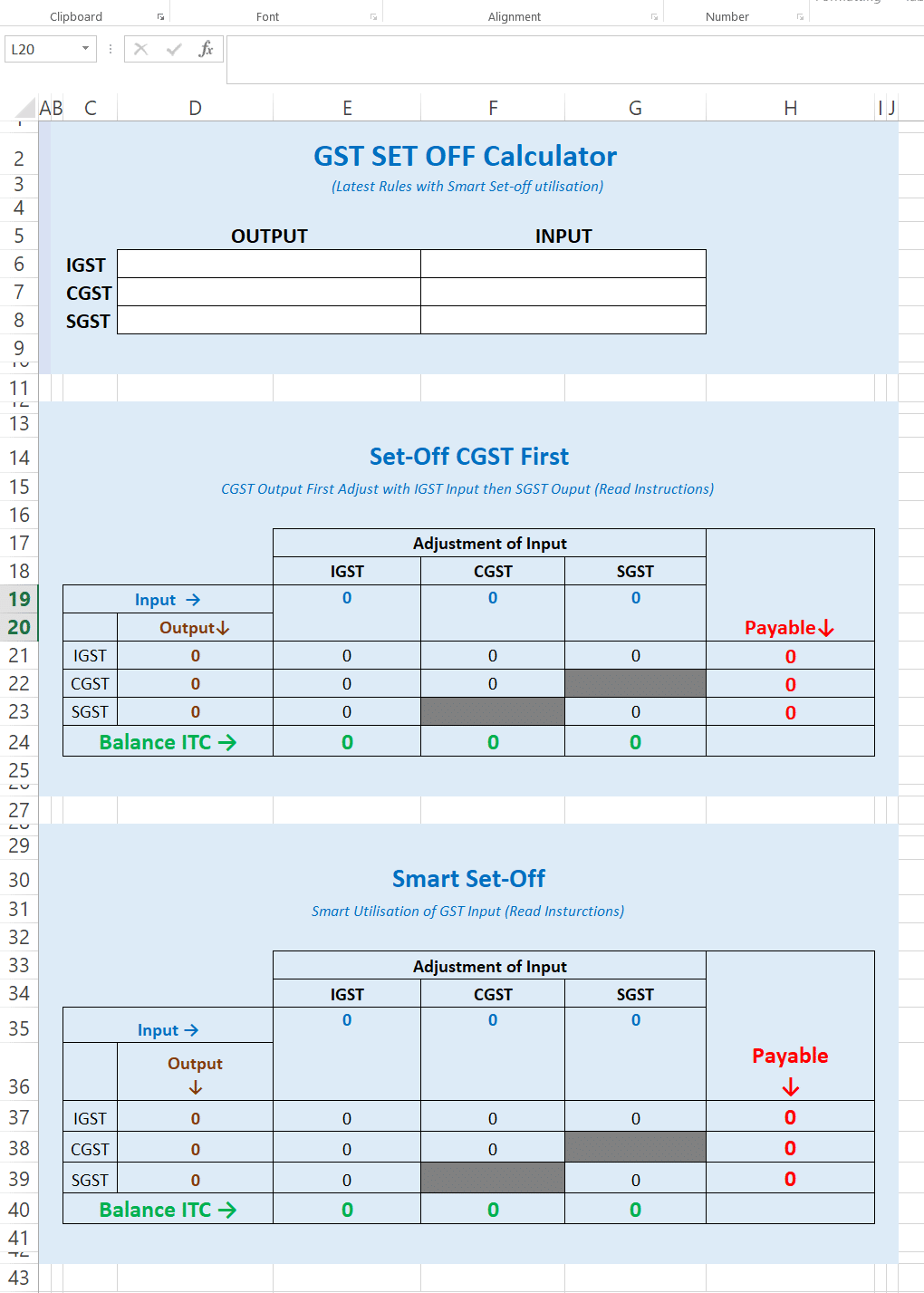

Excel GST Set-Off Calculator: You can download this GST Set off calculator for free. It is free to use in Excel for an unlimited period of time. You can use the GST utilization calculator as often as you like. This calculator is based on new rules applicable w.e.f. 1st Feb 2019. Prior to using the CGST and SGST credits, the IGST credit must be fully utilized.

You can calculate GST payable or GST input tax credit carryover to the next month, quarter, or year. This GST set-off calculator includes amendments up until the finance bill 2023. Calculate the GST payable or carry forward amount for any period that you wish. In order to calculate GST under the new rules, you must enter GST inputs and outputs.

Download GST Set Off Calculator in Excel Format

Here are the links to download GST Set off or Utilisation calculator in Excel format.

| GST Set Off Calculator Excel | Download Here |

| GST Set Off Calculator (Online) without downloading | Visit Here |

How to Use Excel GST Set-Off Calculator

It is very easy to use the GST set-off calculator in Excel. If you would like to use this calculator effectively, please follow the steps below.

Step 1: First of all, you must download the GST set-off calculator from the links provided above in the table in order to use it.

Step 2: In order to use the calculator, you will need to open this Excel file after downloading the calculator.

Step 3: As soon as you open the Excel file, all you have to do is enter the GST output and input for any particular month, quarter or any period.

Step 4: I would like to remind you not to forget to add the opening balance of GST input or any liability to the appropriate head of IGST, CGST or SGST.

That’s it, right now the calculator will automatically calculate the GST payable or the GST input carry forward, i.e. the IGST Payable, CGST Payable, SGST Payable or IGST Input, CGST Input, SGST Input.

Don’t forget to check the smart set off as well, which is included in the calculator as well. Choose any option from Smart Set off or from CGST output first. It’s up to you.

Benefits of GST Set off Calculator Excel

The GST set off calculator in Excel offers a lot of benefits.

- This GST set-off calculator offers many advantages while calculating GST payable or GST input carry forwared. These are some of the benefits:

- Excel calculations are accurate and reliable when they are set up correctly. With a GST set-off calculator, you are less likely to make mistakes when calculating GST payable and set-offs.

- By using the calculator’s automatic features, you don’t need to do as many calculations by hand, making you more productive. Each transaction’s GST amount and set-offs will be calculated by the formulas once you enter the numbers.

- There is no limit on how many times you can calculate GST using this calculator.

- There is also the advantage that you can choose either CGST first or smart set off.

- Furthermore, you can print the calculation sheet and make it into a pdf through Excel and send it to anyone.

- Businesses can reduce their GST obligations and get the most out of their input tax payments by accurately calculating GST amounts and set-offs. As a result, you save money.

Using a GST set-off tool in Excel simplifies GST compliance, efficiency, and accuracy. In addition to helping businesses figure out GST, it gives them the knowledge they can use and allows them to make more informed financial decisions.

If you experience any problems downloading or using this calculator, please use the comment form. The issue will be resolved as soon as possible by our team.

Disclaimer for GST Set-Off Calculator: This GST set-off calculator in Excel is provided for informational purposes only and should not be taken as tax advice. Calculations are based on general rules and assumptions and may not take into account your unique legal or financial situation. Calculations are accurate and thorough based on the inputs and formulas used. We tried to ensure the information was accurate, but we make no promises or warranties regarding the calculator’s reliability, suitability, or ability to be used in specific situations. Getting accurate and up-to-date information about GST rules, set-off rules, and other laws requires talking to a trained tax professional or contacting the relevant tax authorities. Their advice can be tailored to your business’s needs. We are not responsible for any loss or damage caused by your use of the GST set-off calculator or the information it provides. Make sure you verify the results on your own and speak to a professional before making any business or financial decisions based on the GST set-off calculator.

what is the password to unprotect the Excel sheet

Hello, You can’t unprotect the sheet. It is only for using calculation. Have you found any error then please tell us?

with the help this calculator we can save our time

Thanks Onkar, Please share GST set off calculator with your friends. Its help us a lot. Thanks