E-verifying your income tax return is a crucial step in the tax filing process. Without e-verification, your return remains incomplete, and any refunds due will be withheld. In this comprehensive guide, we will explore how to e-verify income tax returns using various methods, ensuring a smooth and hassle-free experience.

Updates: The new rule for e-verification or verification by sending ITR-V is that the time limit is now 30 days, whereas it used to be 120 days. These new rules will apply from 1st August 2022. Therefore, for the Assessment Year 2023-24, the e-verification time limit is 30 days.

Table of contents

- 1. What is E-Verify Income Tax Return

- 2. Importance of E-Verification

- 3. Methods to E-Verify Income Tax Return

- 4. E-Verification Time Frame

- 4. Frequently Asked Questions

Prerequisites for e-Verify Income Tax Return

| e-Verification Method | Prerequisite |

|---|---|

| Net Banking | PAN linked with your bank account

Net Banking should be enabled for the preferred bank account |

| OTP on mobile number registered with Aadhaar | PAN is linked with Aadhaar |

| Digital Signature Certificate | Valid and active DSC Emsigner utility installed and running on your PC Plugged-in DSC USB token in your PC DSC USB token procured from a Certifying Authority provider<br>The DSC USB token is a Class 2 or Class 3 certificate |

| Bank Account EVC / Demat Account EVC | Pre-validated and EVC-enabled bank/demat account |

In order to verify income tax returns electronically, taxpayers have several methods available to them. Each method requires specific prerequisites to ensure a successful e-verification process. The table above outlines these methods and their corresponding prerequisites. These methods include using a Digital Signature Certificate, receiving an OTP on a registered mobile number linked with Aadhaar, utilizing Bank Account EVC/Demat Account EVC, or using Net Banking. By understanding and meeting the prerequisites for each method, taxpayers can conveniently and securely verify their income tax returns online.

1. What is E-Verify Income Tax Return

E-verification is the process of authenticating your income tax return filing using electronic methods. It is a convenient and quick alternative to physically sending the signed ITR-V form to the Centralized Processing Center (CPC) in Bangalore. E-verification is essential for processing your return and receiving any refunds due.

2. Importance of E-Verification

E-verifying your income tax return is necessary to complete the tax filing process. Without e-verification, your return is considered invalid, and you won’t receive any refunds. Moreover, e-verification ensures instant processing of your return, saving you time and effort.

3. Methods to E-Verify Income Tax Return

There are several ways to e-verify your income tax return. You can choose the method that best suits your needs and preferences. Here are the primary methods to e-verify your return:

| Method | Description |

|---|---|

| Aadhaar OTP | E-verification using a one-time password (OTP) sent to the mobile number registered with Aadhaar. |

| Electronic Verification Code (EVC) | E-verification through an alphanumeric code sent to the registered mobile number and email ID. |

| – Net Banking | E-verification using net banking credentials and the e-filing link provided by the bank. |

| – Bank Account EVC | E-verification using an EVC generated through a pre-validated bank account. |

| – Demat Account EVC | E-verification using an EVC generated through a pre-validated demat account. |

| – Bank ATM (offline) | E-verification using an EVC generated at a bank ATM with a registered ATM card. |

| Digital Signature Certificate (DSC) | E-verification using a valid and active Digital Signature Certificate. |

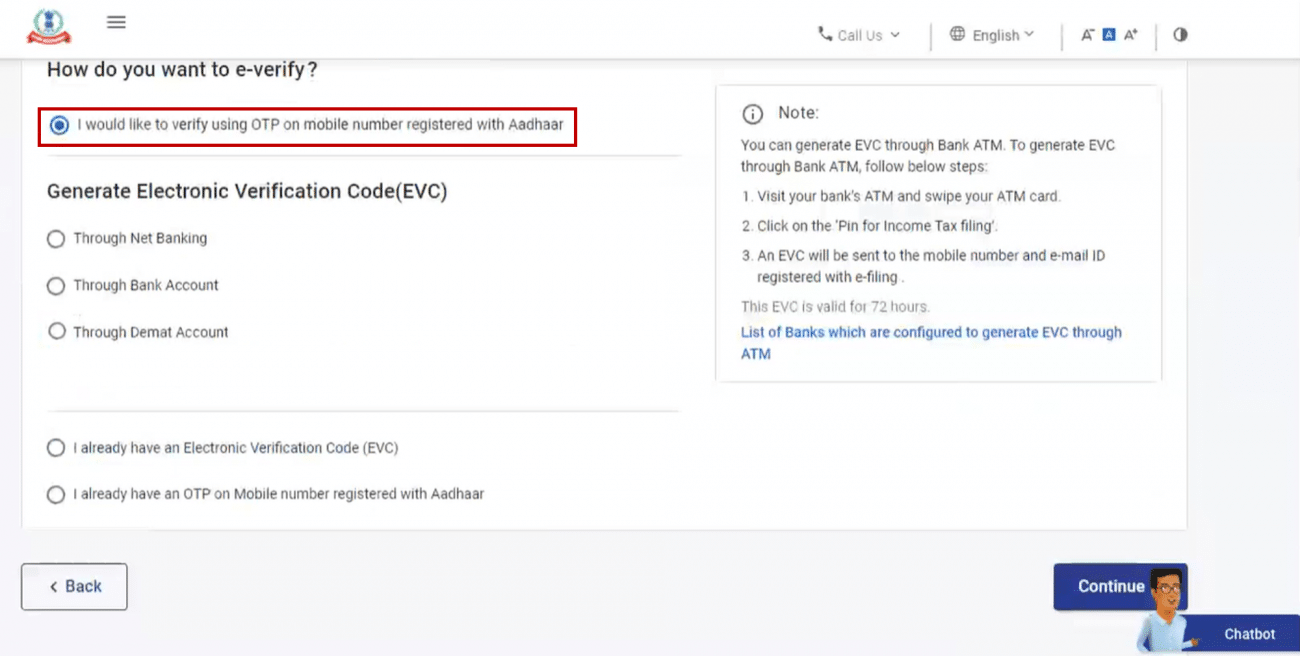

3.1. E-Verify Income Tax Return through Aadhaar OTP

A popular and straightforward method for e-verifying your income tax return is using Aadhaar OTP (One-Time Password). To use this method, ensure that your mobile number is registered with Aadhaar and that your PAN is linked to your Aadhaar number.

- Follow these steps to e-verify your return using Aadhaar OTP:

- Log in to your e-filing account at the income tax website.

- Under the e-file tab, select ‘Income Tax Returns’ > ‘e-Verify Return’.

- Choose ‘I would like to e-verify using OTP on a mobile number registered with Aadhaar’ on the ‘e-Verify Return’ page.

- Agree to validate your Aadhaar details and click on ‘Generate Aadhaar OTP’.

- Enter the received OTP in the designated field and click ‘Submit’.

- A success message will appear, confirming the completion of e-verification.

3.2. E-Verification using Electronic Verification Code (EVC)

An Electronic Verification Code (EVC) is a 10-digit alpha-numeric code sent to your registered mobile number and email ID during the e-verification process. EVC is valid for 72 hours from the time of generation. You can generate an EVC through various methods:

- EVC via Net Banking

- EVC through Bank Account

- EVC via Demat Account

- EVC using Bank ATM (offline)

3.2.1. E-Verification through Net Banking

To e-verify your return using net banking, you need to have an active net banking facility with your bank. Follow these steps to e-verify your return through net banking:

- Log in to your e-filing account and select ‘e-Verify Return’ under the e-file tab.

- Click on ‘Through Net Banking’ and continue.

- Select your bank and click ‘Continue’.

- Log in to your net banking account and locate the e-filing link.

- Select the appropriate ITR form and click ‘e-verify’.

3.2.2. E-Verification through Bank Account

- To e-verify your return using a pre-validated bank account, follow these steps:

- Log in to your e-filing account and select ‘e-Verify Return’ under the e-file tab.

- Choose ‘I would like to e-verify using EVC generated through my pre-validated bank account’.

- An EVC will be sent to your registered mobile number and email ID.

- Enter the received EVC and click ‘e-verify’.

3.2.3. E-Verification through Demat Account

- To e-verify your return using a pre-validated demat account, follow these steps:

- Log in to your e-filing account and select ‘e-Verify Return’ under the e-file tab.

- Choose ‘I would like to e-verify using EVC generated through my pre-validated demat account’.

- An EVC will be sent to your registered mobile number and email ID.

- Enter the received EVC and click ‘e-verify’.

3.2.4. E-Verify Income Tax Return using Bank ATM (offline)

You can also e-verify your return using a bank ATM card. This method is available only through limited banks. To e-verify your return using a bank ATM:

- Visit your bank’s ATM and swipe your card.

- Enter your ATM PIN and select ‘Generate EVC for Income Tax Return filing’.

- An EVC will be sent to your registered mobile number and email ID.

- Log in to your e-filing account, select ‘I already have an Electronic Verification Code (EVC)’, enter the EVC, and click ‘e-verify’.

3.3. E-Verify Income Tax Return through DSC

If your books of accounts are audited, you must e-verify your return using a Digital Signature Certificate (DSC). To e-verify your return using DSC:

- Log in to your e-filing account and select ‘e-Verify Return’ under the e-file tab.

- Choose ‘I would like to e-verify using Digital Signature Certificate (DSC)’.

- Download and install the emsigner utility.

- Return to the e-filing page, select ‘I have downloaded and installed emsigner utility’, and click ‘Continue’.

- Select your provider and certificate, enter the password, and click ‘Sign’.

4. E-Verification Time Frame

As per the latest updates, the Central Board of Direct Taxes (CBDT) has reduced the time limit for ITR verification to 30 days from the date of return submission. This new rule applies to returns filed online on or after 1st August 2022. For income tax returns filed up to 31st July 2022, the time limit for ITR verification remains 120 days.

4. Frequently Asked Questions

4.1. Is e-verification mandatory for income tax returns?

Yes, e-verification is mandatory to complete the tax filing process. Without e-verification, your return remains invalid, and you won’t receive any refunds.

4.2. Can I e-verify my return after the stipulated time has passed?

Yes, you can e-verify your return after the time limit by submitting a condonation request and providing an appropriate reason for the delay. However, the return will be considered verified only after the Income Tax Department approves the condonation request.

4.3. Can someone else e-verify my return on my behalf?

Yes, an Authorized Signatory or Representative Assessee can e-verify the return on your behalf using any of the available e-verification methods.

4.4. What happens if I don’t e-verify my income tax return?

If you don’t e-verify your return within the stipulated time, it will be treated as not filed, and you may face consequences under the Income Tax Act, 1961. However, you can request a condonation of delay in verification by providing an appropriate reason.

4.5 Are there any penalties for failing to e-verify the income tax return?

– Failing to e-verify the income tax return within the specified time can lead to the return being treated as invalid. This may result in additional notices, penalties, and the loss of any refunds due.

4.6 What are the advantages of e-verify Income Tax Return?

– E-verification ensures the timely processing of your return, reduces paperwork, and eliminates the need to physically send the ITR-V form to the CPC. It also enables faster refunds and provides a convenient and secure method of verifying your income tax return.

4.7. Can I e-verify my return using multiple methods?

– No, you can choose only one method to e-verify your return. Once the return is successfully e-verified using one method, it is considered verified, and further verification using other methods is not required.

4.8. Is e-verification applicable to all types of income tax returns?

– Yes, e-verification is applicable to all types of income tax returns, including individual, HUF, partnership firm, company, etc.

4.9. Can I e-verify my return for previous assessment years?

– Yes, you can e-verify your return for the previous assessment years by following the same e-verification methods applicable for the respective assessment year.

4.10. Where can I find the status of my e-verification?

– You can check the status of your e-verification by logging in to your e-filing account on the income tax website and navigating to the e-verification status section.

E-verifying your income tax return is a crucial step in the tax filing process. It ensures that your return is processed, and any refunds due are released. By understanding the various methods available for e-verification, you can choose the most convenient option and complete the tax filing process seamlessly. With the help of this comprehensive guide, you are now equipped to e-verify your income tax return with ease.

Sir i am inspired by you . Please give me ur number i have to clear some doubts face by me while filling income tax and i am a student of bcom final year . Please give suggestion to do after my completion of bcom .