When your Income Tax paid exceeds the amount of Income Tax payable, the excess amount is referred to as an Income Tax refund i.e. excess TDS deduction, excess advance tax paid. The Income Tax Department processes the Income Tax Return and refunds the excess payment. To be eligible for an Income Tax refund, it is necessary to file an Income Tax return. The Income Tax Department processes the return and initiates the refund process accordingly. you can track the status of your income tax refund online. You can visit the income tax department’s official website or use the e-filing portal to check the refund status. You will need to provide your PAN (Permanent Account Number) and the assessment year for which you filed the return. In this article, we will discuss in detail how you can claim your income tax refund, how to track the status of your income tax refund, how to put the re-issue request for an income tax refund, and more.

Overview of Income Tax Refunds

When you pay more in taxes than your actual liability for a given financial year, you may be eligible to receive an income tax refund. To facilitate a smooth refund process, it’s crucial to provide accurate bank account details, including the correct account number and IFSC code. Additionally, your bank account should be pre-validated on the government’s income tax e-filing portal, and your PAN must be linked to your bank account.

Understanding Assessment Years and Financial Years

Before delving further into tracking your income tax refund status, it’s essential to understand the difference between Assessment Years (AY) and Financial Years (FY). The Financial Year refers to the period during which income is earned and taxes are paid, whereas the Assessment Year is the period during which the income earned in the previous Financial Year is assessed and taxed. For example, FY 2022-23 corresponds to AY 2023-24. Where the amount of tax paid by a person in respect of any assessment year, exceeds the amount of tax assessed for that year, the taxpayer shall be entitled to refund of such excess tax paid.

Time-Limit for Claiming Income Tax Refund

You can claim the refund only by filing an income tax return, i.e., the original return, revised return 1, or belated return 2. You cannot claim the income tax return through an updated return 3. In other words, you can claim the income tax return up to the due date of filing the original return, belated return, or revised return. If, for any reason, you cannot file your income tax return, you can file a request for a condonation of delay in filing the return. The income tax department may condone the delay.”

Tracking Income Tax Refund Status on the New Income Tax Portal

You can track your income tax refund status on the government’s new income tax portal by following these steps:

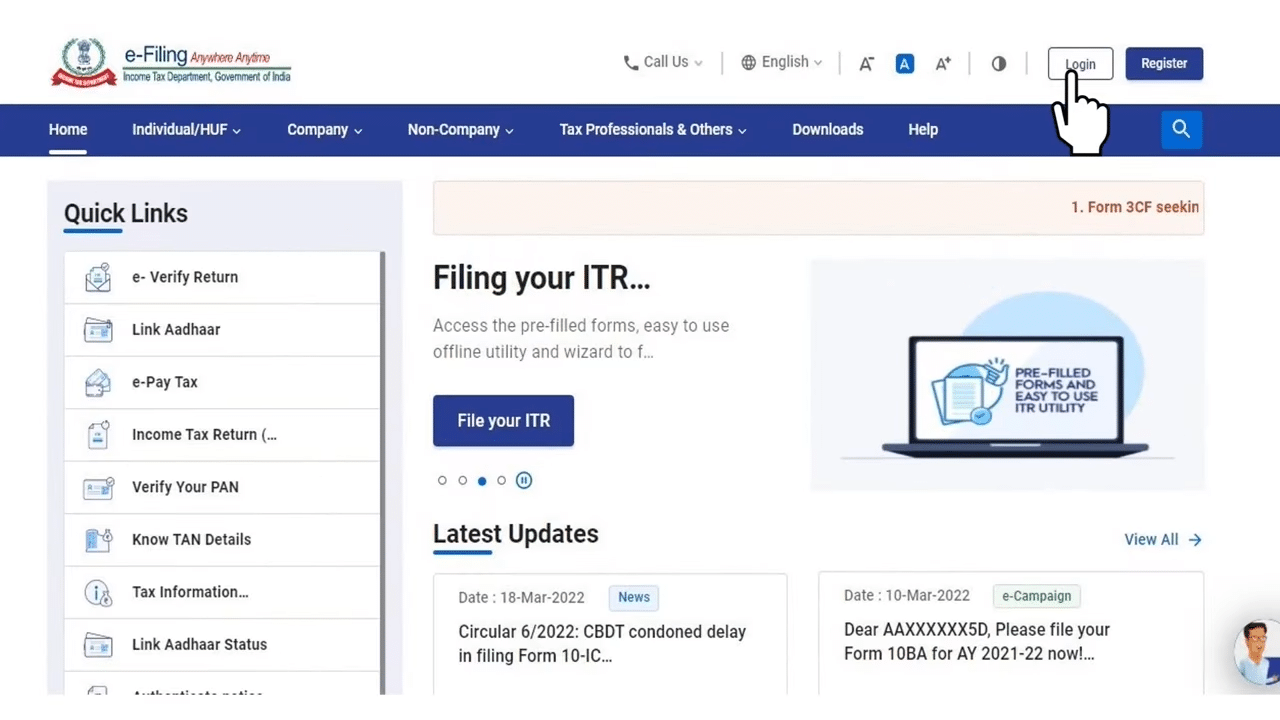

| Step 1: Visit www.incometax.gov.in and log in to your account using your PAN/Aadhaar number as the user ID and your password. (Income tax login and registration complete procedure) |  |

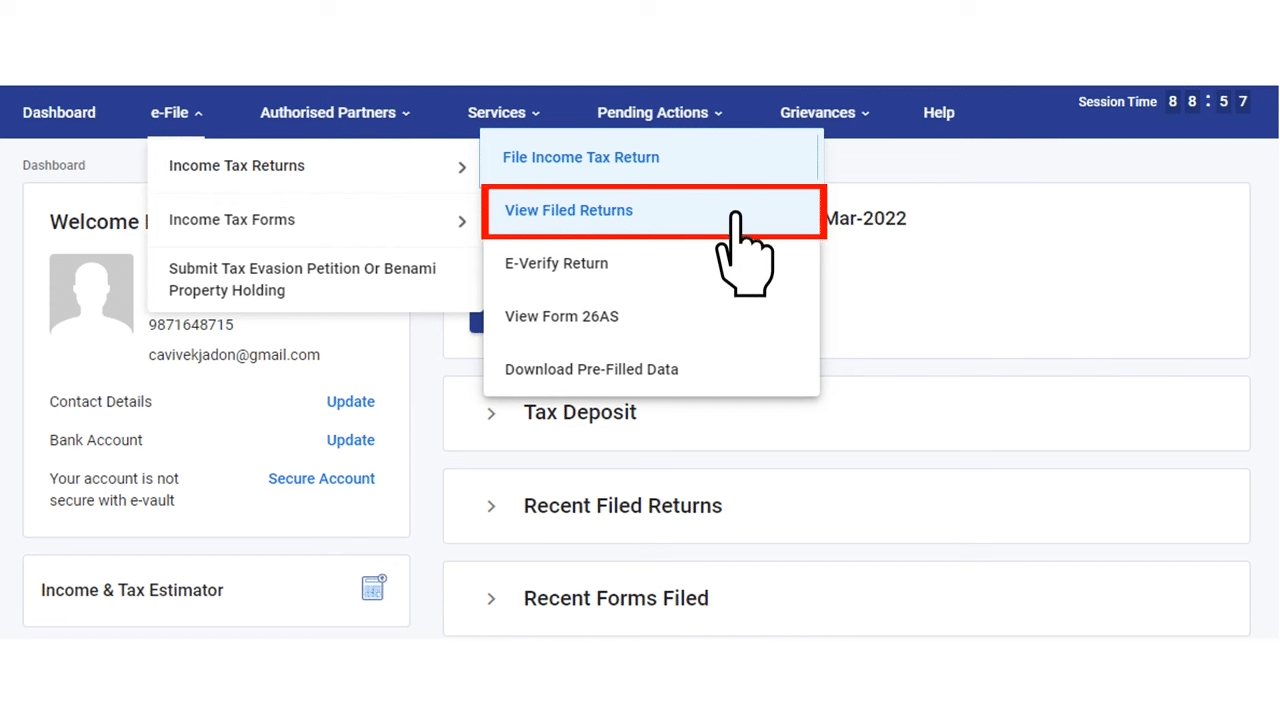

| Step 2: Once logged in, click on the ‘e-file’ option. Under this tab, select ‘Income Tax Returns’ and then choose ‘View Filed Returns’. |  |

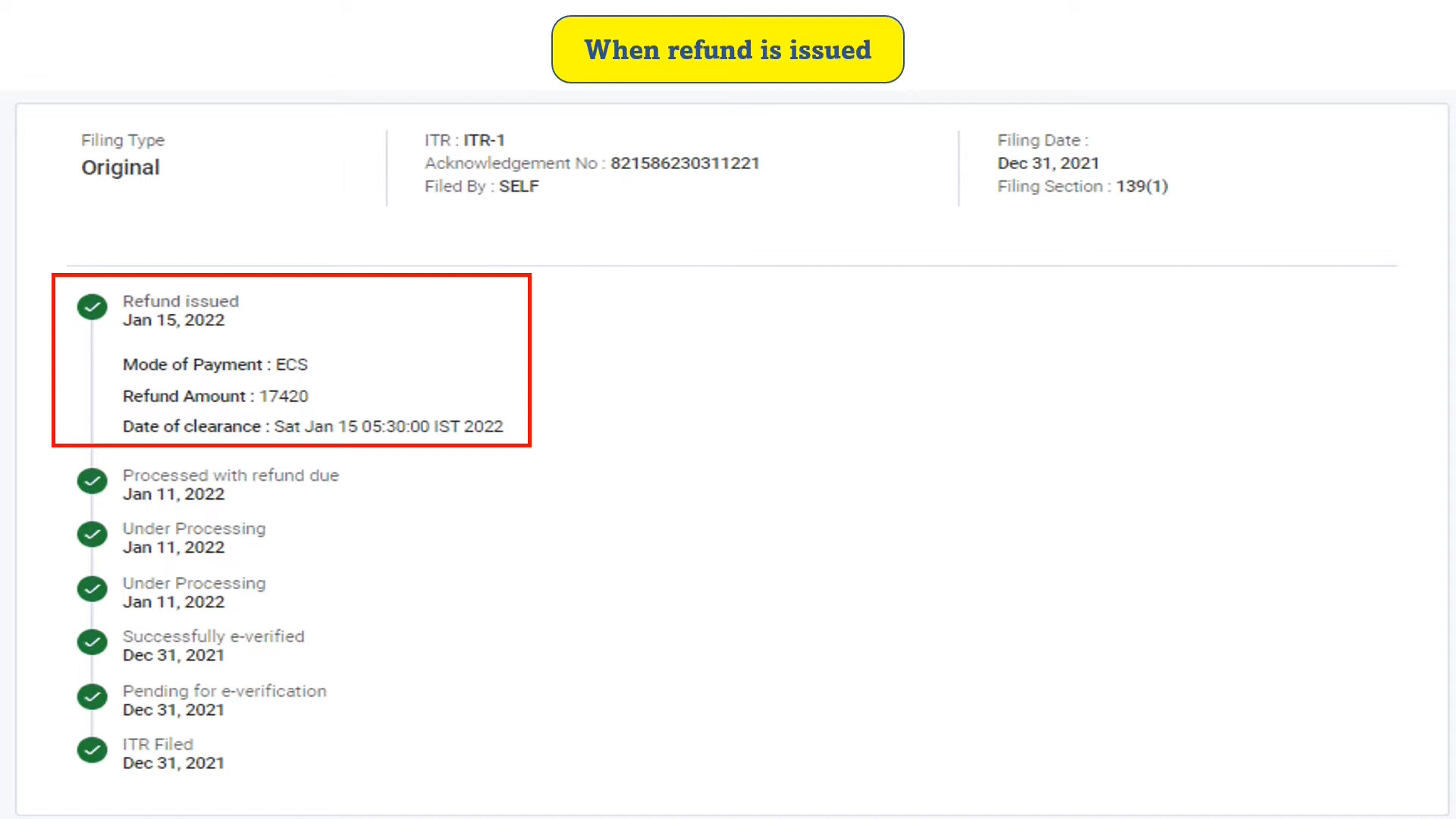

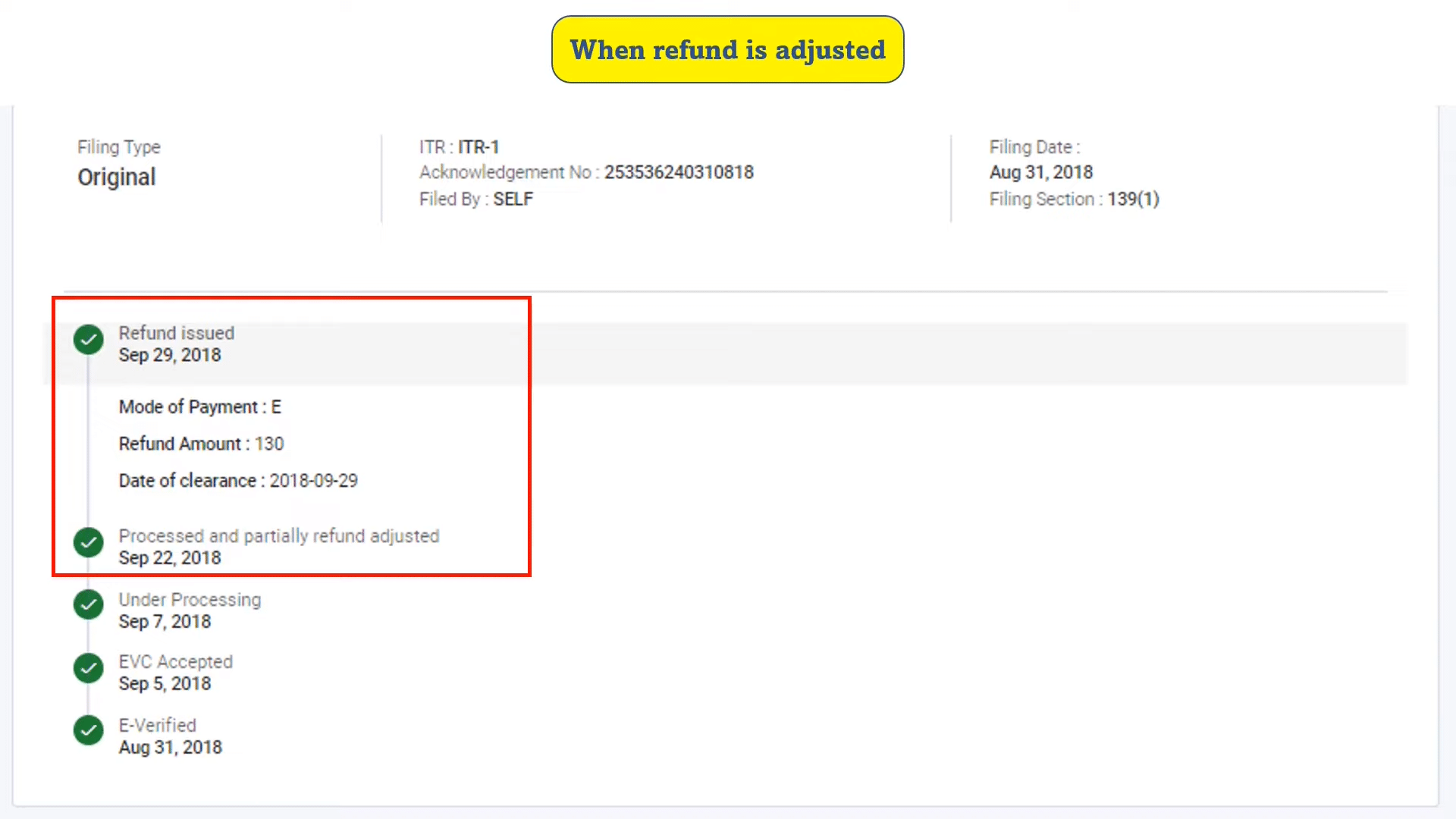

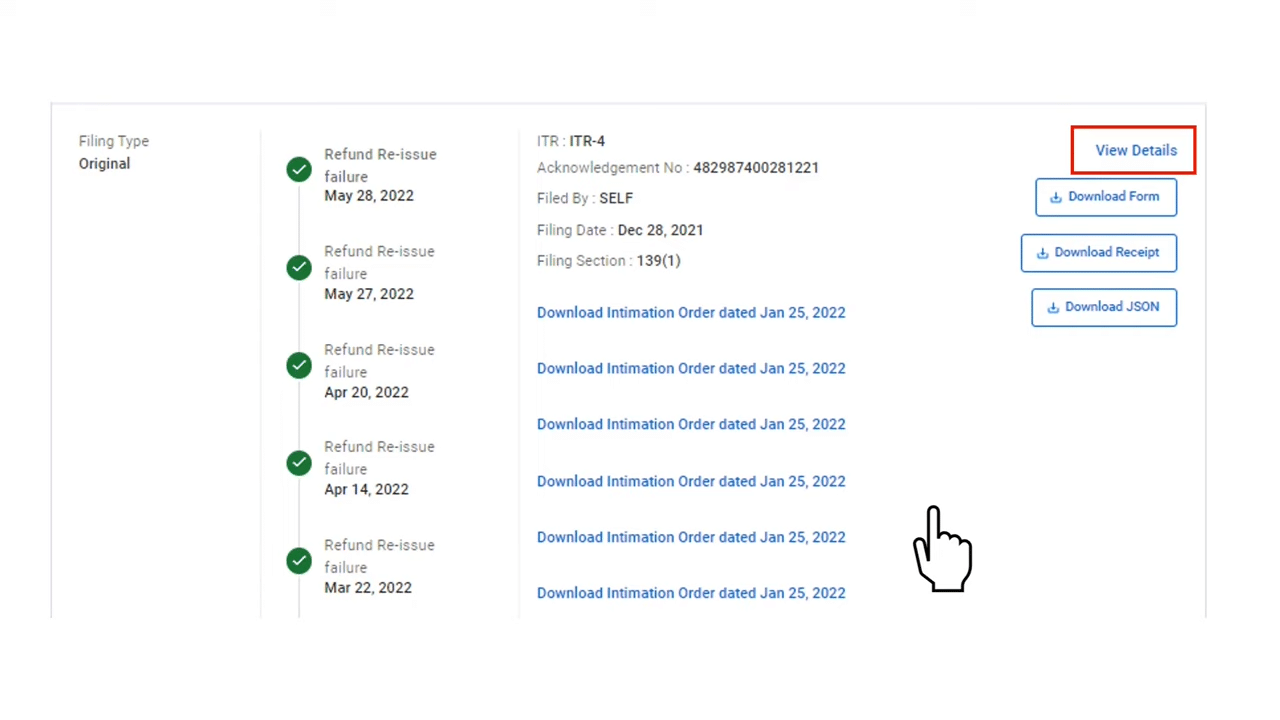

| Step 3: Check the latest ITR filed. For example, for FY 2022-23, the latest ITR filed (presuming you have already filed it) will be for AY 2023-24. Select ‘View Details’ to see the status of your ITR, as well as the date of issue, the amount refunded, and date of clearance for any refund due for that AY. |

|

Decoding the Refund Status Messages

The message displayed on your screen will depend on your refund status. Here are some common messages you may encounter and what they mean:

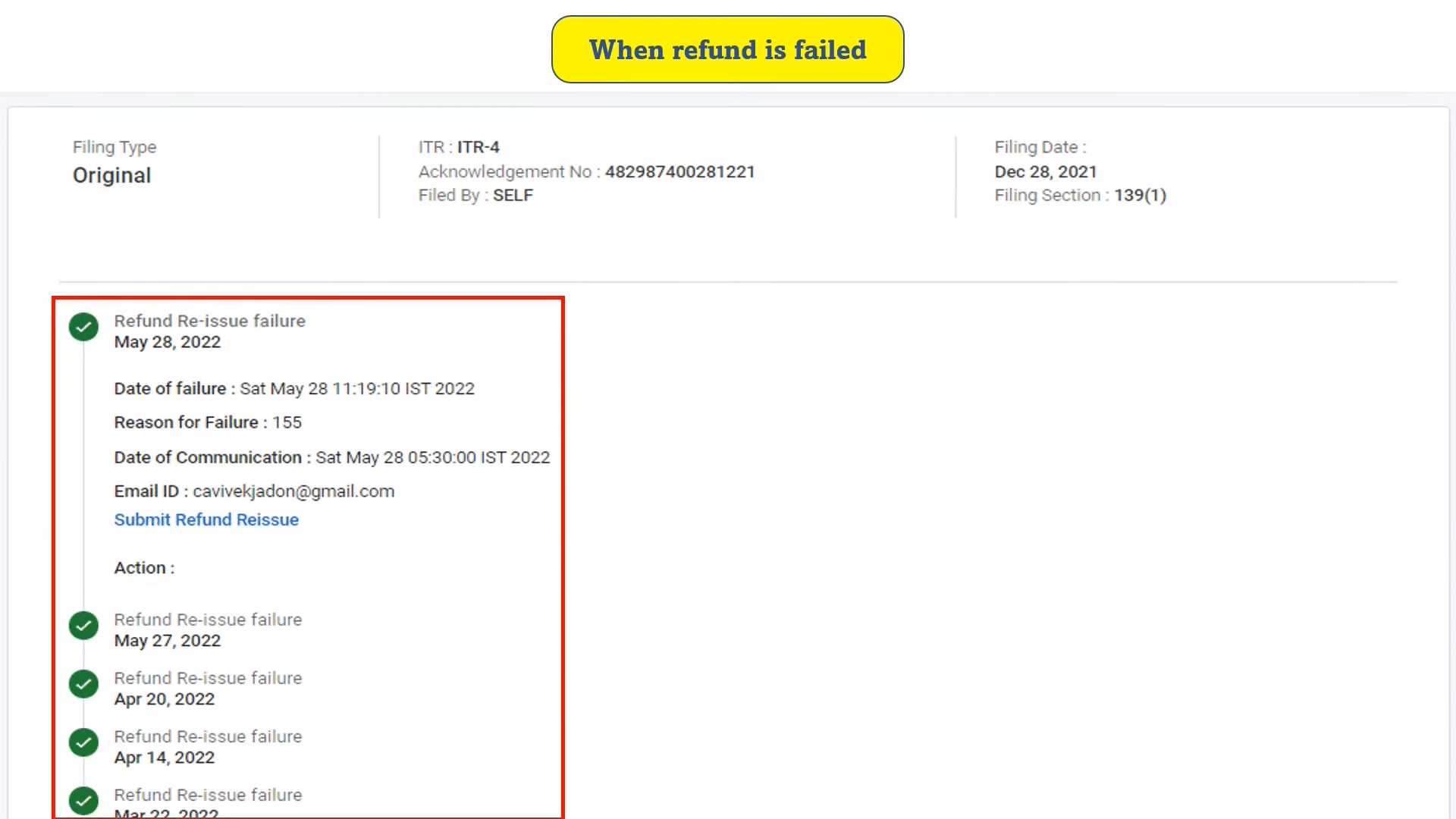

Requesting a Refund Reissue

If your refund fails to be credited to your bank account due to incorrect bank details, you can raise a refund reissue request on the new income tax portal. This request can only be made if your income tax refund credit has failed. To raise a refund reissue request, select ‘Refund Reissue’ under the ‘Services’ tab. Then, choose the ITR for which the refund has failed, select the bank account, and verify it to complete the request.

You can contact the official support of the income tax department about a refund.

- Twitter handle: @IncomeTaxIndia

- Instagram: Incometaxindia. official

- YouTube: Income Tax India

- Facebook:@incometaxindiaofficial

- Linkedin: Income Tax India Official

- For More Information Official Website: www.incometax.gov.in

- Helpline Number: 1800 103 0025 / 1800 419 0025

Monitoring Income Tax Refund Status on the TIN NSDL Website

Another method to track your income tax refund status is by checking it on the TIN NSDL website. Keep in mind that you can view the status of your refund on this site only 10 days after it has been sent by the Assessing Officer to the refund banker. Follow these steps to track your income tax refund on the TIN NSDL website:

Steps to check Income Tax Refund status:

- Visit https://tin.tin.nsdl.com/oltas/refundstatuslogin.html

- Enter your PAN details.

- Choose the relevant assessment year for which you want to check the refund status. For instance, for FY 2022-23, the assessment year will be 2023-24.

- Input the captcha code and click on ‘Submit.’ A message will appear on your screen, indicating the status of your refund.

Interest on Delayed Refund

As per section 244A of the Income Tax Act, if a taxpayer does not receive the refund within the due time, he is granted interest on the delayed refund. The interest rate is one-half percent (0.50%) for every month or part of a month. Suppose the refund arises out of any tax deducted/collected at source or tax paid by way of advance tax, in that case, the interest shall be allowed for a period commencing from the 1st day of April of the assessment year to the date on which the refund is granted if the return of income is furnished on or before the due date of filing of return specified under section 139(1) of the Income Tax Act.

Interest on Excess Refund

When an assessee receives a refund through a summary assessment but later, during the regular assessment, it is discovered that either no refund was actually due or the refunded amount exceeds the eligible refund, the assessee will be required to pay interest on the excess refund. The interest rate will be 0.5% per month or part thereof. This interest will be calculated from the date the refund was granted until the regular assessment is completed.

Let’s consider an assessee, Mr. Raj, who filed his income tax return and underwent a summary assessment. Based on the initial assessment, he was determined to be eligible for a refund of Rs. 15,000. The refund was credited to his account on September 30th.

However, during the subsequent regular assessment process, it was discovered that Mr. Raj was not entitled to any refund as his tax liability matched the amount he had already paid. Therefore, the refund of Rs. 15,000 was considered an excess refund.

As per the rules, Mr. Raj would now be liable to pay interest on the excess refund amount at a rate of 0.5% per month or part thereof.

Assuming the regular assessment was completed on December 30th, the interest calculation would be based on the period from September 30th (the date the refund was credited) to December 30th (the date of completion of regular assessment). This totals a period of 3 months.

Using the formula: Principal amount (excess refund) x interest rate x time period, we can calculate the interest. In this case, it would be Rs. 15,000 x 0.5% x 3 = Rs. 225.

Therefore, Mr. Johnson would be required to pay Rs. 225 as interest on the excess refund amount of Rs. 15,000.

Rounding off Income Tax Refund Amount

The refund amount that a taxpayer is owed is rounded to the nearest multiple of ten rupees, as stated in Section 288B. To do this, any amount less than one rupee is ignored. If the resulting figure is not already a multiple of ten and the last digit of that amount is five or greater, the amount is increased to the next highest multiple of ten. However, if the last digit is less than five, the amount is reduced to the next lowest multiple of ten.

Example 1:

Let’s say you are owed a tax refund of Rs. 2,987.60. Again, we will apply the rounding rules mentioned in Section 288B. Since the amount has paise (less than one rupee), it will be ignored for rounding.

Looking at the resulting figure without the paise, which is 2,987, we see that the last digit is 7. Since 7 is greater than or equal to 5, the amount will be increased to the next higher multiple of ten. Therefore, the refund amount of Rs. 2,987.60 will be rounded up to Rs. 2,990.

Example 2:

Now, let’s consider a refund amount of Rs. 4,873.90. Applying the same rounding rules, we ignore the paise.

Looking at the resulting figure without the paise, which is 4,873, we observe that the last digit is 3. As 3 is less than 5, the amount will be reduced to the next lower multiple of ten. Hence, the refund amount of Rs. 4,873.90 will be rounded down to Rs. 4,870.

In summary, these examples illustrate the rounding process for tax refunds according to Section 288B, where amounts are adjusted to the nearest multiple of ten rupees.

8. FAQ About Income Tax Refund

In this section, we’ll address some frequently asked questions related to income tax refund status and provide answers to help you better understand the process.

Q: How long does it take for the income tax department to process a refund?

A: The processing time for income tax refunds can vary, we have not found any official announcement about the processing time of income tax refunds. But you can expect it from 20 to 50 days.

Q: Can I track my income tax refund status without logging in to the income tax portal?

A: Yes, you can track your refund status on the TIN NSDL website without logging in to the income tax portal. Simply follow the steps outlined under the heading of track income tax refund status from the website of TIN NSDL.

Q: What should I do if my refund status shows ‘Refund Returned’?

A: If your refund status indicates ‘Refund Returned,’ you should verify your bank account details, ensure the account is pre-validated, and then request a refund reissue on the income tax portal.

Q: What should I do if I haven’t received my income tax refund within the expected time frame?

A: If you haven’t received your income tax refund within the expected time frame, you can first check the refund status online using the income tax department’s official website or the e-filing portal. If the status shows that the refund has been issued but you haven’t received it, you can contact the income tax department’s helpline number or reach out to their official support channels mentioned in the previous information.

Q: Can I request a refund reissue if my income tax refund is returned or failed?

A: Yes, if your income tax refund is returned or failed due to reasons such as an incorrect bank account number or IFSC code, you can request a refund reissue. This can be done through the income tax e-filing portal. Select the ‘Refund Reissue’ option under the ‘Services’ tab, choose the relevant ITR, verify the bank account details, and submit the request.

Q: Is there any interest payable on delayed income tax refunds?

A: Yes, as per section 244A of the Income Tax Act, if a taxpayer does not receive the refund within the due time, he/she is entitled to receive interest on the delayed refund. The interest rate is one-half percent (0.50%) for every month or part of a month, starting from the 1st day of April of the assessment year to the date on which the refund is granted. However, interest on delayed refunds is applicable only if the return of income is furnished on or before the due date of filing specified under section 139(1) of the Income Tax Act.

Q: What happens if I receive an excess refund, and do I have to pay any interest on it?

A: If you receive an excess refund (more than the eligible amount) due to a mistake or error, you may be liable to pay interest on the excess refund amount. The interest rate for excess refunds is typically 0.5% per month or part thereof. The interest calculation starts from the date the refund was granted until the completion of the regular assessment process.

Q: Can I change my bank account details for the income tax refund after filing the return?

A: Yes, you can change your bank account details for the income tax refund if the refund has not yet been processed by the income tax department. Log in to the income tax e-filing website, go to the ‘Services’ tab, select ‘Refund Reissue,’ update your bank account information, pre-validate the account, and submit the request. However, once the refund is processed, you may not be able to make changes to the bank account details.

Q. Can I claim an income tax refund through an updated return?

No, you cannot claim an income tax refund through an updated return. An updated return allows taxpayers to make changes within 24 months from the end of the relevant assessment year, but it requires the payment of additional tax rather than claiming a refund.

Remember to stay patient and keep track of your income tax refund status regularly. With the information provided in this guide, you’ll be well-equipped to monitor your refund and stay informed throughout the process.

- A revised return is a tax return that is filed to correct any mistakes or omissions found in the original return. This revised return can be submitted at any time within three months before the relevant assessment year expires or before the assessment is completed, whichever comes first.

- A belated return of income refers to a tax return that is filed after the deadline has passed. In other words, it is a return that is filed late. The option to file a belated return is available until three months before the end of the relevant assessment year or before the assessment is completed, whichever occurs earlier.

- A taxpayer has the option to file an updated return within 24 months from the end of the relevant assessment year, even if they hadn’t previously filed a return for that assessment year. However, along with the updated return, the taxpayer is required to pay an additional tax amount equal to either 25% or 50% of the tax liability.