Form 15H is a self-declaration senior (aged 60 or above) can use to lessen the tax taken from interest earned on fixed or recurring bank deposits. For senior citizens, the bank usually takes tax (TDS) on deposit interest above Rs. 50,000. However seniors can avoid this tax by using Form 15H if they meet these criteria.

- They are an individual taxpayer, not a company.

- They are an Indian citizen or live in India.

- They are at least 60 years old. (Use Form 15G if less than the age of 60 years)

- They don’t owe any tax for that financial year.”

How to Download Form 15H?

- Visit the websites of major banks in India or the Income Tax Department’s website. (Download Form 15H)

- Look for the form in a fillable format or find it as a downloadable file.

- Once downloaded, print the form.

- Fill in the details as required.

- Submit the filled form to your bank or the relevant authority to reduce your TDS burden on deposits.

- Remember, you’ll need to submit separate Form 15H for each bank/post office where you have deposits to reduce the overall TDS burden.

Fillable Form 15G and 15H PDF and Excel – Download

How to Fill Form 15H?

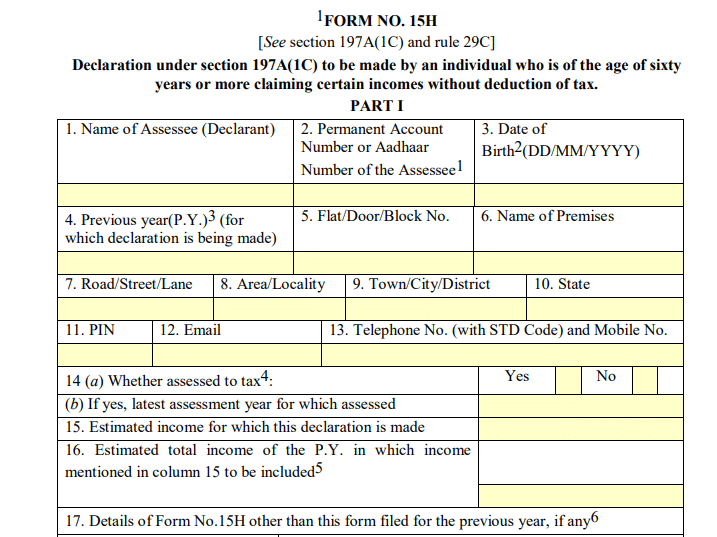

Part 1: This section is for senior citizens who want to claim TDS on their various incomes during the year.

- Personal Details: Name, PAN, date of birth, financial year for income, residential status, complete address, and contact info.

- Tax Assessment History: If assessed in the last six years, declare “YES.”

- Income Declaration: State estimated total income, current year’s total income, and number of Form submissions.

- Income Details: Specify shares, deposit account, NSS, LIC policy, and employee code.

- Verification: Check for errors, if any, before signing.

Part 2:

This section is for the entity, like a bank/employer, that deducts TDS on a depositor’s interest earned from fixed or recurring deposits. They fill and submit this part to deposit the deducted TDS with the bank authorities or employees.

- For Deductor: The entity deducting TDS (like a bank) fills this section to deposit the deducted tax with the authorities. For instance, a bank deducts TDS on interest earned from fixed/recurring deposits.

Uses of Form 15H

Form 15H is a powerful tool for various scenarios. It helps senior citizens save tax on fixed deposit interest, prevent TDS on EPF withdrawals before 5 years, corporate bond income, post office deposits, and high rental payments. By submitting this form to the respective authorities on time, individuals declare their income as non-taxable, effectively preventing TDS deductions on applicable incomes.

1. TDS on Fixed Deposit Interest: It helps senior citizens save tax on interest earned from fixed deposits and recurring deposits held in banks.n

2. TDS on EPF Withdrawals: When withdrawing EPF before 5 years of continuous service, submitting Form 15H can prevent TDS deduction, provided the taxable income, including EPF balance, is below the specified tax bracket.

3. TDS on Corporate Bond Income: For income exceeding Rs. 5,000 annually from corporate bonds, Form 15H can be submitted to avoid TDS, meeting specific criteria.

4. TDS on Post Office Deposits: Similarly, digitized Post Offices deduct TDS on income from deposits; Form 15H submission can prevent this, subject to meeting criteria.

5. TDS on Rent: Rental payments above Rs. 1.8 lakh annually face TDS. Form 15H submission to the tenant can avoid this deduction if the total income tax for the previous year was zero.

To prevent TDS deductions, submit Form 15H to the deductor on time, either before the interest payment due date or by the end of the financial year. It’s a declaration stating that the previous year’s income doesn’t fall within the taxable bracket and isn’t liable for taxation.

Form 15H for EPF Withdrawal

Form 15H serves a critical role in EPF withdrawal, particularly when the process is conducted offline. Its primary purpose is to request the EPFO (Employees’ Provident Fund Organisation) to refrain from deducting TDS (Tax Deducted at Source). This request is relevant when the EPF withdrawal occurs before completing five years of service and the withdrawn amount exceeds Rs. 50,000.

Evolution of TDS Regulations for EPF:

- TDS Introduction (June 1, 2015): EPF withdrawals before completing five years of service were subjected to TDS.

- TDS Revision (June 2016): TDS applies when the withdrawal amount exceeds Rs. 50,000, altered from the previous limit of Rs. 30,000.

Tax Deduction Rates:

- TDS Rates: Under normal circumstances, TDS is imposed at 10% provided the PAN is furnished. Absence of PAN results in TDS at a higher rate of 20% after budget 2023.

Submission of Form 15G/15H:

- Purpose: When withdrawing EPF offline, submission of Form 15G/15H can prevent TDS deduction.

- Form 15H: Specifically designed for senior citizens, this form declares that their income falls below the taxable threshold, thereby exempting them from TDS on EPF withdrawals.

Form 15H acts as a crucial tool to prevent unnecessary tax deductions, especially for senior citizens, ensuring that their EPF withdrawals remain unaffected by TDS regulations.

Q. What are the steps to claim a TDS refund if Form 15G/15H wasn’t submitted in time during EPF withdrawal?

If you forget to submit Form 15G/15H on time, resulting in TDS being deducted from your EPF withdrawal, you can still claim a refund for the TDS deducted while filing your income tax return. Here’s what you can do:

Steps to Claim TDS Refund:

- File Income Tax Return: Include details of the EPF withdrawal and the TDS deducted while filing your income tax return.

- Claim TDS Refund: If the TDS deducted exceeds your actual tax liability, you can claim a refund for the excess TDS amount.

- Submit Form 15G/15H (if eligible): While you cannot prevent the TDS already deducted, you can submit Form 15G/15H for subsequent withdrawals to prevent further TDS deductions, provided you meet the eligibility criteria.

- Stay Updated: Be vigilant about submitting Form 15G/15H before the applicable deadline for future withdrawals to avoid TDS deductions.

Submitting your income tax return accurately and on time enables you to claim the TDS deducted erroneously on EPF withdrawals. Always aim to submit the relevant forms beforehand to prevent unnecessary TDS deductions in the future.

Q. Is there a timeframe for submitting Form 15G/15H to prevent TDS deduction during EPF withdrawal?

Yes, there is a timeframe for submitting Form 15G/15H to avoid TDS deduction when withdrawing from the Employee Provident Fund (EPF). This form must typically be submitted before the EPF withdrawal is processed. It’s advisable to submit it at the time of applying for withdrawal or beforehand to ensure that the EPF authority does not deduct TDS from your withdrawal amount. Delay in submitting this form might result in TDS deductions, impacting the final amount you receive upon withdrawal.