As per Income Tax Department guidelines, you will get your income tax refund only if your bank account is validated on the income tax filing portal. So all taxpayers who want income tax refunds fast and without any error should pre-validate their bank account on the income tax portal. The official website of income tax filing is incometax.gov.in. It is a very simple procedure to pre-validate a bank account for a faster income tax refund. There is also another benefit to validating the bank account like e-verify income tax return and protection against fraud. With effect from 1st March 2019, the pre-validation of a bank account is mandatory for all taxpayers.

In this article, we will discuss the complete procedure of how you can pre-validate your bank account. As per the latest guidelines by the income tax department that the income tax refund will be credited to only those bank accounts which are linked with PAN and have been pre-validated on the new income tax filing website. So, if any taxpayer doesn’t pre-validate their bank account, they will not get an e-refund in their bank account. This article will walk you through the process of ensuring your bank account is pre-validated, enabling you to receive your income tax refund as quickly as possible. We will cover everything from why it’s necessary to pre-validate your bank account, to the actual process of pre-validating, and even how to check if your bank account is already pre-validated.

So here is the complete procedure for how to pre-validate a bank account on the income tax portal.

Table of contents

- 1. Why Pre-Validate Your Bank Account?

- 2. Which Bank Accounts Can Be Pre-Validated?

- 3. Prerequisites for Successful Pre-Validation

- 4. How to Check if Your Bank Account is Pre-Validated

- 5. How to Pre-Validate Your Bank Account

- 6. How to Enable EVC for Pre-Validated Bank Accounts

- 7. Updating Contact Details for EVC-Enabled Bank Accounts

- 8. Time Required for Pre-Validation Process

- 9. Failed Pre-Validation Process

- 10. Checking Income Tax Refund Status Online

- 11. FAQ on Pre-Validate Bank Account

1. Why Pre-Validate Your Bank Account?

Pre-validating your bank account is essential for two main reasons:

a. Receiving Income Tax Refund

The income tax department issues refund only through electronic credit service (ECS) directly into a pre-validated bank account. This means that if your bank account is not pre-validated, you will not be able to receive your income tax refund.

b. Enabling EVC for e-Verification

A pre-validated bank account can also be used to enable the Electronic Verification Code (EVC) for e-Verification purposes. EVC can be used for income tax returns, e-Proceedings, refund reissue, and secure login to the e-Filing account.

2. Which Bank Accounts Can Be Pre-Validated?

The following types of bank accounts can be pre-validated:

- Savings Bank Accounts

- Current Accounts

- Cash Credit Accounts

- Over Draft Accounts

- NRO (Non-Resident Ordinary) Accounts

It is important to note that you cannot pre-validate loan or PPF accounts.

3. Prerequisites for Successful Pre-Validation

To successfully pre-validate your bank account, you must fulfill the following criteria:

- A valid PAN registered with e-Filing

- An active bank account linked to your PAN

4. How to Check if Your Bank Account is Pre-Validated

Follow these steps to check if your bank account is already pre-validated on the income tax portal:

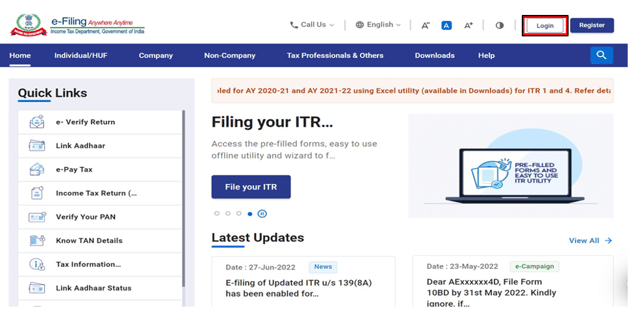

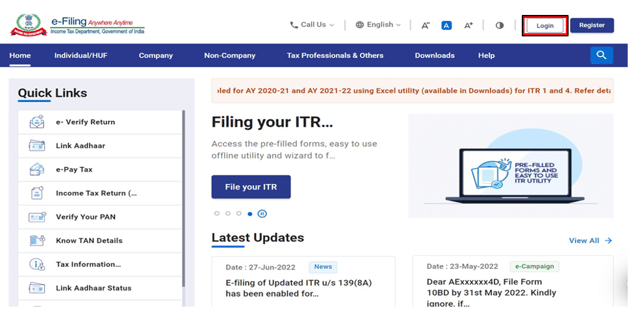

Step 1: Log in to your account on the Income Tax portal.

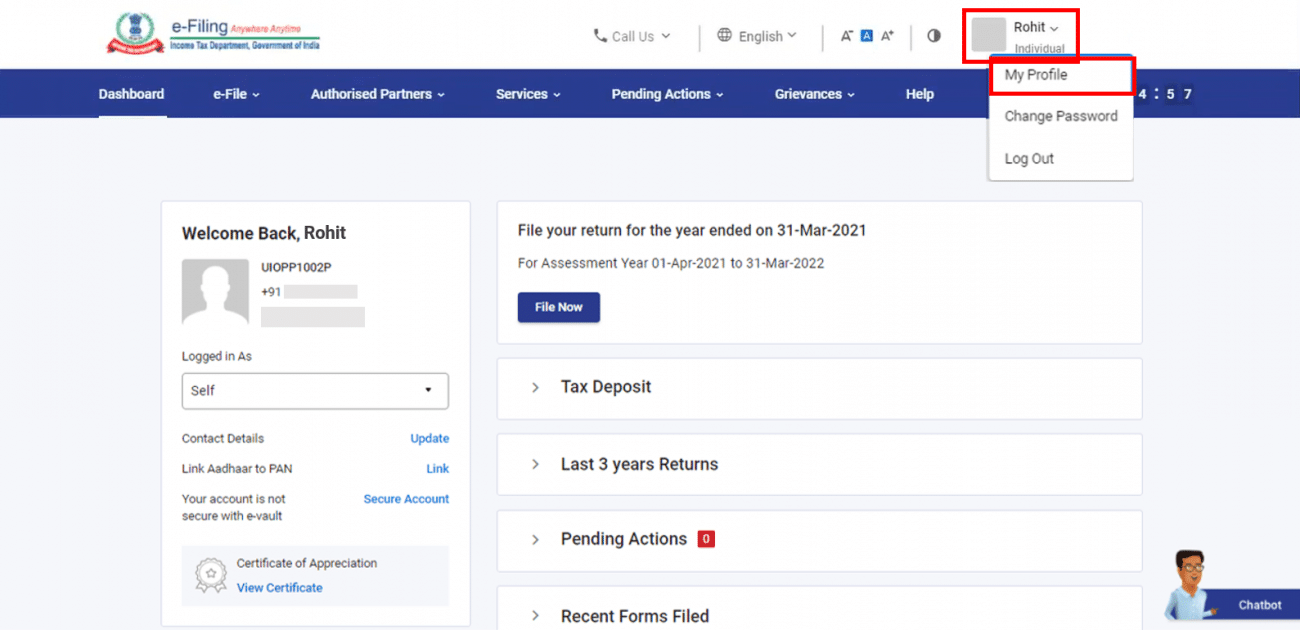

Step 2: Click on ‘My Profile’ and select ‘My Bank Account.’

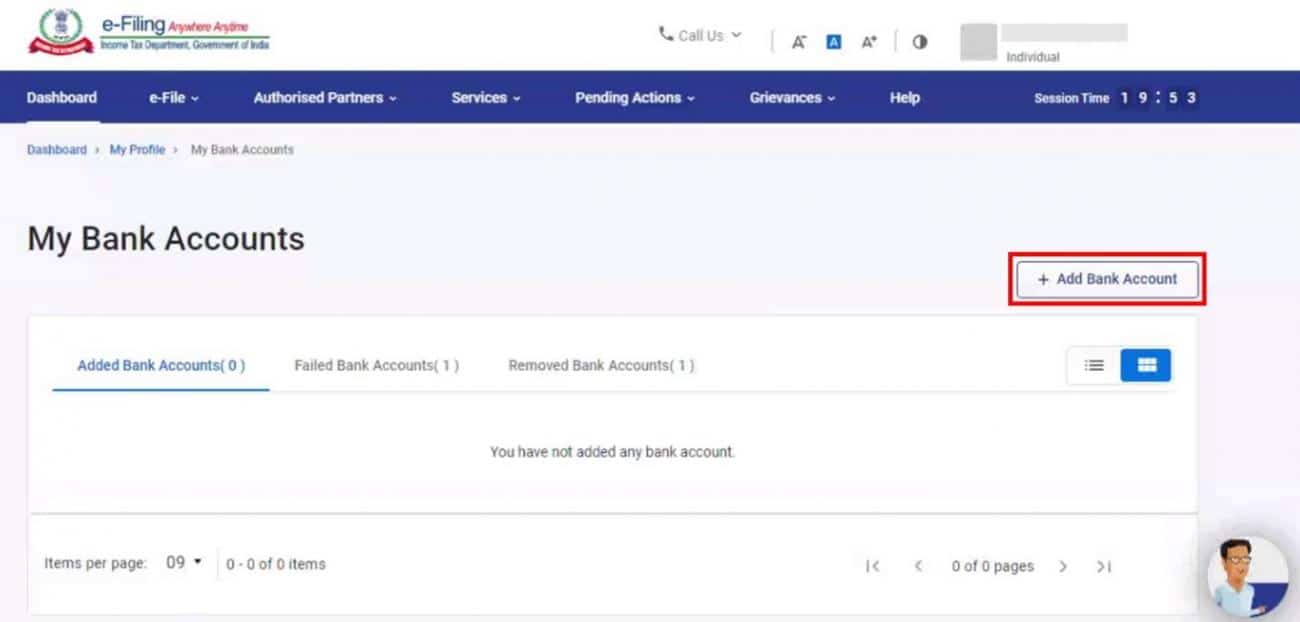

The screen will display the bank accounts that are pre-validated and the bank account selected by you for receiving the income tax refund.

If you have not added a bank account yet, you can follow the below steps to pre-validate your bank account.

5. How to Pre-Validate Your Bank Account

If your bank account is not yet pre-validated, follow these steps to complete the process:

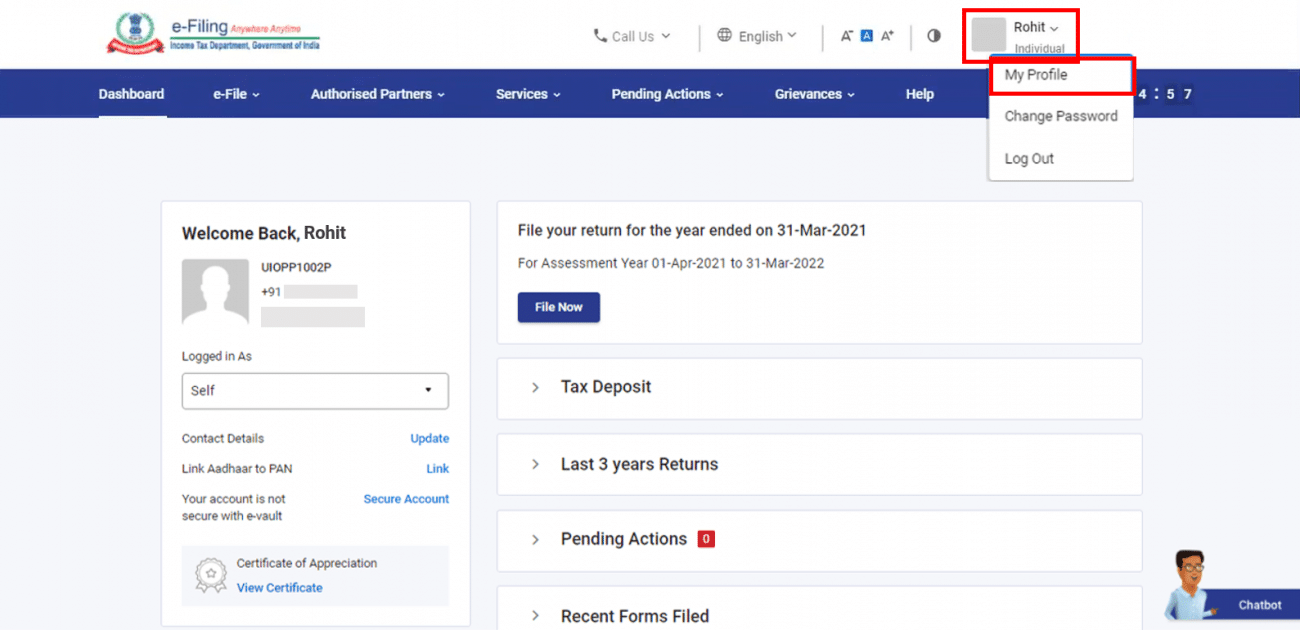

Step 1: Log in to your account on the Income Tax portal.

Step 2: Select ‘My Profile’ by clicking on your name.

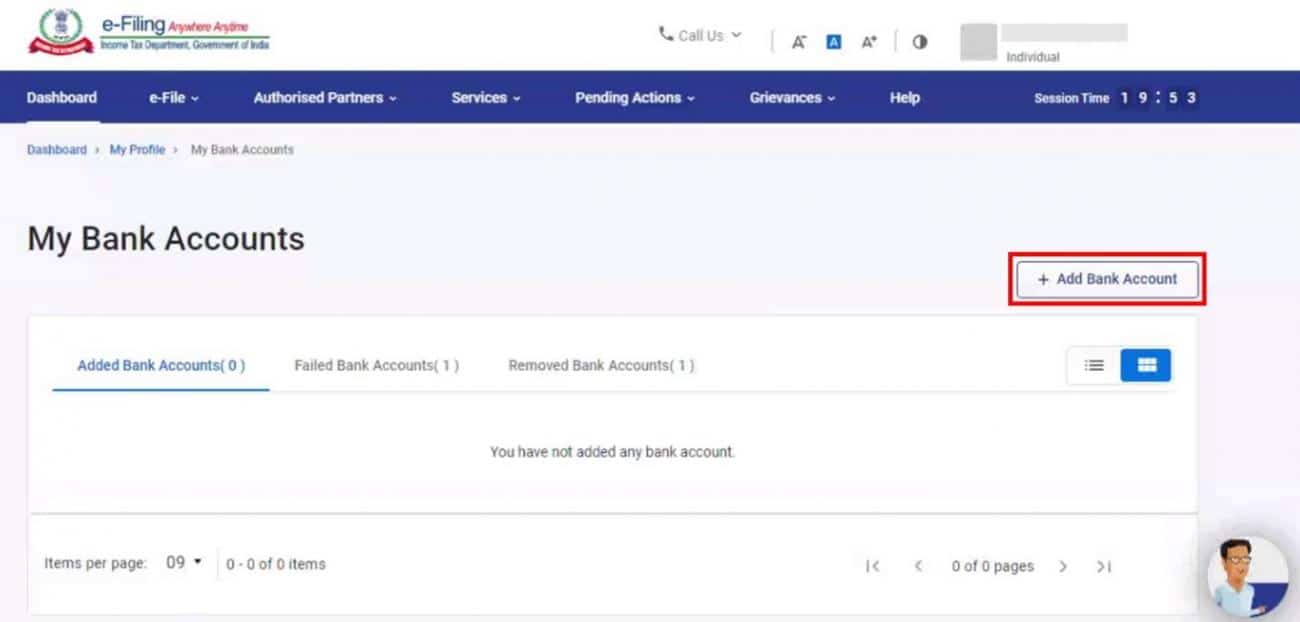

Step 3: Select ‘My Bank Account,’ and then click on ‘Add Bank Account.’

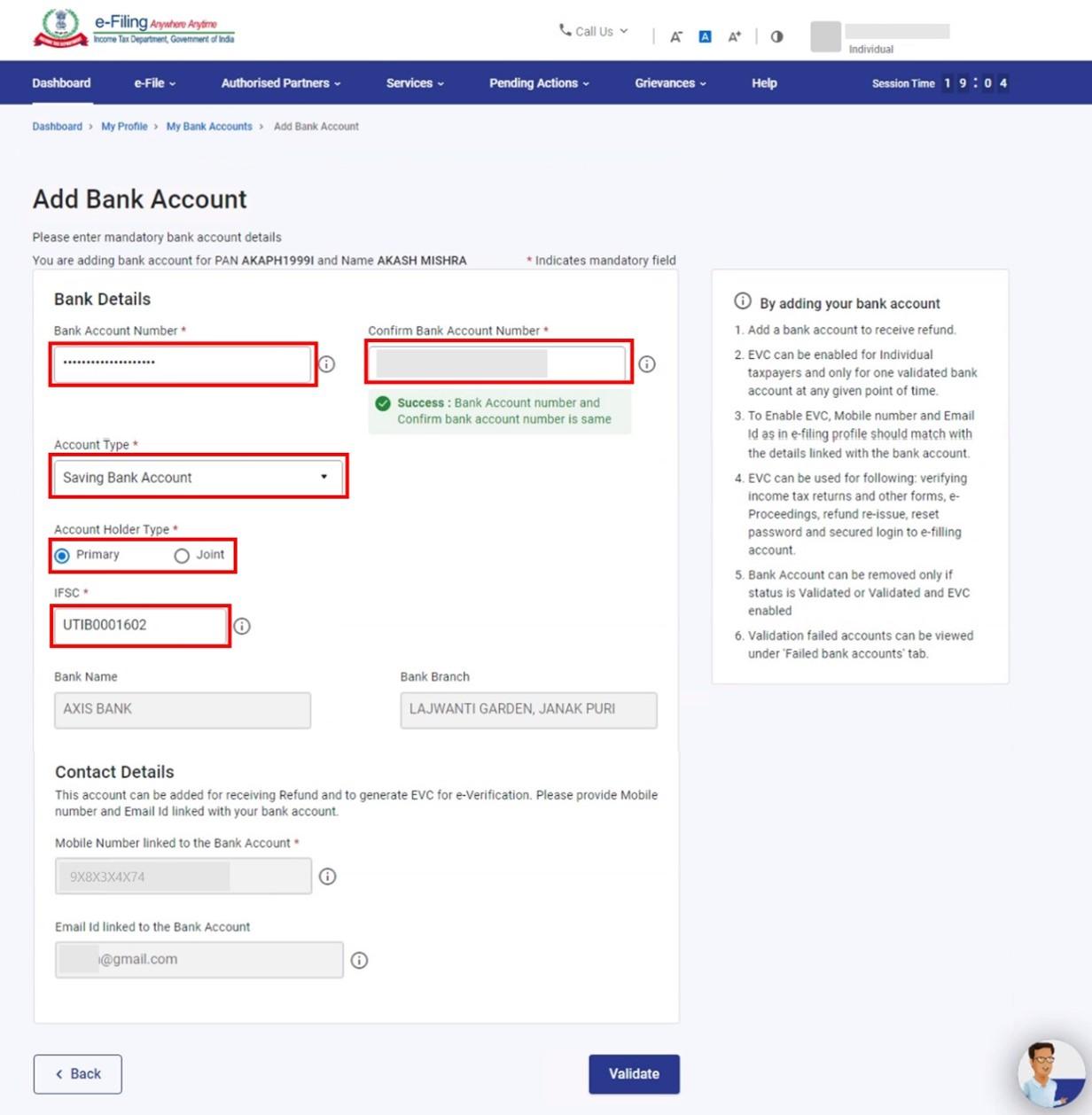

Step 4: Enter the required details, such as Bank Account Number, Account Type, Account Holder Type, and IFSC. The bank name and branch will be auto-populated based on the IFSC.

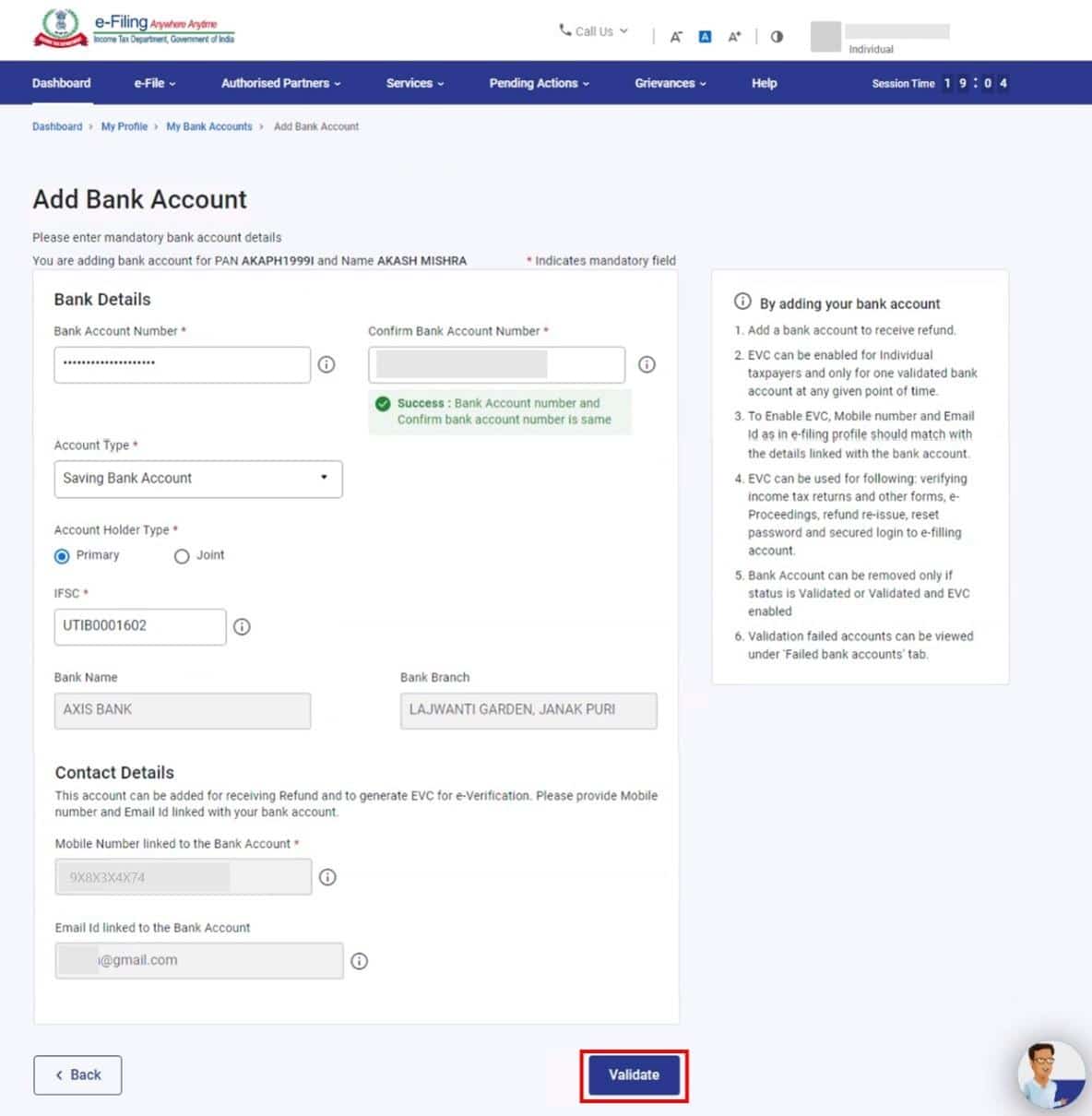

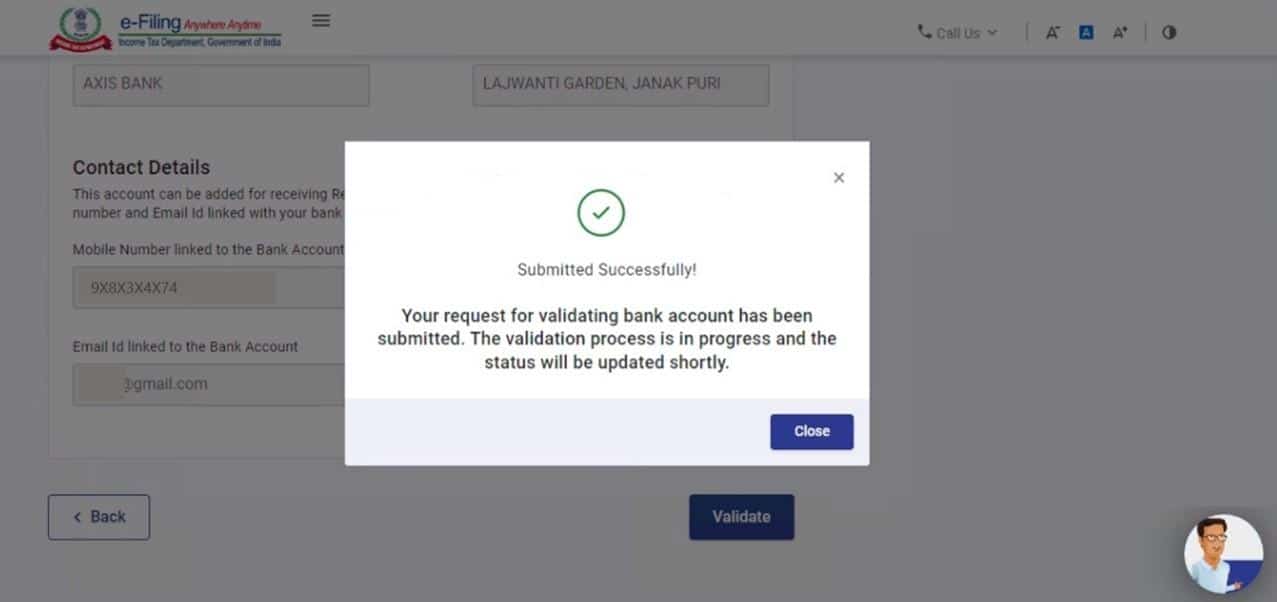

Step 5: Cross-check the details, and click on ‘Validate.’

Step 6: Once successfully validated, your bank account will be automatically added to your profile. You can then nominate the account on the e-filing portal to receive your income tax refund.

6. How to Enable EVC for Pre-Validated Bank Accounts

To enable EVC for your pre-validated bank account, follow these steps:

Step 1: Log in to your account on the Income Tax portal.

Step 2: Go to ‘My Profile’ and click on ‘My Bank Account.’

Step 3: Click on the ‘Enable EVC’ option next to the validated bank account.

Please note that EVC can only be enabled for one bank account at a time.

7. Updating Contact Details for EVC-Enabled Bank Accounts

If you change your mobile number or email ID registered with the bank for an EVC-enabled pre-validated bank account, you must update your contact details on the e-Filing portal to match the bank’s records. Once the details are updated, revalidate your bank account.

8. Time Required for Pre-Validation Process

The pre-validation process is automatic and takes around 10-12 working days to complete. The validation status will be updated in your e-Filing account once the process is complete.

9. Failed Pre-Validation Process

If the pre-validation process fails, the details will be displayed under ‘Failed Bank Accounts.’ You can resubmit the failed bank accounts for validation by clicking on the ‘Re-Validate’ option.

10. Checking Income Tax Refund Status Online

You can check your income tax refund status on both the National Securities Depository Ltd (NSDL) website and the Income Tax Department’s e-filing portal.

a. On the NSDL Website

- Visit the NSDL website to track your refund.

- Fill in the required details, such as PAN and AY, and click ‘Proceed.’

- Your income tax refund status will be displayed.

b. On the e-Filing Portal

- Log in to the Income Tax department’s e-filing portal.

- Select ‘View Returns/Forms.’

- Go to the ‘My Account’ tab and select ‘Income Tax Returns.’ Click ‘Submit.’

- Click on the acknowledgment number.

A page showing your return details and income tax refund status will appear.

By following these steps, you can ensure that your bank account is pre-validated and ready to receive your income tax refund. Always double-check your bank details and maintain updated contact information to avoid delays in receiving your refund.

11. FAQ on Pre-Validate Bank Account

1. Why is it important to pre-validate my bank account for income tax refunds?

Pre-validating your bank account is essential because:

– The Income Tax Department will only issue refunds through electronic credit service (ECS) to pre-validated bank accounts. Without pre-validation, you won’t receive your income tax refund.

– Pre-validating your bank account also enables Electronic Verification Code (EVC) for e-Verification purposes, which is required for various income tax processes.

2. Which types of bank accounts can be pre-validated?

You can pre-validate the following types of bank accounts:

– Savings Bank Accounts

– Current Accounts

– Cash Credit Accounts

– Overdraft Accounts

– NRO (Non-Resident Ordinary) Accounts

Note that loan or PPF accounts cannot be pre-validated.

3. What are the prerequisites for successful pre-validation?

To pre-validate your bank account successfully, you must have:

– A valid PAN registered with the e-Filing portal

– An active bank account linked to your PAN

4. How can I check if my bank account is already pre-validated?

To check if your bank account is pre-validated on the income tax portal:

– Log in to your account on the Income Tax portal.

– Go to ‘My Profile’ and select ‘My Bank Account.’

– The screen will display your pre-validated bank accounts and the account selected to receive income tax refunds.

If you haven’t added a bank account yet, you can follow the steps below to pre-validate your bank account.

5. How can I pre-validate my bank account?

If your bank account is not pre-validated, follow these steps:

– Log in to your account on the Income Tax portal.

– Select ‘My Profile’ and click on ‘My Bank Account.’

– Click on ‘Add Bank Account.’

– Enter the required details, such as Bank Account Number, Account Type, Account Holder Type, and IFSC.

– Cross-check the details and click on ‘Validate.’

– Once successfully validated, your bank account will be added to your profile, and you can nominate it to receive your income tax refund.

6. Can I enable EVC for my pre-validated bank account?

Yes, you can enable EVC (Electronic Verification Code) for your pre-validated bank account. Follow these steps:

– Log in to your account on the Income Tax portal.

– Go to ‘My Profile’ and click on ‘My Bank Account.’

– Click on the ‘Enable EVC’ option next to the validated bank account.

Please note that you can enable EVC for one bank account at a time.

7. How long does the pre-validation process take?

The pre-validation process is automatic and usually takes around 10-12 working days to complete. Once the process is complete, the validation status will be updated in your e-Filing account.

8. What should I do if the pre-validation process fails?

If the pre-validation process fails, the details will appear under ‘Failed Bank Accounts.’ You can resubmit the failed bank accounts for validation by clicking on the ‘Re-Validate’ option.

9. How can I check my income tax refund status?

You can check your income tax refund status through the following methods:

– Visit the National Securities Depository Ltd (NSDL) website and fill in the required details like PAN and AY to track your refund.

– Log in to the Income Tax Department’s e-Filing portal, select ‘View Returns/Forms,’ go to the ‘My Account’ tab, choose ‘Income Tax Returns,’ and click on the acknowledgment number to view your return details and income tax refund status.

10. Is pre-validation of bank account mandatory for all taxpayers?

Yes, as per the Income Tax Department guidelines effective from 1st March 2019, pre-validation of the bank account is mandatory for all taxpayers who want to receive their income tax refunds directly into their bank accounts.

11. Can I pre-validate my bank account on any income tax filing portal?

No, you can only pre-validate your bank account on the official income tax filing portal, which is incometax.gov.in. Ensure that you use the correct and authorized website for pre-validation.

12. What are the benefits of pre-validating my bank account?

By pre-validating your bank account, you can enjoy the following benefits:

– Fast and error-free income tax refunds directly credited to your bank account.

– Enhanced security through e-Verification using Electronic Verification Code (EVC).

– Protection against fraudulent refund claims and unauthorized access to your bank account.

13. What should I do if I change my bank account or update my contact details?

If you change your bank account or update your contact details, follow these steps:

– Log in to your account on the Income Tax portal.

– Go to ‘My Profile’ and select ‘My Bank Account.’

– Update the bank account details or contact information as necessary.

– Re-validate your bank account to ensure it is linked correctly.

14. Is there any charge or fee for pre-validating my bank account?

No, pre-validating your bank account on the income tax portal is free of charge. There are no fees or charges associated with the pre-validation process.

15. Can I pre-validate my bank account after filing my income tax return?

Yes, you can pre-validate your bank account even after filing your income tax return. However, it is recommended to pre-validate your bank account before filing to ensure a seamless refund process.

16. What should I do if I encounter any issues or need assistance with pre-validation?

If you face any issues or require assistance regarding the pre-validation process, you can reach out to the Income Tax Department’s customer support helpline or visit their official website for guidance and support.

Remember to always follow the official guidelines provided by the Income Tax Department and stay updated with any changes or notifications related to pre-validation and income tax refunds.