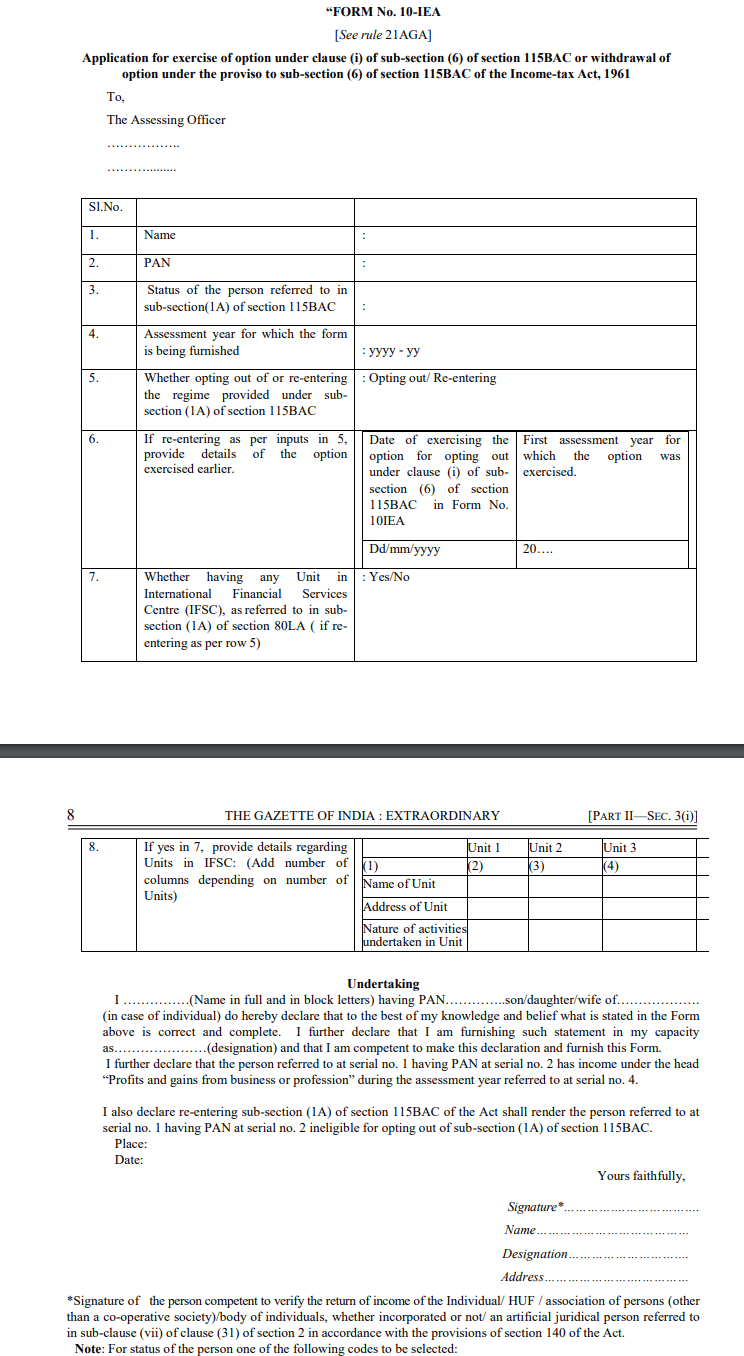

Form 10IEA: Switch to Old Tax Regime (A.Y. 2024-25): Form 10IEA is a tax form introduced by the income tax department specifically for the assessment year 2024-25. It is used by individuals and Hindu Undivided Families (HUFs) having business and professional income who want to opt out of the default new tax regime and switch to the old tax regime. The default tax regime for the assessment year 2024-25 becomes the new tax regime. Therefore, individuals who prefer the old tax regime need to fill out Form 10IEA to exercise their options.

Table of contents

Quick Summary of Form 10IEA

The table provides a concise summary of the key details regarding Form 10-IEA

| Particulars | Details |

|---|---|

| Applicable for | Individuals and HUFs with income from business or profession for A.Y. 2024-25 |

| Purpose | To declare and exercise the option for the old tax regime |

| Filing Deadline | Not yet released online (On or Before Filing Income Tax Return) |

| Frequency | Can be filed once for A.Y. 2024-25 |

| Business/Profession Income | Required if opting for the old tax regime as the default tax regime is the new tax regime |

| Salary/Capital Gain/House Property | Not required (can be selected on the Income Tax Return form) |

What is Form 10IEA

Form 10IEA requires individuals to provide essential details and make a choice regarding opting in or out of the default new tax regime. It needs to be submitted before the specified due date for filing the income tax return (ITR) for the assessment year. The last date to submit the income tax return form for Assessment Year 2024-25 is 31st July 2024. Please note that this deadline is significantly later than the end of the financial year, which falls on 31st March 2024.

It is important to note that the current focus should be on the income tax return for Assessment Year 2023-24. The last date to file the income tax return for this assessment year is 31st July 2023. If you wish to opt for the new tax regime for A.Y. 2023-24, you can utilize Form 10IE.

Form 10IEA Availability

As of now, the Income Tax Department has not made Form 10IEA available online on their portal. We will keep you updated regarding any developments and inform you when the form becomes accessible. It’s important to note that Form 10IEA is not currently required as it is applicable for Assessment Year 2024-25, and there is no immediate need for it at the moment.

Updates About 10IEA

Taxpayers who have opted out of the new tax regime by filing their declaration under Section 115BAC(6) and have income from business or profession, now have the option to switch back to the new regime under Section 115BAC(1A).

To facilitate this process, the Central Board of Direct Taxes (CBDT) has issued notification No. 43/2023 dated 21st June 2023, introducing a new Rule 21AGA.

This rule mandates the use of the prescribed Form 10-IEA, which must be filed by taxpayers engaged in business or profession and opting for the old tax regime. By submitting Form 10-IEA, these taxpayers can withdraw from the old regime only once.

Important Notes

It is important to note that individuals with business income who have opted for the new tax regime have only one opportunity to switch back to the old tax regime. This can be done by filing Form 10IEA and indicating the preference for the old regime. The form needs to be verified using a digital signature or electronic verification code, similar to the process for Form 10IE. Taxpayers without business or professional income can also opt for the old regime by ticking the checkbox provided in their ITR forms.

Form 10IEA vs Form 1oIE

Below is a comparison table that outlines the key distinctions between Form 10-IEA and Form 10-IE.

| Form 10-IEA | Form 10-IE | |

|---|---|---|

| Applicable for | Individuals and HUFs with income from business or profession for A.Y.2024-25 | Individuals and HUFs opting for new tax regime for A.Y. 2023-24 |

| Purpose | To declare and exercise the option for the old tax regime | To declare and exercise the option for the new tax regime |

| Filing Deadline | Not yet released online (On or Before Filing Income Tax Return ) | On or Before Filing Income Tax Return |

| Frequency | Can be filed once for A.Y. 2024-25 | Can be filed once for A.Y. 2023-24 |

| Business/Profession Income | Only Required if you want to opt for the old tax regime as for a.y. 2024-25, the default tax regime is the new tax regime | Only Required if you want to opt new tax regime as for a.y. 2023-24 the default tax regime is the old tax regime |

| Salary/Capital Gain/House Property | Not Required (You can easily select on Income Tax Return form) | Not Required (You can easily select on Income Tax Return form) |

FAQs About Form 10IEA

Q: What is Form 10IEA?

A: Form 10IEA is a tax form introduced by the income tax department for the assessment year 2024-25. It is used by individuals and Hindu Undivided Families (HUFs) with business and professional income who wish to opt out of the default new tax regime and switch to the old tax regime.

Q: When should Form 10IEA be submitted?

A: Form 10IEA needs to be submitted before the specified due date for filing the income tax return (ITR) for the assessment year. For Assessment Year 2024-25 (Financial Year 2023-24), the last date to submit the income tax return form is 31st July 2024.

Q: Is Form 10IEA available online?

A: Currently, Form 10IEA is not available online on the Income Tax Department’s portal. We will keep you updated on any developments regarding its availability.

Q: Can I opt for the new tax regime for Assessment Year 2023-24?

A: Yes, if you wish to opt for the new tax regime for Assessment Year 2023-24, you can use Form 10IE. The last date to file the income tax return for this assessment year is 31st July 2023.

Q: Can individuals with business income switch back to the old tax regime?

A: Yes, individuals with business income who have opted for the new tax regime have the option to switch back to the old tax regime. They can do this by filing Form 10IEA and indicating their preference for the old regime. However, this option can only be exercised once.

Q: What is the difference between Form 10IEA and Form 10IE?

A: Form 10IEA is applicable for individuals and HUFs with business or professional income for A.Y. 2024-25 and is used to exercise the option for the old tax regime. On the other hand, Form 10IE is applicable for individuals and HUFs opting for the new tax regime for A.Y. 2023-24 and is used to exercise the option for the new tax regime.

Q: Is Form 10IEA the same as Form 10IE?

A: No, Form 10IEA and Form 10IE serve different purposes. Form 10IEA is for opting out of the new tax regime, while Form 10IE is for opting into the new tax regime.