Form 26AS is an important document for taxpayers in India as it provides a comprehensive summary of the tax credits associated with their Permanent Account Number (PAN). Form 26 AS consolidates information from various sources such as tax deducted at source (TDS), tax collected at source (TCS), advance tax, and self-assessment tax payments. You have the option to obtain Form 26AS by downloading it from either the e-filing website (www.incometaxindiaefiling.gov.in) or TRACES (www.tdscpc.gov.in). We will discuss the complete details of Form 26AS i.e. how to download, benefits, mismatch, and grievances. Let’s get started!

Updated: Starting from the assessment year 2023-24, the TRACES portal will only show TDS/TCS-related information in Form 26AS. All other details will be accessible through the AIS (Annual Information Statement) on the e-filing portal at https://www.incometax.gov.in/iec/foportal. The display for data before the assessment year 2023-24 will remain unchanged.

Table of contents

- What is Form 26AS?

- How to View Form 26AS: A Step-by-Step Guide

- Why is Form 26AS important?

- Structure of Form 26AS

- Form 16 Vs Form 16A Vs Form 26AS - Comparison to Clear Your Confusion

- What to do if the wrong entry of Income and TDS appears in Form 26AS?

- Form 26AS vs AIS

- Discrepancies in Form 26AS

- What to do if I find any discrepancies in my Form 26as?

- Can I claim credit of TDS deducted by the employer but not paid by it to Govt.?

- FAQ on Form 26AS

What is Form 26AS?

Form 26AS is like a tax passbook for taxpayers. It contains various types of information, including:

- Details about Tax Deducted at Source (TDS) and Tax Collected at Source (TCS).

- Information about Specified Financial Transactions (SFT) like major financial activities.

- Payment details of taxes made by the taxpayer.

- Information about any tax demands or refunds.

- Details of any ongoing tax proceedings.

- Information about completed tax proceedings.

- Information received from government bodies, officers, or other sources under various laws or agreements.

In addition, the Central Board of Direct Taxes (CBDT) has authorized specific income tax authorities to upload information related to GST returns in Form 26AS within three months from the end of the month in which the information is received.

Overall, Form 26AS serves as a comprehensive record of taxpayer tax-related information and transactions.

This article will guide you through the process of viewing your Form 26AS, helping you stay updated on your tax liabilities and avoid any discrepancies.

How to View Form 26AS: A Step-by-Step Guide

Step 1: Access the Income Tax e-Filing Portal

To view your Form 26AS, you need to visit the official website of the Income Tax Department of India at https://www.incometax.gov.in. Ensure that you have an active internet connection and a valid PAN number to proceed.

Step 2: Log in or Register

If you are a registered user, simply enter your PAN as the User ID and provide the password to log in to the portal. If you’re not registered, click on the “Register Yourself” button and complete the registration process by providing the necessary details.

Step 3: Go to ‘My Account’

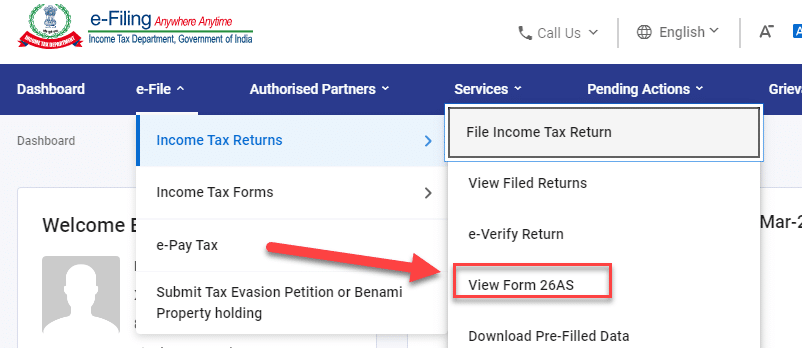

After logging in, click on the “e-File => Income Tax Returns => View Form 26AS” tab at the top of the page. A drop-down menu will appear with several options.

Step 4: Select ‘View Form 26AS’

From the drop-down menu, select the “View Form 26AS” option. You will be redirected to the Tax Credit Statement page.

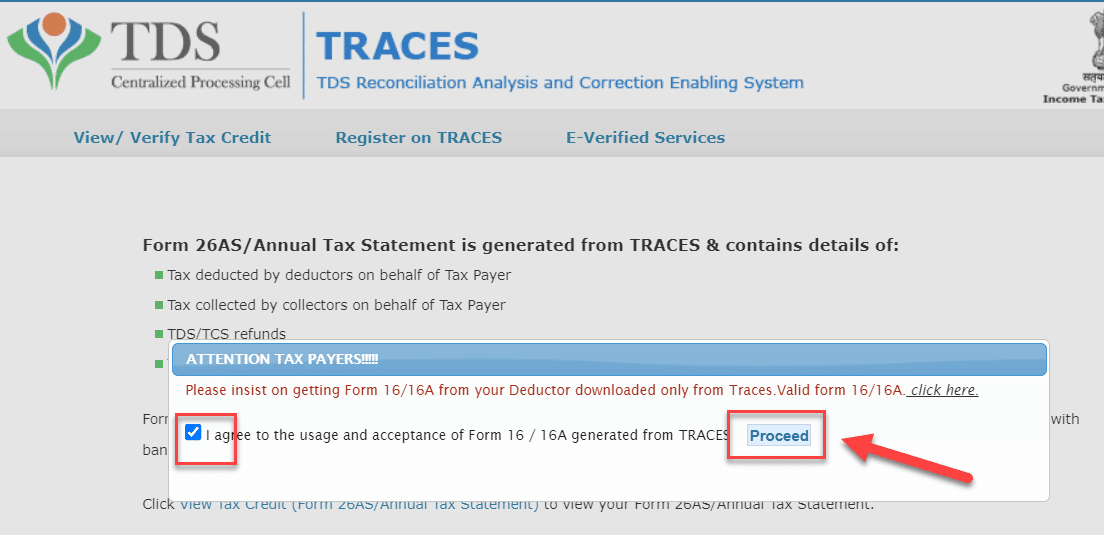

Step 6: Agree to the Terms and Proceed

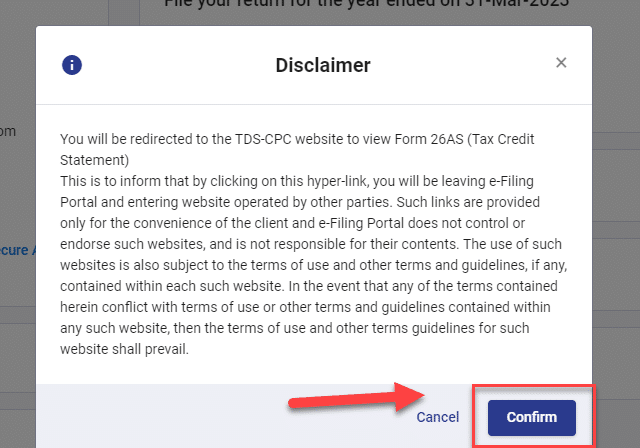

Read the disclaimer carefully and check the box to agree to the terms and conditions. Click on the “Confirm” button to continue.

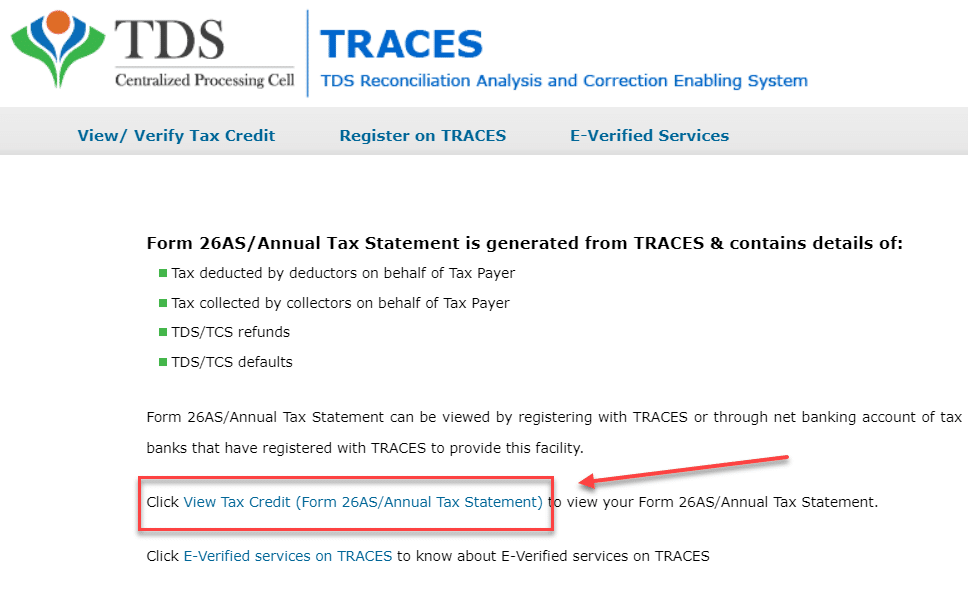

Step 7: You Will Be Redirected to the TRACES Website

Upon clicking “Proceed,” you will be redirected to the TRACES (TDS Reconciliation Analysis and Correction Enabling System) website. TRACES is the official platform for accessing Form 26AS.

Step 8: Verify Your Personal Information

On the TRACES website, your personal details will be displayed. Ensure that the information is correct and matches the details on your PAN card.

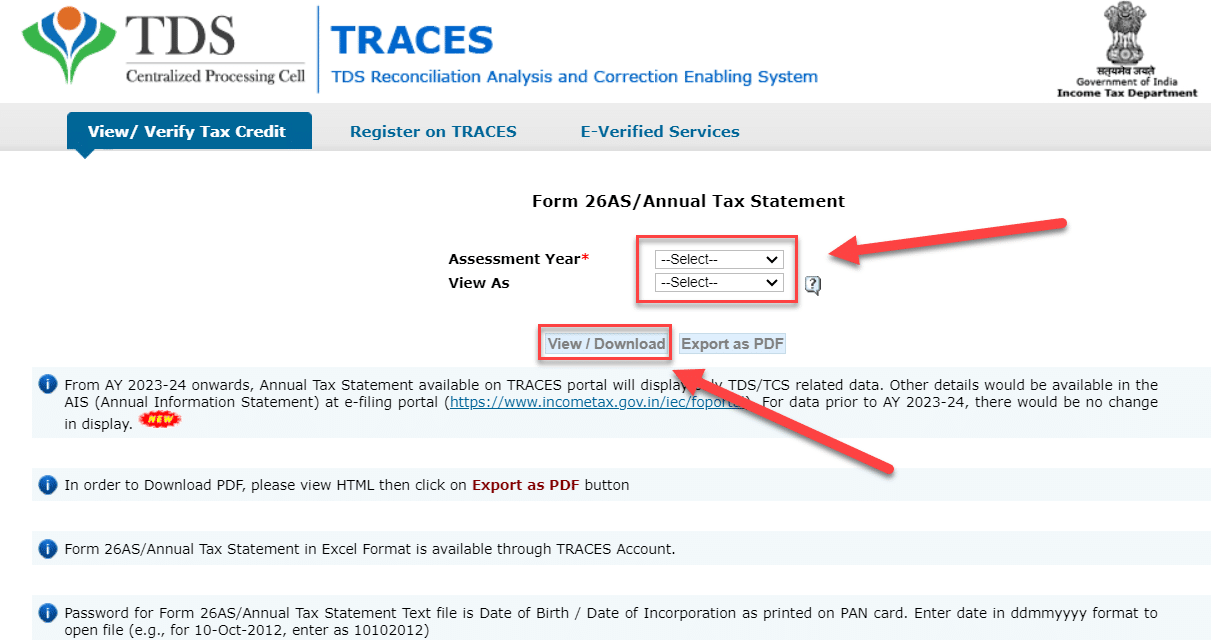

Step 5: Choose the Appropriate Assessment Year and Verification

On the Tax Credit Statement page, choose the relevant assessment year for which you want to view Form 26AS. It is crucial to select the correct assessment year to access the desired information. Next, select the verification mode as per your preference, either through net banking or through Aadhaar.

Step 9: Select the Type of View

You can choose between two types of views: HTML and PDF. The HTML version is user-friendly and provides an interactive interface, while the PDF version is a downloadable file that can be saved for future reference. Choose the preferred view and click on the respective option.

Step 10: Download or View Form 26AS

If you select the HTML view, Form 26AS will be displayed on the screen. You can scroll through the sections to review the information. If you opted for the PDF version, it will be downloaded to your device and you can access it using a PDF reader.

Congratulations! You have successfully viewed your Form 26AS, which contains crucial information about your tax credits and liabilities. It is advisable to review the details carefully, ensuring they align with your records and financial transactions.

By regularly checking your Form 26AS, you can stay updated on TDS deductions made by your employer or other deductors, ensuring accurate tax compliance. If you notice any discrepancies or errors, you should promptly contact the relevant authorities to rectify them.

Why is Form 26AS important?

Form 26AS is very important for taxpayers due to the following reasons:

1. Verification of Tax Credits: Form 26AS serves as a consolidated statement of tax credits associated with a taxpayer’s PAN. It provides a comprehensive view of tax deducted at source (TDS), tax collected at source (TCS), advance tax, and self-assessment tax payments. By reviewing Form 26AS, taxpayers can verify whether the taxes deducted from their income or other financial transactions have been appropriately credited to their account.

2. Filing Accurate Income Tax Returns: The taxpayer should file their income tax return correctly by accurately reporting income, such as the TDS amount and advance tax. Form 26AS helps taxpayers cross-check the TDS amount, advance tax, and other income like dividends. It provides valuable assistance to taxpayers in filing their income tax return accurately, without any errors or discrepancies.”

3. Avoiding Tax Notice and Penalties: In cases where there is a mismatch between the tax credits claimed in the income tax return and the information available in Form 26AS, taxpayers may receive notices from the Income Tax Department. By regularly monitoring and verifying Form 26AS, individuals can identify any discrepancies or missing tax credits and rectify them in a timely manner, thus avoiding unnecessary tax notices, penalties, and legal consequences.

4. Claiming Tax Refunds: Form 26AS provides details of Income tax refunds received by the taxpayer during a specific financial year. It serves as evidence of the amount refunded by the tax authorities. Taxpayers can refer to Form 26AS to ensure that they have received the correct refund amount and claim any pending refunds, if applicable.

5. Comprehensive Financial Overview: The updated version of Form 26AS includes additional information from the Statement of Financial Transactions (SFTs). This includes details of high-value financial transactions such as cash deposits/withdrawals, property transactions, investments, and more. By having this comprehensive financial overview, taxpayers can easily recall their major financial activities and have a ready reckoner while filing their income tax returns.

Structure of Form 26AS

Form 26AS consists of various areas that provide a comprehensive view of taxpayer tax-related information. The structure and parts of Form 26AS include the following:

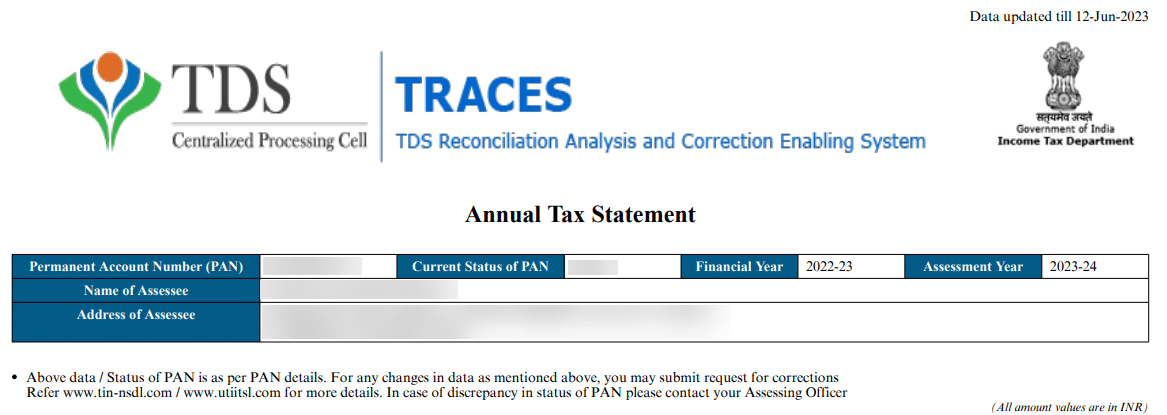

Personal Information – This section displays the taxpayer’s personal details, such as their name, address, Permanent Account Number (PAN), and Assessment Year.

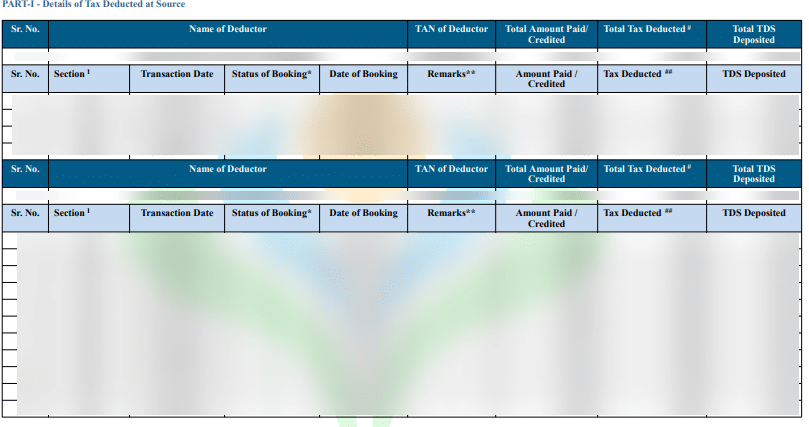

Part I: Details of Tax Deducted at Source (TDS) – This part provides information about tax deducted at source by deductors. It includes details like the deductor’s name, TAN (Tax Deduction and Collection Account Number), TDS amount, and the nature of income on which TDS is deducted.

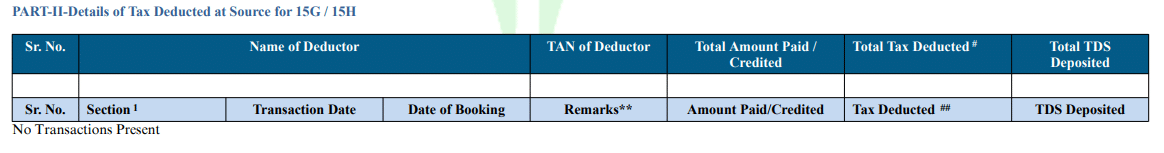

Part – II: Detail of Tax Deduction at Source for 15G /15H: This part provides the information about tax deducted at source for the payment required to submit form 15G/15H. Form 15G and Form 15H serve as self-declaration forms for individuals to claim exemption from tax deduction at source (TDS) on certain types of income, such as interest income from bank deposits.

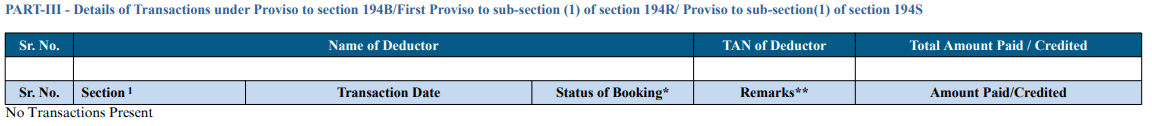

Part – III: Detail of Transactions under Provision 194B/194R (1)/194S:

Part III of Form 26AS is used to report details of transactions under Provision 194B/194R (1)/194S. This provision requires deductors to deduct tax at source from payments made to residents for specified services.

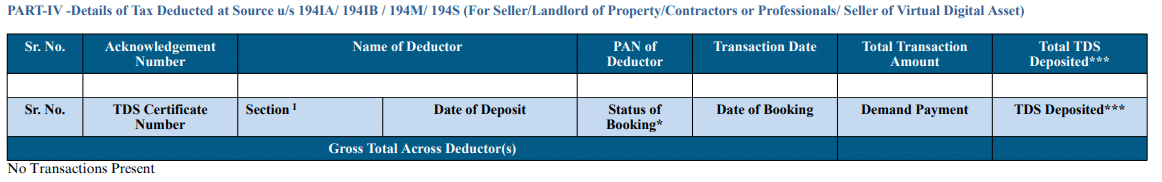

Part – IV: PART-IV -Details of Tax Deducted at Source u/s 194IA/ 194IB / 194M/ 194S (For Seller/Landlord of Property/Contractors or Professionals/ Seller of Virtual Digital Asset)

art-IV of Form 26AS contains details of tax deducted at source under the following provisions:

- Section 194IA: This section provides for the deduction of tax at source at the rate of 1% on the amount of consideration paid by a person to a resident transferee for the transfer of immovable property.

- Section 194IB: This section provides for deduction of tax at source at the rate of 2% on the amount of rent paid by a person to a resident landlord for letting of immovable property.

- Section 194M: This section provides for the deduction of tax at source at the rate of 5% on the amount of payment made by a person to a resident contractor or professional for carrying out any work (including the supply of labour) under any contract or by way of fees for professional services rendered during the financial year, exceeding Rs 50,00,000 in a year.

- Section 194S: This section provides for the deduction of tax at source at the rate of 1% on the amount of consideration paid by a person to a resident seller for the transfer of a virtual digital asset.

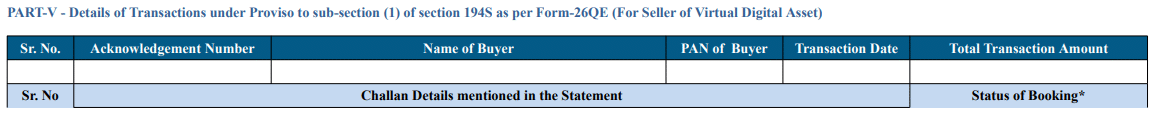

PART-V – Details of Transactions under Proviso to sub-section (1) of section 194S as per Form-26QE (For Seller of Virtual Digital Asset): Part-V of Form 26AS contains details of transactions under the proviso to sub-section (1) of section 194S as per Form-26QE (For Seller of Virtual Digital Asset). This section provides for deduction of tax at source at the rate of 1% on the amount of consideration paid by a person to a resident seller for transfer of virtual digital asset (VDA).

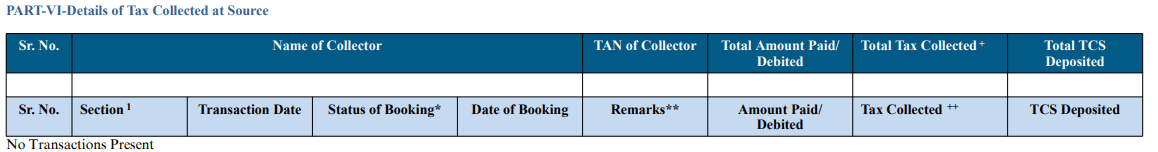

Part VI: Details of Tax Collected at Source (TCS) – This section contains information regarding tax collected at source by collectors. It includes details such as the collector’s name, TAN, TCS amount, and the nature of the transaction on which TCS is collected.

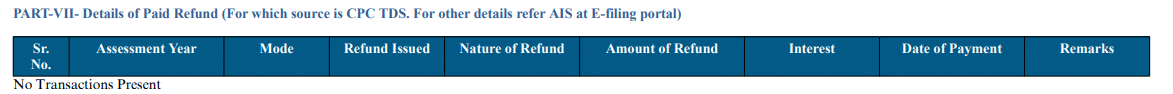

PART-VII- Details of Paid Refund (For which source is CPC TDS. For other details refer AIS at E-filing portal): You can check Annual Information Statement (AIS) on the e-filing income tax portal.

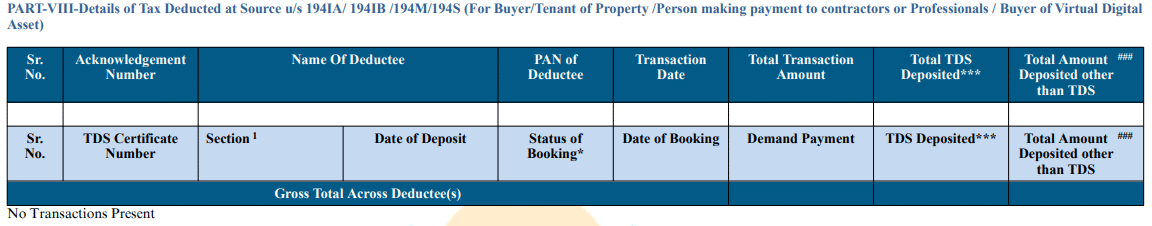

PART-VIII-Details of Tax Deducted at Source u/s 194IA/ 194IB /194M/194S (For Buyer/Tenant of Property /Person making payment to contractors or Professionals / Buyer of Virtual Digital Asset)

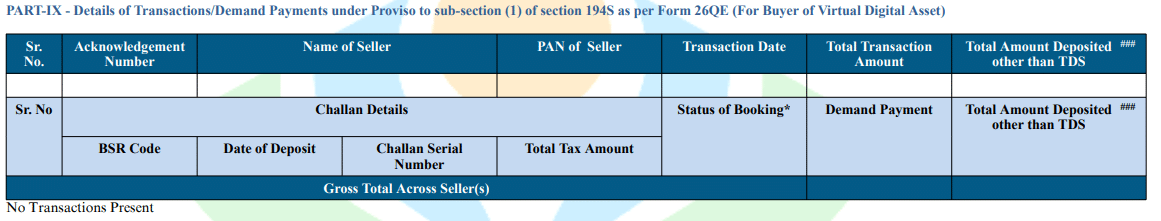

PART-IX – Details of Transactions/Demand Payments under Proviso to sub-section (1) of section 194S as per Form 26QE (For Buyer of Virtual Digital Asset)

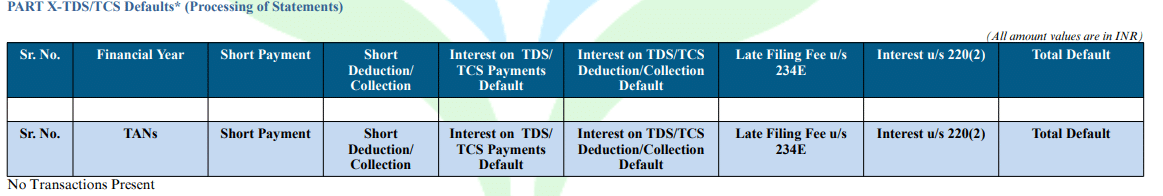

PART X-TDS/TCS Defaults* (Processing of Statements)

Form 16 Vs Form 16A Vs Form 26AS – Comparison to Clear Your Confusion

| Aspect | Form 16 | Form 16A | Form 26AS |

|---|---|---|---|

| Purpose | Certificate for TDS on Salary | Certificate for TDS | Consolidated tax statement |

| Issued by | Employer | Deductor (Other than Employer) | Income Tax Department |

| Applicability | Salaried employees | Non-salaried individuals | All taxpayers |

| Contents | Salary details, TDS on Salary | TDS details | TDS, TCS, tax payments, income details, etc. |

| Components | Part A, Part B | Part A, Part B | Multiple parts with different information |

| Use in ITR | Used to file income tax return | Used to file income tax return | Used to verify tax details, cross-check TDS |

| Frequency | Issued annually | Issued for each TDS transaction | Available for the entire financial year |

| Availability | From employer | From deductor | Downloadable from e-filing website or TRACES |

| Importance | Important for salary income taxpayers | Important for non-salary income taxpayers | Important for all taxpayers to verify tax details |

| Purpose | To determine taxable income and TDS credit | To determine taxable income and TDS credit | To verify and reconcile tax details |

| Dependency | Depends on employer’s timely issuance | Depends on deductor’s timely issuance | Independent of employer or deductor |

What to do if the wrong entry of Income and TDS appears in Form 26AS?

If you notice a wrong entry of income or TDS (Tax Deducted at Source) appearing in your Form 26AS, it is important to take prompt action to rectify the discrepancy. Here are the steps you can follow:

1. Verify the Accuracy: Before taking any action, double-check the entries in your own records, such as your income statements, TDS certificates, and tax filings. Ensure that you have accurate documentation to support your claim that the entry in Form 26AS is incorrect.

2. Contact the Deductor or Employer: If the discrepancy relates to TDS, get in touch with the deductor or employer responsible for deducting the tax. Provide them with the necessary details and supporting documents to demonstrate the error. Request them to rectify the TDS entry and issue a revised TDS certificate, if required.

3. Request for Correction: If the deductor or employer fails to rectify the wrong entry, or if the discrepancy pertains to income other than TDS, you can approach the Income Tax Department to request a correction. Use the online grievance redressal portal, the e-filing portal, or visit the nearest Income Tax office to submit a complaint. Provide all the relevant details and supporting documents to substantiate your claim.

4. File Revised Return, if necessary: In some cases, it may be necessary to file a revised income tax return with the correct details and supporting documents. This is typically done if the wrong entry in Form 26AS affects the accuracy of your tax calculations. Consult with a tax professional or seek guidance from the Income Tax Department to determine if a revised return is required.

5. Maintain Documentation: Throughout the process, make sure to maintain copies of all communications, documents, and proofs related to the incorrect entry. These records will be useful if you need to provide evidence or follow up with the tax authorities.

6. Regularly Monitor Form 26AS: It is advisable to regularly monitor your Form 26AS to ensure that any corrections or updates made reflect accurately in subsequent versions. Stay vigilant and review your Form 26AS before filing your income tax return each year to avoid any potential discrepancies.

Remember, resolving any wrong entry in Form 26AS requires proactive communication with the relevant parties and timely action.

Example

Here’s an example to illustrate what you can do if you come across a wrong entry of income and TDS in your Form 26AS:

Let’s say you received a TDS certificate from your employer for the financial year, showing a certain amount of tax deducted. However, when you check your Form 26AS, you notice that the TDS amount mentioned there is different from what was mentioned in the TDS certificate. This indicates a discrepancy that needs to be addressed.

1. Verify the Accuracy: Review your TDS certificate and payslips to confirm the correct amount of tax deducted by your employer. Ensure that you have accurate documentation to support your claim.

2. Contact your Employer: Reach out to your employer and inform them about the discrepancy. Provide them with copies of your TDS certificate and any relevant payslips. Request them to rectify the entry in their records and update the correct TDS details with the Income Tax Department.

3. Follow-up with your Employer: If your employer acknowledges the mistake, they should take steps to rectify it. Request them to issue a revised TDS certificate reflecting the correct TDS amount. Keep a record of all communication with your employer regarding the issue.

4. File a Complaint with the Income Tax Department: If your employer fails to address the discrepancy or if it pertains to income other than TDS, you can file a complaint with the Income Tax Department. Visit the Income Tax Department’s website or the nearest Income Tax office to submit a complaint. Provide all the relevant details, including copies of your TDS certificate, payslips, and any communication with your employer.

Form 26AS vs AIS

Form 26AS and Annual Information Statement (AIS) are both important documents related to tax credit statements, but they serve different purposes. Here’s a comparison between the two:

From AY 2023-24 onwards, Form 26AS available on the TRACES portal will display only TDS/TCS related data. Other details would be available in the AIS (Annual Information Statement) at e-filing portal (https://www.incometax.gov.in/iec/foportal). For data prior to AY 2023-24, there would be no change in display.

| Aspect | Form 26AS | AIS (Annual Information Statement) |

|---|---|---|

| Purpose | Consolidated tax statement | Information on specified financial transactions |

| Issued by | Income Tax Department | Financial institutions, government bodies, etc. |

| Contents | TDS, TCS, tax payments, etc. | Information on high-value financial transactions |

| Availability | Downloadable from e-filing website or TRACES | Automatically available to taxpayers through the AIS portal |

| Importance | Important for all taxpayers to verify tax details | Important for all taxpayers to review and reconcile financial transactions |

| Use in ITR | Used to verify tax details, cross-check TDS | Used to reconcile financial transactions with the income reported in ITR |

| Dependency | Independent of employer or deductor | Independent of specific entities, available to all taxpayers |

| Source of Information | Income Tax Department, deductors, banks, etc. | Financial institutions, government bodies, reporting entities, etc. |

| Frequency | Available for the entire financial year | Annually, containing information for the relevant financial year |

| Usage | Verification of tax details and cross-checking TDS | Reconciliation of financial transactions with income reported in ITR |

| Scope | Comprehensive view of tax-related information | Comprehensive view of high-value financial transactions |

Form 26AS:

1. Content: Form 26AS is a consolidated statement that provides a comprehensive view of tax credits associated with a taxpayer’s PAN. It includes details of taxes deducted at source (TDS), taxes collected at source (TCS), advance tax, self-assessment tax, and other tax payments.

2. Source of Information: Form 26AS is generated based on information provided by various deductors and collectors who have deducted or collected taxes on behalf of the taxpayer.

3. Availability: Taxpayers can access their Form 26AS online through the TRACES (TDS Reconciliation Analysis and Correction Enabling System) portal or through internet banking facilities of authorized banks.

4. Purpose: Form 26AS helps taxpayers verify whether the taxes deducted from their income or paid by them have been accurately credited to their account. It acts as a reference while filing income tax returns to ensure correct tax calculations.

Annual Information Statement (AIS):

1. Content: The Annual Information Statement (AIS) provides details of specified financial transactions reported under the Statement of Financial Transactions (SFT) by specified persons. It includes information related to high-value financial transactions such as cash deposits, immovable property purchases, credit card payments, mutual fund investments, etc.

2. Source of Information: The information in the AIS is collected from “specified persons” like banks, mutual funds, registrars, or sub-registrars who are required to report these transactions under Section 285BA of the Income Tax Act.

3. Availability: The AIS is made available to taxpayers through their registered accounts on the Income Tax Department’s e-filing portal.

4. Purpose: The AIS helps taxpayers recall and review their major financial transactions during a financial year. It assists in ensuring that all relevant transactions are appropriately disclosed while filing income tax returns, promoting transparency and accountability in tax compliance.

In summary, Form 26AS focuses on tax credits, while the Annual Information Statement (AIS) provides information about specified financial transactions. Both documents are important for taxpayers to ensure accurate tax reporting and compliance.

Examples to illustrate the difference between Form 26AS and the Annual Information Statement (AIS):

Let’s consider a taxpayer named Ram who wants to file his income tax return for the financial year. Here’s how Form 26AS and the AIS would provide different information for Ram :

Form 26AS:

Ram logs into the TRACES portal or his internet banking facility to access his Form 26AS. He reviews the document and finds the following details:

– TDS from his salary, which was deducted by his employer on a monthly basis.

– TDS from his fixed deposit interest, which was deducted by the bank.

– Advance tax payments made by Ram during the financial year.

– Self-assessment tax paid by Ram before filing his return.

Form 26AS serves as a consolidated statement of tax credits for Ram. It helps him cross-check the TDS amounts, advance tax payments, and other tax-related details to ensure accurate tax calculations while filing his income tax return.

Annual Information Statement (AIS):

Ram logs into his e-filing account on the Income Tax Department’s portal and accesses the AIS for the financial year. He finds the following information in the statement:

– Cash deposits of Rs. 10 lakh in his bank account.

– Purchase of a property worth Rs. 50 lakh.

– Credit card payments totaling Rs. 2 lakh.

– Mutual fund investments of Rs. 5 lakh.

The AIS provides Ram with a summary of his significant financial transactions reported by specified persons. It helps him recall and review these transactions to ensure that he includes them in his income tax return, promoting transparency and accuracy in his tax compliance.

In this example, Form 26AS focuses on tax credits, such as TDS and tax payments, while the AIS provides information about specified financial transactions like cash deposits, property purchases, and credit card payments. Both documents serve different purposes and are crucial for Ram to ensure accurate tax reporting and compliance.

Discrepancies in Form 26AS

The discrepancies in TDS credit can occur due to various reasons, including:

(a) TDS not deposited with the government: If the TDS amount has been deducted but not deposited by the deductor, it is essential to inform them about the non-deposit of TDS and request them to rectify the situation.

(b) TDS deposited but TDS statement not filed: In some cases, the deductor may have deposited the TDS amount but has not yet filed the TDS statement. The taxpayer should communicate with the deductor to ensure that the TDS statement is filed promptly.

(c) Incorrect PAN quoted in the TDS statement: If the deductor has mentioned the wrong PAN in the TDS statement, it can result in a TDS credit mismatch. The taxpayer should inform the deductor about the incorrect PAN and request them to rectify it in the TDS statement.

(d) Incorrect TDS amount mentioned in the TDS statement: Sometimes, the deductor may mistakenly mention an incorrect TDS amount in the TDS statement. The taxpayer should bring this discrepancy to the attention of the deductor and ask for the necessary correction.

What to do if I find any discrepancies in my Form 26as?

Resolution 1: Contact to Deductor: If a taxpayer finds discrepancies in their Form 26AS, it is advisable to contact the deductor (employer or entity responsible for deducting TDS) to rectify the mismatch. The taxpayer should approach the deductor as soon as possible to ensure that the necessary corrections are made before filing their Income Tax Return (ITR).

Resolution 2: Submit grievance through Grievance on e-filing Income Tax Portal: You can choose to file a grievance on the e-filing portal. To submit the grievance, the assessee shall log in to the e-portal and submit a grievance by visiting Grievance => Submit Grievance menu.

It is important for the taxpayer to maintain proper communication with the deductor and ensure that the necessary corrections are made before filing the ITR. By resolving these discrepancies, the taxpayer can ensure that their tax credit is accurately reflected in their Form 26AS and claim the correct TDS amount while filing their tax return.

Can I claim credit of TDS deducted by the employer but not paid by it to Govt.?

Yes, you can claim credit for TDS (Tax Deducted at Source) that has been deducted by your employer but not deposited with the government. As per the guidelines issued by the Central Board of Direct Taxes (CBDT), if TDS has been deducted from your income but not deposited by the deductor, the Assessing Officer cannot raise tax demands on you, the payee.

While you cannot directly force the deductor to deposit the TDS or make corrections in the TDS statement, you can take the following steps to address the issue:

Submit TDS proof to the Income Tax Department: If the deductor refuses to cooperate, you can submit the evidence of TDS deducted from your income to the Income Tax Department. This can include salary slips and bank statements showing the credit of net salary or other income after the deduction of TDS.

Respond to the demand notice: If you receive a demand notice from the Income Tax Department, you can file a reply on the e-filing portal. Include the supporting documents mentioned above to prove that TDS has been deducted from your income. This will help in resolving the issue and claiming the credit for the TDS amount.

It is important to maintain proper documentation and evidence of TDS deducted from your income to support your claim.

FAQ on Form 26AS

Here are some more frequently asked questions (FAQs) about Form 26AS:

1. How often is Form 26AS updated?

Form 26AS is updated periodically as and when new information is received and uploaded by the deductors, collectors, or other income tax authorities. It is advisable to check your Form 26AS at regular intervals to stay updated on the latest tax credits and transactions.

2. Can I view Form 26AS for previous years?

Yes, you can view Form 26AS for previous years. The e-filing portal and TRACES allow you to select the relevant assessment year for which you want to view the form. However, please note that the availability of information in Form 26AS may vary for different assessment years.

3. Can I download Form 26AS for offline reference?

Yes, you can download Form 26AS in PDF format for offline reference. While viewing your Form 26AS on the TRACES website, you have the option to choose between HTML and PDF views. If you select the PDF view, the form will be downloaded to your device, and you can save it or print it for future reference.

4. What should I do if I find a discrepancy between my records and Form 26AS?

If you notice any discrepancies between your records and Form 26AS, it is essential to take prompt action to rectify them. First, verify the accuracy of your own records and supporting documents. If the discrepancy is related to TDS, contact the deductor or employer responsible for deducting the tax. You can approach the Income Tax Department through grievance redressal from itself Income Tax Department’s official website.

5. Can I use Form 26AS as proof of tax payments for other purposes?

Yes, Form 26AS can be used as proof of tax payments for various purposes, such as applying for loans, claiming deductions, or addressing any tax-related queries. It provides a comprehensive view of your tax credits, tax deducted at source, and other tax-related information, which can be used as evidence of your tax compliance.

6. What is the difference between Form 26AS and Form 16/16A?

Form 26AS is a consolidated tax statement that provides a comprehensive view of your tax-related information and transactions. On the other hand, Form 16 is a certificate issued by the employer for TDS on salary, while Form 16A is a certificate issued by other deductors for TDS on non-salary income. While Form 16/16A is specific to TDS, Form 26AS includes a broader range of information, such as TDS, TCS, tax payments, income details, and more.

7. Is it necessary to reconcile my TDS certificates with Form 26AS?

Yes, it is highly recommended to reconcile your TDS certificates with Form 26AS to ensure the accuracy of your tax credits and to avoid any discrepancies. By comparing the information in your TDS certificates with Form 26AS, you can identify any missing or incorrect entries and take appropriate steps to rectify them.

8. Can I access Form 26AS if I don’t have an account on the e-filing portal?

No, to access Form 26AS, you need to have an account on the e-filing portal of the Income Tax Department. If you don’t have an account, you will need to register yourself on the portal to view and download your Form 26AS.a