TCS Rates Chart AY 2024-25: The table below shows the TCS rate for the financial year 2023-24/ Assessment Year 2024-25 under section 206C. If the collector does not receive the collectee’s PAN, tax will be collected in accordance with section 206CC at either twice the rate listed in the table or at 5%, whichever is higher.

The exception to this rule

- In the case of non-resident collectors who do not have permanent establishments in India, this rule will not apply.

- The rate is 1% if PAN is not submitted for TCS u/s 206C(1H) i.e. sale of any other goods.

The tax shall be collected as per section 206CCA either at double the rate specified in the table or at the rate of 5%, whichever is greater if the collectee is not a filer of income tax returns.

TCS Rates AY 2024-25

The following TCS rates are applicable for the transactions applicable from 01-04-2023 to 31-03-2024 i.e. the assessment year 2024-2025.

| Section | Nature of Transaction | Rate |

|---|---|---|

| 206C(1C) - Sale of Goods | ||

| Tendu Leaves | 5% | |

| Timber & Other Forest Products | 2.5% | |

| Alcoholic Liquor for Human Consumption | 1% | |

| Scrap | 1% | |

| Minerals Being Coal Lignite, Iron Ore | 1% | |

206C(1C) | Leasing or licensing or transferring any right or interest in any -Parking lot or -Toll plaza or -Mine or quarry for the purpose of business | 2% |

| 206C(1F) | Sale of a motor vehicle of the value exceeding 10 lakhs Notes: 1) TCS will apply only in the case of motor vehicles at the retail level. No TCS under this section sale by manufacturers to dealers/distributors. 2) A threshold limit of Rs.10 lakhs has to be looked at on each individual purchase and not on aggregate purchases made during the year. | 1% |

| 206C(1G) | Foreign remittance of money more than Rs.7 Lakhs under Liberalised Remittance Scheme (LRS) of RBI Notes: 1) 5% of the amount in excess of Rs.7 Lakhs 2) In the case of LRS if the remitted amount is out of education loan taken from Financial Institution then TCS rate shall be 0.5% instead of 5%. | 5% |

| Selling of overseas tour package (no threshold limit) | ||

| - Up to June 30, 2023 | 5% | |

| - From July 1, 2023 | 20% | |

| Any other case (Foreign remittance through LRS and overseas tour package) | ||

| - Up to June 30, 2023 (exceeding Rs. 7 lakh in a financial Year) | 5% | |

| - From July 1, 2023 (no threshold limit) | 20% | |

| 206C(1H) | Sale of Goods (other than export and covered u/s 206C(1)/(1F)/(1G) Notes: 1) 0.1% of the consideration in excess of Rs.50 Lakhs 2) Seller/Collector in this case whose last year turnover is more than 10 Crore. 3) If the buyer deducts TDS under any section then TCS will not be applicable under this section. 4) No TCS if the buyer is Central Government, State Government, High Commission, Legation, Commission, Consulate, the trade representation of a foreign State, a local authority or a person importing goods into India or any other notified person. 5) No need for any adjustment for GST or sale return as TCS under this section applies only on receipt of consideration 6) In the case of the sale of fuel to NR Airlines companies at Indian Airport are not liable for TCS under the section.< 7) In the case of Motor vehicles if section 206C(1F) is not applicable then section 206C(1H) will be applicable if other conditions of this section are satisfied. | 0.1% |

Download TCS Rates Chart (Excel & PDF)

You can download TCS Rates chart for A.Y. 2024-25 in Excel and PDF format from the links given below.

| Particulars | Download Link |

| TCS Rates ay 2024-25 (Excel Format) | Link to Download |

| TCS Rates ay 2024-25 (PDF Format) | Link to Download |

Updated Provisions:

- The provisions of section 206CC do not apply to a non-resident who does not have a permanent establishment in India with effect from 1-7-2023, by the finance act 2023, the TCS rate under this section shall not exceed 20%.

- In the finance act 2023, section 206CC (1) and section 206CCA(1) are amended to provide that the TCS rate under section 206C shall not exceed 20%. With effect from 01-07-2023, these provisions have been inserted.

Who is responisble to collect TCS?

Every person being a seller shall collect tax at source from the buyer of goods specified in section 206C. The following persons are responsible to deduct TCS at the rate specified in the above TCS rate table for A.Y.2024-25 for the sale transactions from 01-04-2023 to 31-03-2024.

- A lessor or licensor in respect of specified transactions is also liable to collect TAX.

- A seller of any motor vehicle of value exceeding Rs. 10 lakhs is liable to collect TDS.

- Remittance through LRS and Overseas Tour Programme Package.

- The seller of any other goods is liable to collect tax at source.

Specified Goods to collect TCS

There are certain goods or payments that require TCS to be collected from the collectee at the rate specified in the table of TCS rates above.

- Alcoholic liquor for human consumption (including Indian-made foreign liquor)

- Tendu Leaves – 5%

- Timber obtained under a forest lease

- Timber obtained by any mode other than under a forest lease

- Any other forest produce not being timber or tendu leaves

- Scrap

- Minerals, being coal or lignite or iron ore.

Who is the seller?

Tax is required to be collected by a person carrying on a business whose total sales, gross receipts, or turnover exceeds Rs.10 crores in the financial year immediately preceding the financial year of sale.

- The Central Government

- a State Government

- Any local authority

- Any statutory corporation or authority

- Any company

- Any firm

- Any Co-operative society

- Individual/HUF (if his/its total sales, gross receipts or turnover from the business or profession carried on by him exceed Rs.1 crore in case of business or Rs. 50 lakhs in case of the profession during the financial year immediately preceding the financial year in which goods of the specified nature are sold.

How to Deposit TCS?

You can deposit TCS online or offline as per the following conditions. But keep in mind to check TCS rate in the above table and updated provisions to that.

- Online – Corporate assessee and other assessees (who are subjected to tax audit under section 44AB)

- Offline/Online – other collectors other than above.

Time Limit to Deposit TCS

- Tax collected during the month shall be deposited on or before the 7th day of the next month in which tax has been collected.

When to Collect TCS?

Tax has to be collected by the seller or lessor or licensor at the time of debiting of the amount payable by the buyer/lessee/license to the account of the buyer/lessee/license or at the time of receipt of such amount from the buyer/lessee/licensee in cash or by the issue of cheque/draft or by any other mode, whichever is earlier.

Please let us know if you have difficulty calculating TCS based on the rate specified in the above table via the comment form. Please comment if you would like TCS rate in Excel or PDF. You will be able to download the TCS rate in PDF and Excel formats from the links we provide.

Due Dates for Filing of TDS/TCS Returns

The due dates for filing of TCS return for different quarters are as follows.

| Quarter Ending | Due Date for Filing of TCS Return |

| 30th June | 15th July |

| 30th September | 15th October |

| 31st December | 15th January |

| 31st March | 15th May |

Here are the dates on which TCS returns are due for different quarters.

Check Also

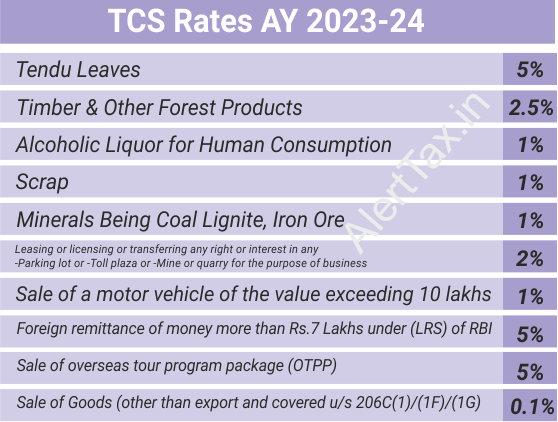

TCS Rates Chart AY 2023-24

Every seller who comes under the specified goods as prescribed by the Income-tax act collects TCS from the buyer at prescribed rates and deposits the same in the account of the Income Tax Department. The TCS will be collected as mentioned in the following table. The table shows the nature of payment, TCS rates and status of assessee. The TCS Rates will be different according the status of assessee like individual assessee, company assessee, non resident assesee and resident assessee. Here you will find the TCS Rates Chart for F.Y.2022-23 A.Y.2023-24.

TCS Rates Chart for F.Y.2022-23 (A.Y.2023-24)

(TCS Rates As amended up to Finance Bill 2022)

| Section | Nature of Transaction | Rate |

|---|---|---|

206C(1C) | Sale of Goods |

|

| Tendu Leaves | 5% | |

| Timber & Other Forest Products | 2.5% | |

| Alcoholic Liquor for Human Consumption | 1% | |

| Scrap | 1% | |

| Minerals Being Coal Lignite, Iron Ore | 1% | |

206C(1C) | Leasing or licensing or transferring any right or interest in any -Parking lot or -Toll plaza or -Mine or quarry for the purpose of business | 2% |

| 206C(1F) | Sale of a motor vehicle of the value exceeding 10 lakhs Notes: 1) TCS will apply only in the case of motor vehicles at the retail level. No TCS under this section sale by manufacturers to dealers/distributors. 2) A threshold limit of Rs.10 lakhs has to be looked at on each individual purchase and not on aggregate purchases made during the year. | 1% |

| 206C(1G) | Foreign remittance of money more than Rs.7 Lakhs under Liberalised Remittance Scheme (LRS) of RBI Notes: 1) 5% of the amount in excess of Rs.7 Lakhs 2) In the case of LRS if the remitted amount is out of education loan taken from Financial Institution then TCS rate shall be 0.5% instead of 5%. | 5% |

| Sale of overseas tour program package (OTPP) Notes: 1) 5% of the sale value 2) OTPP means any tour package which offers a visit to a country or countries or territory or territories outside India and includes expenses for travel or hotel stay or boarding or lodging or any other expenditure of similar nature or in relation thereto. (No TCS if buyer Central Government, State Government, Embassy High Commission, legation Consulate and Trade representation, Local Authority. | 5% | |

| 206C(1H) | Sale of Goods (other than export and covered u/s 206C(1)/(1F)/(1G) Notes: 1) 0.1% of the consideration in excess of Rs.50 Lakhs 2) Seller/Collector in this case whose last year turnover is more than 10 Crore. 3) If the buyer deducts TDS under any section then TCS will not be applicable under this section. 4) No TCS if the buyer is Central Government, State Government, High Commission, Legation, Commission, Consulate, the trade representation of a foreign State, a local authority or a person importing goods into India or any other notified person. 5) No need for any adjustment for GST or sale return as TCS under this section applies only on receipt of consideration 6) In the case of the sale of fuel to NR Airlines companies at Indian Airport are not liable for TCS under the section.< 7) In the case of Motor vehicles if section 206C(1F) is not applicable then section 206C(1H) will be applicable if other conditions of this section are satisfied. | 0.1% |

Surcharge and Health & Education Cess on TCS Rates

| Payee Status | Payment Exceeds | Surcharge Rates | Education Cess |

| Non Resident Individuals/HUF | Payments of more than Rs. 50 lakh but not more than Rs. 1 crore | 10% | 4% w.e.f. A.y. 2019-20 on (TCS+Surcharge) |

| Payments of more than Rs. 1 crore | 15% | 4% w.e.f. A.y. 2019-20 on (TCS+Surcharge) | |

| Non Resident – Co-operative society/firm | Payment more than Rs.1 crore | 12% | 4% w.e.f. A.y. 2019-20 on (TCS+Surcharge) |

| Non-domestic companyNon-comestic company | Payment of more than Rs. 1 crore but not more than Rs. 10 crore | 2% | 4% w.e.f. A.y. 2019-20 on (TCS+Surcharge) |

| Payment of more than Rs. 10 crore | 5% | 4% w.e.f. A.y. 2019-20 on (TCS+Surcharge) |

Additional Notes on TCS Rates AY 2023-24

- Time of collection of TCS: As per section 206C (1) every person, being a seller shall, at the time of debiting of the amount payable by the buyer to the account of the buyer or at the time of receipt of such amount from the said buyer in cash or by the issue of a cheque or draft or by any other mode, whichever is earlier, collect from the buyer. Hence, the amount debited to the account of the buyer or payment shall be received by the seller inclusive of VAT/ excise/GST. TCS to be collected inclusive of GST.

- TCS rates for F.Y.2022-23 A.Y.2023-24 without PAN double of TCS rates as above or 5%, whichever is higher under section 206CC.

- Interest on late collection/deposit TCS: In case of any delay, interest shall be calculated at @1% per month or part thereof from the date on which TCS was collectible to the date on which TCS is actually paid.

If you have any doubt regarding TCS Rates chart F.Y.2022-23 A.Y.2023-24 then you can us via the comment form given below.

TCS can applicable on sale old machinery ? Which rate

Sir, Whether TCS is applicable to a Lender Bank , when he auctions a motor car of a defaulting Borrower

Is TCS applicable, if dealer sales car to another dealer?

Sir,

Pls confirm any cess on TCS for the year 2019-20

pl tell me tcs collection code for sale of motor cars

TCS can applicable on sale of wooden scrap and iron scrap ? Which rate

Hello, Yes TCS will be applicable on Wooden Scrap and Iron scrap @1%. You can check above table for TCS rates on scarp. Thanks

सर TCS SALE AMOUNT पर लगता है या sale amount+gst पर…..

Hello Sir, you have to deduct TCS on basic value + GST. As per section 206C “Every person, being a seller shall, at the time of debiting of the amount payable by the buyer to the account of the buyer or at the time of receipt of such amount from the said buyer in cash or by the issue of a cheque or draft or by any other mode, whichever is earlier, collect from the buyer of any goods of the nature. So, The amount you will collect from buyer is including GST not basic amount. Please ask if you have any doubt.

If party purchase alcohol 7849500 then he has to sale the whole purchase in the same year or

he will not allowed to made any closing stock..for that year…

.

Example

Purchase 7849500

Sale. 4156800

Profit. 415680

Hi, please send current TDS and TCS rate chart.

Please provide current Rate chart of TDS and TCS

is tcs applicabe on machinery and machinery parts. As we are manufacturer of Powerloom and other textile machineries as well as Rice plants.

plz tell me hosiery cutting waste confirm tcs rate

when goods are sold to party then party sales return to me .

when which amount calculated for tcs .

KINDLY DETAIL PROVIDE ME FOR TDS DEDUCTION ON TRANSPORTATION

We will cover it in future. thanks

What is the TCS rate of Iron & steel scrap, We are manufacturing of Mining machnery and it spares parts, our manufaturi scrap is iron & steel.

Want to know how to deposit the TCS amount under Mining & Quarrying @2%, which is collected from Party.

this is easy procedure