Mahila Samman Savings Scheme Calculator 2023: We have created the Mahila Samman Saving Scheme Calculator to check interest earned and maturity. You can use this calculator for free on our website. We will guide you how to use this Mahila Samman Saving Scheme calculator anytime for free. You can use the MSSC calculator to secure your future or maximize your savings.

How to use Mahila Samman Saving Scheme Calcualtor?

Here is the step by step guide to use Mahila Samman Saving Scheme Calcualtor.

It is very easy to calculate maturity value after maturity period of Mahila Samman Saving Certificate Scheme.

Step 1: Gather Necessary Information

Before using the Mahila Samman Saving Scheme Calcualtor, gather the following information:

1. Initial Deposit: The amount you plan to deposit in the Mahila Samman Savings Scheme.

2. Interest Rate: The annual interest rate offered by the scheme (7.5% compounded quarterly in this case).

3. Investment Tenure: The period for which you plan to keep your money invested (2 years in this case).

Step 2: Access the Calculator:

You can visit our website to use Mahila Samman Saving Scheme Maturity Calculator. You can bookmark this page for any future use to calcualte the interest and maturity under this scheme.

Step 3: Input Details:

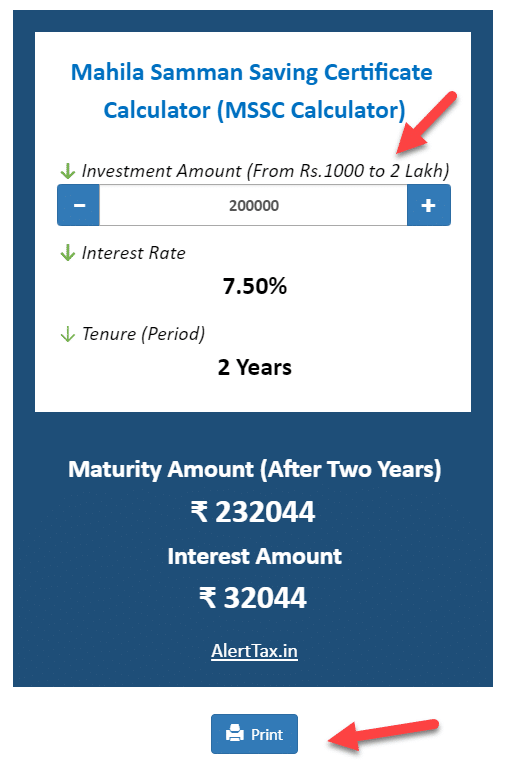

1. Enter the Initial Deposit: Input the amount you plan to deposit in the scheme, e.g., Rs 10,000.

2. Enter the Interest Rate: The current interest rate is 7.5%. So, you don’t need to enter any interest rate, if there will be any update reagarding interest rate of Mahila Samman Saving Certificate Scheme then we will update it.

3. Enter the Investment Tenure: The maturity period of MSSC Scheme is of 2 years. So you don’t need to enter it.

Step 4: Calculate:

Once you’ve input all the necessary details, the Mahila Samman Saving Scheme Calcualtor will calculate automatically all calculation like maturity value and interest rate.

Step 5: Review the Results

The calculator should provide you with the following information:

1. Total Interest Earned: This is the interest your initial deposit will earn over the investment period.

2. Maturity Amount: The final amount you’ll have at the end of the investment period, including both the initial deposit and the earned interest.

Step 6: Interpret the Results:

Review the results to understand how your investment will grow over time. Take note of the interest earned and the maturity amount to make an informed decision about whether the Mahila Samman Savings Scheme meets your financial goals.

Step 7: Adjust Inputs (Optional):

If you want to explore different scenarios, you can adjust the initial deposit in Mahila Samman Savings Scheme Calculator to see how they affect the results.

Mahila Samman Savings Certificate Scheme Features

The Mahila Samman Savings Certificate Scheme (MSSC) is designed to empower women financially by offering attractive interest rates and flexibility in deposits and withdrawals. Here’s a summary of key details:

Eligibility and Features:

- Open to all women, including minors.

- Offers an attractive interest rate of 7.5% compounded quarterly.

- Minimum deposit of Rs 1,000, and maximum deposit of Rs 2 lakh across all accounts.

- Fixed maturity period of 2 years.

- Allows partial withdrawals after the first year.

- Provides the option for premature closure under specific circumstances.

- Taxation applies to interest earned.

Account Opening:

- Women can open an MSSC account themselves or guardians can open on behalf of minors.

- KYC documents required, including Aadhaar, PAN card, etc.

- Submit an account opening form along with KYC documents and initial deposit.

Withdrawals and Closure:

- After one year, eligible for withdrawal of up to 40% of the balance.

- Premature closure allowed after six months without specifying a reason (interest rate of 5.5%).

- Pre-mature closure possible due to life-threatening illness or death of account holder/guardian.

- Maturity after 2 years, with accumulated funds paid to the depositor.

Comparison with PPF:

- MSSC is for women with a 2-year maturity, while PPF is open to all with a 15-year maturity.

- MSSC offers a maximum deposit of Rs 2 lakh, while PPF has a Rs 1.5 lakh annual limit.

- MSSC permits partial withdrawals after the first year, whereas PPF allows it from the 7th year.

- Taxation on MSSC interest, while PPF offers tax benefits under Section 80C and tax-free maturity.

Where to Open:

- MSSC available at Post Offices and qualified Scheduled Banks.

More Information about Mahila Samman Saving Certificate Scheme

Thanks for MSSC calculator, please provide its excel version to download. I want to invest in this scheme. so it will be very easy for me to download excel tool for Mahila Saving scheme interest calculation on my laptop. Thanks

Yes, piyush. We will update you whenever our MSSC excel calculator available. Please subscribe your email ID to get latest updates about Mahila SAving Scheme excel calculator. In the mean time you can use it. thanks