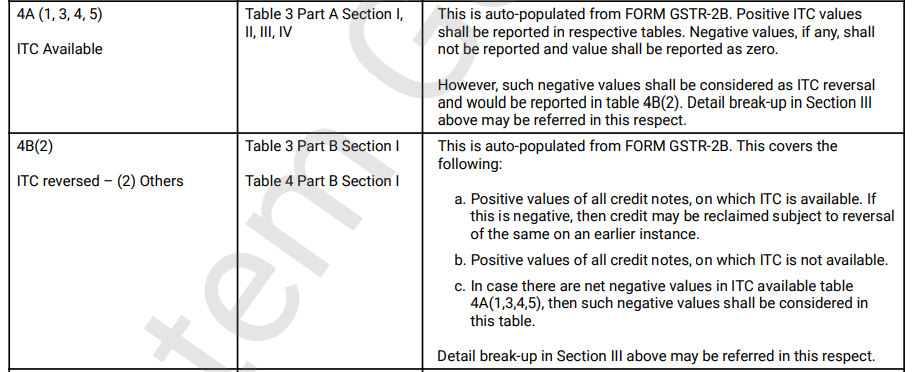

However, earlier credit notes were automatically populated separately as reversals in Table 4(B)(2). Table 4(A) did not include the same adjustments.

A change is being made to ensure that tables 6A and 8A of GSTR 9 Return are not mismatched.